Markets and economists widely anticipate that the Reserve Bank of New Zealand (RBNZ) will reduce the Overnight Cash Rate (OCR) by 50 basis points (bps) to 4.25% on Wednesday, a move that would push the OCR closer to neutral levels.

Markets fully pricing in a 50 basis point cut

Markets are assigning a 60% chance that the RBNZ will opt for a 50 bp cut (60 bps of easing priced in), with a 40% chance that the central bank may swing for a bulkier 75 bp reduction. A 50 bp cut in the OCR would follow a 50 bp reduction in October and a surprise 25 bp cut in August.

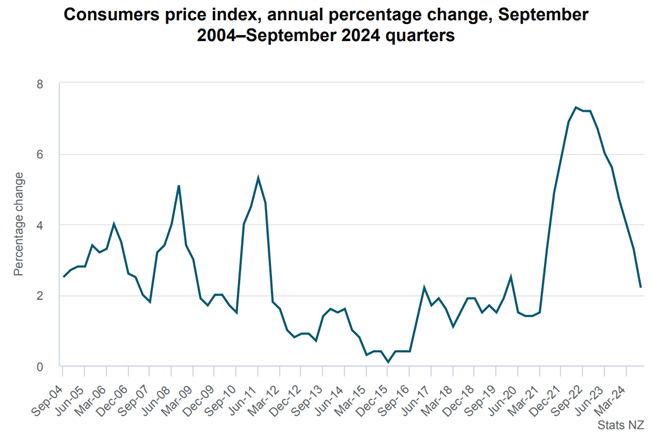

I expect the RBNZ to follow through and reduce the OCR by 50 bps this week. Inflation has cooled to 2.2% in Q3 24 and is now within the RBNZ’s target band of 1-3% for the first time since early 2021. Inflation expectations also remain pretty much anchored around the 2.0% mark.

Economic activity (GDP – Gross Domestic Product) remains well and truly in the doldrums; Q2 24 data showed economic growth shrank by 0.2%, following a paltry 0.1% expansion in Q1 24. GDP per capita also contracted by 0.5% in Q2 24, coupled with a loosening jobs market. Employment growth showed a contraction of 0.5% in Q3 24, and the unemployment rate rose to its highest level since late 2020 (4.8% in Q3 24).

However, on the other side of this fence, some desks – such as Goldman Sachs – highlight the possibility of a 75 bp cut given the economic downturn, increased unemployment, and the long break between now and the next meeting (mid-February next year), which could leave the central bank somewhat behind the curve.

Global risks remain uncertain

The re-election of Donald Trump and potential tariff changes introduce a degree of unpredictability for New Zealand’s economy, particularly for tradeable inflation. Still, it is merely speculation at this point, and the implications for New Zealand's inflation are unclear.

I anticipate that the November statement will reflect confidence in the progress made on inflation, and the central bank will emphasise a gradual approach to policy easing, contingent on incoming data. With that being said, considering the economic backdrop, I imagine the quarterly projections may reveal additional rate cuts next year, with CPI forecasts potentially being revised lower, with limited revisions for GDP growth metrics.

NZD/USD in focus

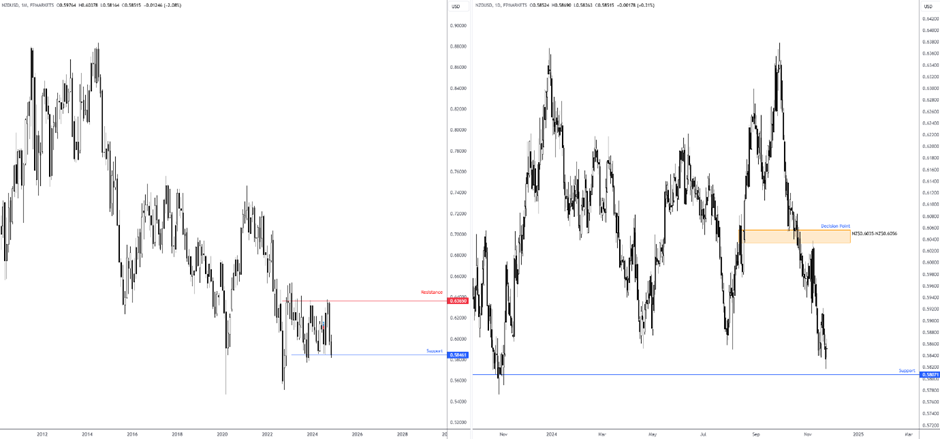

A 75 bp cut would likely trigger enough of a ‘surprise’ and see the New Zealand dollar (NZD) sell off quite extensively, particularly against the US dollar (USD). In contrast, a 50 bp cut, which, as I noted above, is fully priced in, is unlikely to yield that much of a surprise/reaction, especially if dovish language is absent and the OCR projections are only moderately revised lower towards the end of 2025.

I will be keeping a close eye on NZD/USD during the rate announcement. An outsized 75 bp cut might trigger a strong downside move in the pair, particularly as investors have pared back US rate-cut bets – markets are now just pricing in 13 bps of easing for December’s meeting – as well as the USD being bolstered by the incoming Trump administration and safe-haven demand.

The monthly chart shows that price is trading at range support from N$0.5846, while the daily chart suggests scope to push for nearby support at N$0.5807. Therefore, daily and monthly support provides a ‘floor’ for potential buyers, which could hold if the RBNZ opts for a 50 bp cut. A 75 bp cut, nevertheless, could see the aforementioned support zone challenged.

Chart created using TradingView

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD climbs above 1.0500 on persistent USD weakness

EUR/USD preserves its bullish momentum and trades above 1.0500 on Monday. In the absence of high-impact data releases, the risk-positive market atmosphere makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher.

GBP/USD rises to 1.2600 area as mood improves

Following a short-lasting correction, GBP/USD regains its traction and trades at around 1.2600. The US Dollar struggles to stay resilient against its rivals as market mood improves on Monday, allowing the pair to build on its bullish weekly opening.

Gold turns bearish and could test $2,600

After recovering toward $2,700 during the European trading hours, Gold reversed its direction and dropped below $2,650. Despite falling US Treasury bond yields, easing geopolitical tensions don't allow XAU/USD to find a foothold.

Five fundamentals for the week: Fed minutes may cool Bessent boost, jobless claims, core PCE eyed Premium

Will the rally around Scott Bessent's nomination continue? The short Thanksgiving week features a busy Wednesday packed with events, and the central bank may cool the enthusiasm.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.