Reserve Bank of Australia leaves rates unchanged but keeps hawkish tone

There is a disconnect between Reserve Bank of Australia (RBA) Governor Michele Bullock’s assessment of inflation risks and the market’s continued optimism for rate cuts by the year-end…

This would not have been a sensible time to hike

Last month, we took a chance and forecast a rate hike at this meeting. As of yesterday, that forecast lay in tatters. We had still been prepared to take a gamble with that call following the 2Q24 and June CPI data, even though they showed a slightly better outcome for core inflation than expected. But the forecast was already looking highly speculative at that point.

An additional nail in the coffin for the rate hike view, and maybe more of a stake through its heart than a nail, was the market turmoil that has followed the latest US labour report.

No sensible central bank would have been hiking rates against that backdrop, and we are not surprised or disappointed that the RBA left its cash rate unchanged at 4.35% at today's meeting.

The inflation story is not over though

But despite all that, the overwhelming impression given by Governor Bullock's statement accompanying this decision is that inflation is not where she would like it to be, and it is also taking far longer to tame.

The key paragraph in the statement is "Inflation in underlying terms remains too high, and the latest projections show that it will be some time yet before inflation is sustainably in the target range. Data have reinforced the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out. Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range".

The full statement warrants a good read and highlights some of the downside risks as well, but the net impression is that the RBA is still more concerned about upside inflation risks than downside activity disappointments. This may not be a last gasp for rate hike enthusiasts.

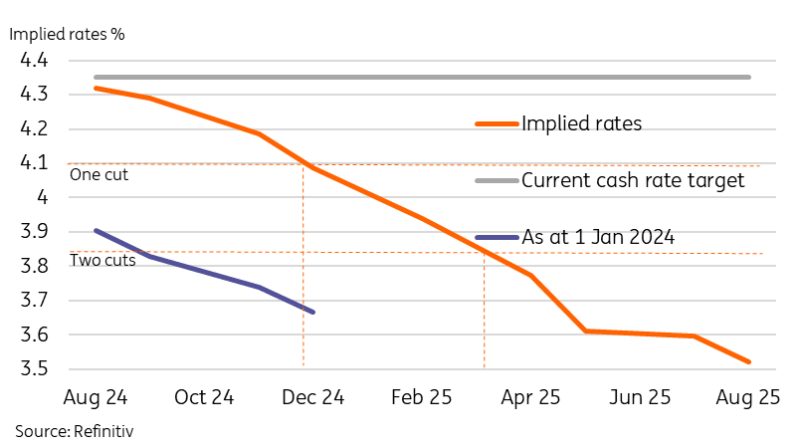

Implied cash rates

Market rates outlook is for cuts by year-end

Given this, it is perhaps a little surprising that the market is still looking for rate cuts by the end of the year. Cash rate futures have priced in about a 90% chance of a 25bp rate cut by the 10 December meeting. That may still be a hangover from the market turmoil of the last few days, and we expect further retracement of the excessive panic that gripped markets this Monday when cash rate futures were close to pricing in two cuts by December.

In our view, even a solitary December cut looks too much too soon, and our revised forecasts for cash rates, which will trim down to 4.35% our peak cash rate forecast (we previously had assumed this would reach 4.6%), will not consider rate cuts until sometime in 2025.

Read the original analysis: Reserve Bank of Australia leaves rates unchanged but keeps hawkish tone

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.