Reserve Bank of Australia Preview: Focus on tapering and growth

- Investors expect Australian policymakers to reverse their tapering plans.

- Australian growth has surprised to the upside in the second quarter of the year.

- AUD/USD may surge past 0.7500 on a hawkish surprise from Lowe & Co.

The Reserve Bank of Australia is having a monetary policy meeting on Tuesday, September 7. Back in July, the central bank announced it would reduce its current financial facilities starting this month by bringing down its weekly government bond purchases from A$5 to A$4, repeating the message on its August meeting. However, market participants consider that Australian policymakers may reverse such a decision amid the latest coronavirus outbreaks in the country and the possibility of a severe economic contraction in the third quarter of the year.

The central bank has maintained the cash rate at a record low of 0.1% and the yield curve control program, aiming to keep April 2024 bond maturity at 10 bps. Both are anticipated to remain on hold. Additionally, policymakers have made it clear that they will not increase the cash rate until inflation is within the 2 to 3% target range, a condition that could be meet if wages grow “sustainably above 3 per cent.” The latter is not expected to be achieved before 2024.

Meanwhile, Australia reported a better than anticipated Q2 Gross Domestic Product, as the economy grew by 0.7% in the three months to June amid resurgent private demand and household spending. Thus, growth was upbeat despite the country's current situation, albeit far from the pre-pandemic levels.

So, overall, market participants are anticipating a dovish stance from Australian policymakers. If they maintain the planned QE as announced, that would be a positive surprise that should boost the aussie.

AUD/USD possible scenarios

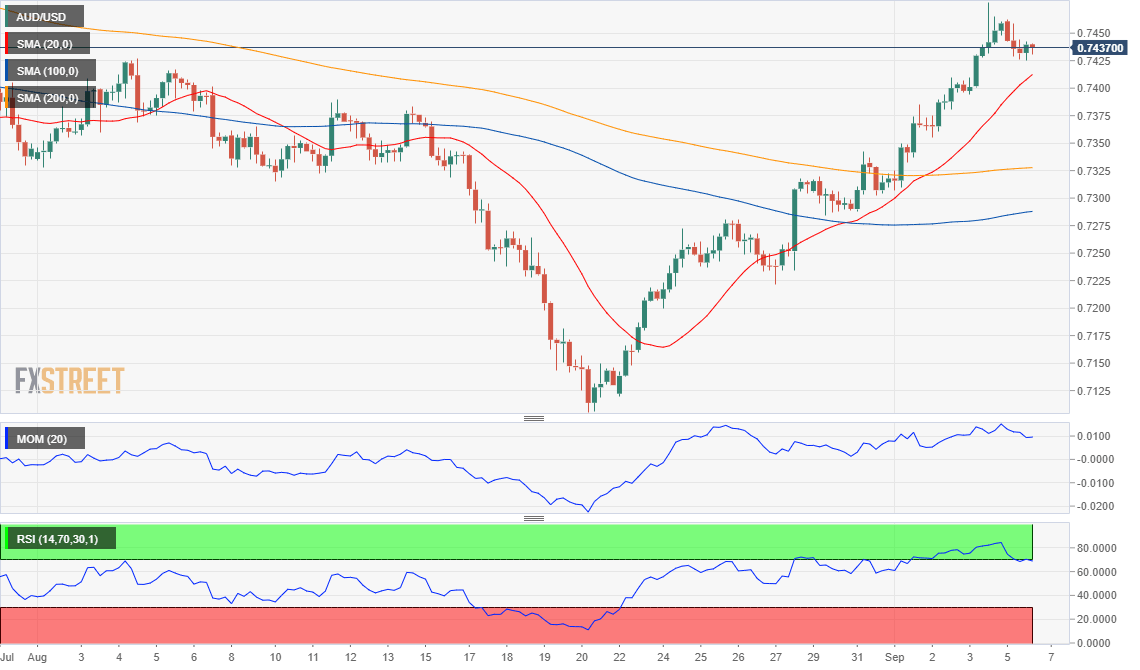

The AUD/USD pair retreated modestly from a multi-week high of 0.7477, holding above the 0.7400 figure and bullish, according to the daily chart. A dovish RBA is partially priced in, so chances of a steep decline are limited. Supports come at 0.7400 and 0.7370.

A hawkish surprise could push the pair through the mentioned 0.7477 level towards 0.7510. The pair may have a hard time retaining gains above the latter, but if it does, the advance could continue in the upcoming sessions toward the 0.7560 price zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.