Retail buyers missing

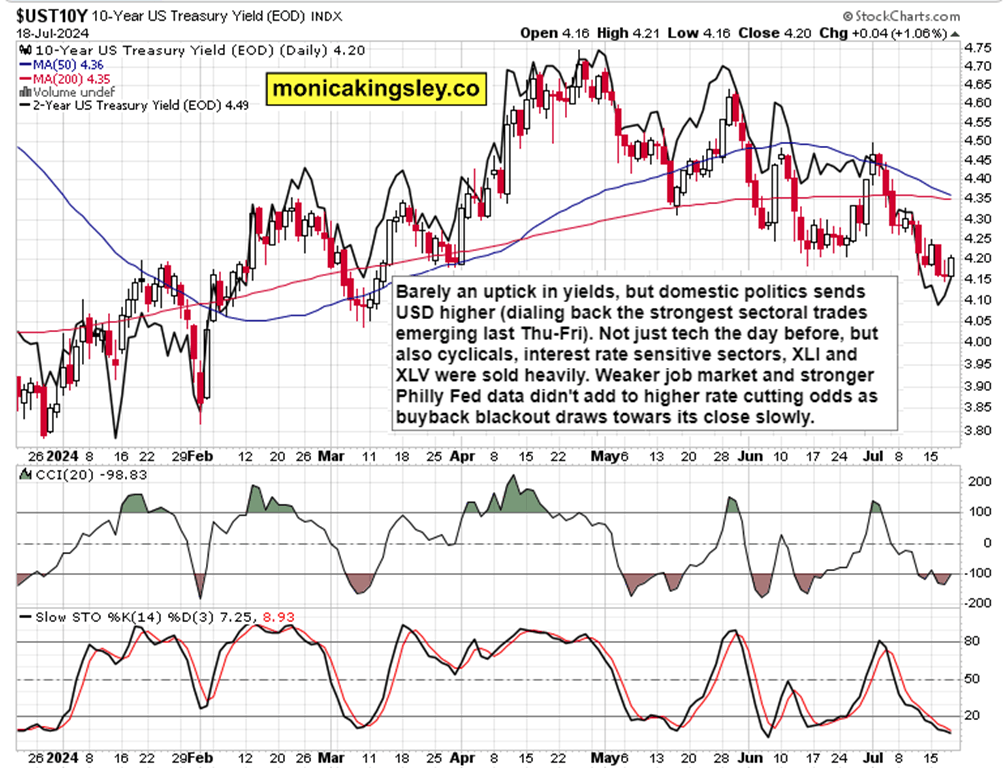

Thursday, the selloff was broader than tech led one, and the combination of hotter Philly Fed data didn‘t add to rate cutting dreams of Jul. Not that Jul cut would be realistic expectation in the first place. It‘s though the dollar that‘s the key beneficiary of domestic policy statements and repositioning, not yields – the TIPS auction shows continued disinflationary expectations.

Still, neither the dollar nor interest rate sensitive plays that had appreciated so greatly since end of last week, were sold off as well. Even healthcare and consumer staples were. As the key PPI support in S&P 500 gave way without buyers coming back later yesterday, we‘re looking at downswing extension, and yet another selling into the opening upswing in stocks.

Yesterday‘s words were simply confirmed, and swing traders better wait for corporate buybacks returning later this month.

(…) Precarious position where S&P 500 is sitting at a strong support (corresponding to $557 SPY with QQQ leading to the downside (well below analogical support), and XLC understandably joining too. Time to be wary, because if the support breaks, there is quite some quick room to the downside.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.