Revisions to Consumer Goods Spending behind lowered GDP growth

Summary

Revisions to first quarter GDP took the headline growth rate down to 1.3% from 1.6% previously, with a sharply lower profile for consumer goods spending accounting for most of the adjustment. Corporate profits slipped, but the decline overstates recent weakness.

Revisions take a hacksaw to Consumer Goods Spending

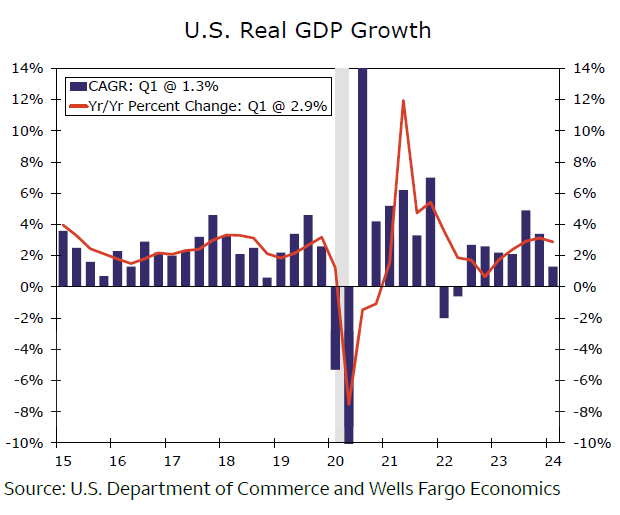

The economy expanded at just a 1.3% annualized rate in the first quarter, down three tenths-of a-percentage point from the initially reported 1.6% (chart). The headline slowing was not much of a surprise, the composition of the revisions was. The main culprit for the weaker read is consumer spending. Since the start of the Federal Reserve's rate hikes more than two years ago, consumers have demonstrated resilience that defied the lessons of prior cycles. The lagged effect of monetary policy is long and variable. Are policymakers at the Fed finally getting through to the consumer?

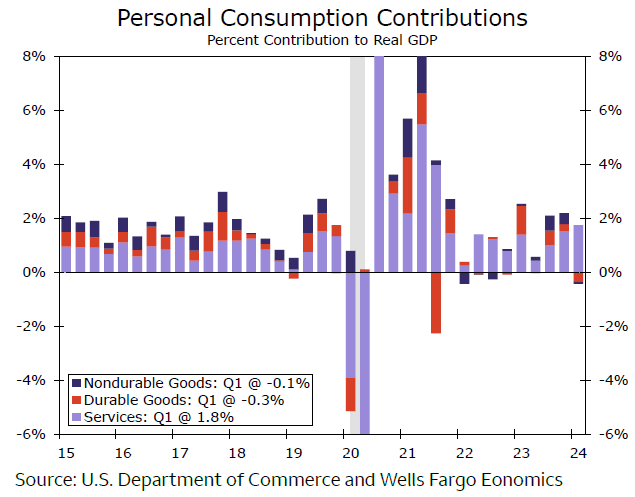

So what is happening with the weakness in consumer spending? A three word answer: less goods spending. In the initial estimate, goods outlays were reported to have contracted at a scant 0.4% annualized rate. All the weakness in the initial estimate was on the durable goods side with non-durable good spending flat. Today's revisions marked down those spending estimates significantly. Goods spending is now estimated to have contracted at an 1.9% annualized rate including a 4.1% contraction in durable goods outlays and a 0.6% annualized drop in non-durable goods spending. These revisions are consistent with downward revisions to Q1 retail sales, and suggests we'll see some revision to monthly durable goods spending. The March personal income and spending report revealed that real durable goods spending rose 0.9% in March after an 1.4% gain in February. Either those figures were revised down or the January decline got bigger. We will get some firm answers when the April Personal Income and Spending report is released tomorrow morning.

The bottom line: the contraction in goods spending subtracted 0.42 percentage points from headline GDP growth in the first quarter (chart), that's a much bigger bite that the 0.09 PP drag in the first estimate. With offsets in other components, today's downward revision in GDP growth can be blamed upon these revisions to goods spending.

The much larger services category was barely changed and grew at a 3.9% annualized rate in Q1, down trivially from 4.0% previously. The continued resilience in services outlays is problematic for the Federal Reserve's efforts to bring down the inflation rate in the service sector. Until then, we can find corroborating evidence of a weakening backdrop for the consumer. Sentiment and confidence gauges have been iffy at best, consumers are lowering their saving rate to sustain spending and rising delinquencies point to a greater struggle for households.

Author

Wells Fargo Research Team

Wells Fargo