Results & Update: The planets are taking a few days off

11/12 Recap: The S&P opened with a 6 handle gap up and then traded another 8 handles higher, for an opening minute high. From that high,

The S&P declined 12 handles into a 9:39 AM low of the day. From that low, the S&P traded in a 7 handle trading range, culminating with a low at 10:34 AM. From that low, the S&P rallied 32 handles into a 12:01 PM high. From that high, the S&P gradually declined 11 handles into a 2:35 PM low. From that low, the

S&P rallied 15 handles into a 3:36 PM high of the day. From that high, the S&P declined 6 handles into the close.

11//12 – The three major indices closed with a strong up day per the following closes: The DJIA + 179.08; S&P 500 + 33.58; and the

Nasdaq Composite + 156.68.

Looking ahead – We have one Fibonacci change in trend point for this weekend. The planets are taking a few days off. LOL!

It should get very interesting toward the end of next week.

The NOW Index is in the NEUTRAL ZONE.

Coming Events:

(Stocks potentially respond to all events).

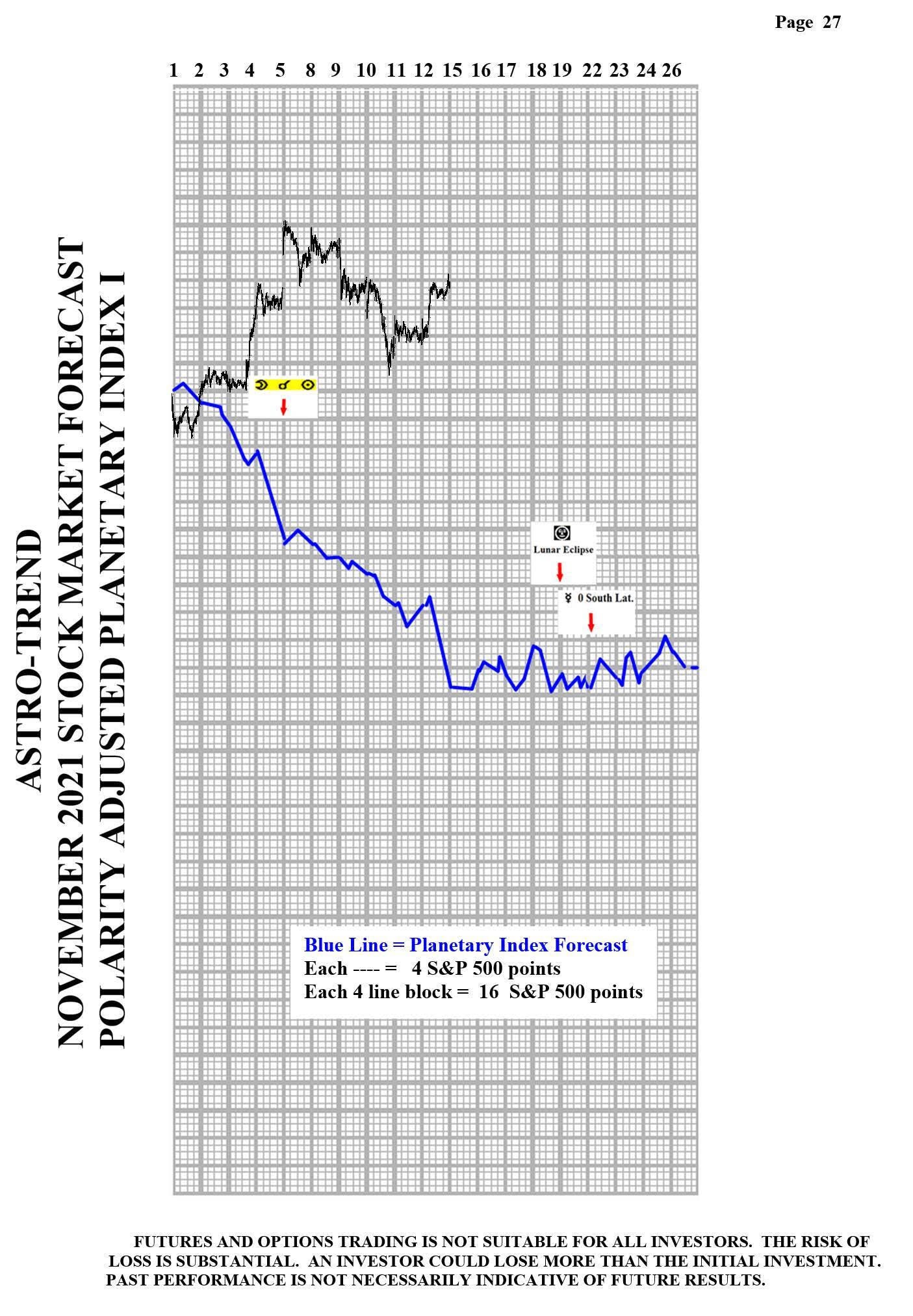

3. A. 11/18 AC – Full Moon/Lunar Eclipse in Taurus. Major Change in Trend Financials, Grains, Precious Metals and

especially Cattle and Cotton.

B. 11/19 PM – Uranus 120 US Part of Fortune. Major change in trend US Stocks, T-Bonds, US Dollar.

C. 11/19 AC – Mercury 0 South Latitude. Major change in trend Corn, Oats, Soybeans, Wheat.

Stock Market Key Dates –

Market Math –

11/29 – 5,161 Music Days from the major 10/11/2007 high.

Fibonacci – 11/13, 11/19-22, 11/26.

Astro – 11/17, 11/19, 11/22, 11/26

Please see below the S&P 500 10 minute chart.

Looks like an inflexion point. Something gotta give!

Support - 4660 Resistance – 4720

Please see below the S&P 500 Daily chart

Support - 4660 Resistance – 4720

Please see below the Planetary Index charts with S&P 500 5 minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com