- The Reserve Bank of Australia could upwardly review its macroeconomic projections.

- Policymakers will likely maintain the door open for additional QE if needed.

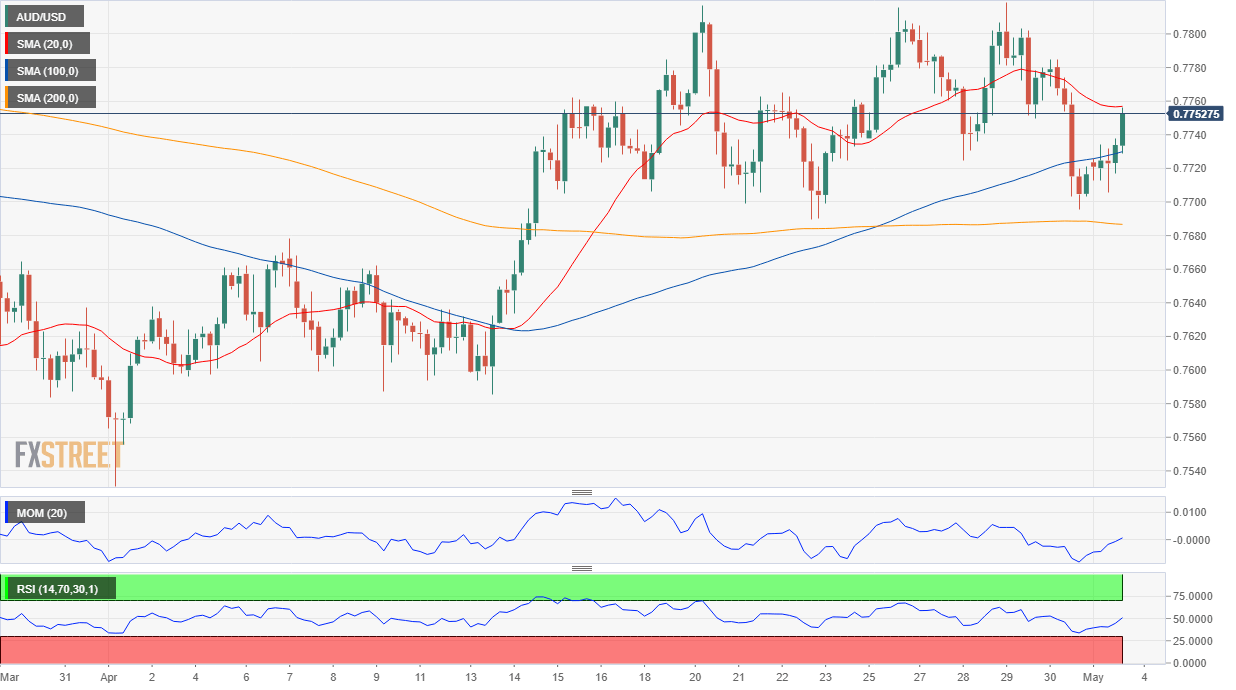

- AUD/USD trades within familiar levels needs to break above 0.7820 to turn bullish.

The Reserve Bank of Australia is having a monetary policy on Tuesday, but no changes to the current policy are expected this time. The central bank has clarified multiple times that they won’t adjust the current policy until inflation is “sustainably within the 2% to 3% target range.” According to the latest available data, inflation rose at 1.1% annual pace in the first quarter of the year.

Inflation, employment and growth

For inflation to reach such levels, wages growth will have to substantially increase, and that would require a tighter labour market. Back in March, the central bank stated that it would not raise interest rates at least until 2024 when it sees a clearer recovery on both legs of the central bank’s mandate.

However, there’s still hope. Economic figures coming from the country have been improving, hinting the RBA may have to review its outlooks. The latest forecasts indicate that Australian policymakers expect the unemployment rate to fall to 6% by the end of 2021 and 5.5% by the end of 2022, while the Gross Domestic Product was foreseen expanding by 4% this year and 3.5% in 2020.

Investors are hoping for an upward review in the overall outlook, but also for policymakers to retain a certain cautious stance, and repeat that they are ready to add quantitative easing if it’s needed. For sure, the latest data suggest that Australian central bankers could be much more confident on what's next for the local economy. Still, no fireworks are to be expected.

AUD/USD possible scenarios

The AUD/USD pair up ahead of the event, as investors are in a risk-on mood. Stocks are up after US data confirmed substantial growth in the country, despite missing the market’s expectations. From a technical point of view, the pair is trading between 0.77 and 0.78, lacking clear directional strength and currently recovering from a daily low of 0.7705.

The near-term picture suggests that the pair may accelerate its advance once above 0.7770, the immediate resistance level, although it would need to settle above 0.7820 to hint at further gains ahead. The main support is 0.7690.

Worth noting that the pair will continue to depend on the market’s sentiment. Higher equities and base metal prices will likely support a bullish extension, while a dismal mood will end up benefiting the greenback.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.