Readying to squeeze some more

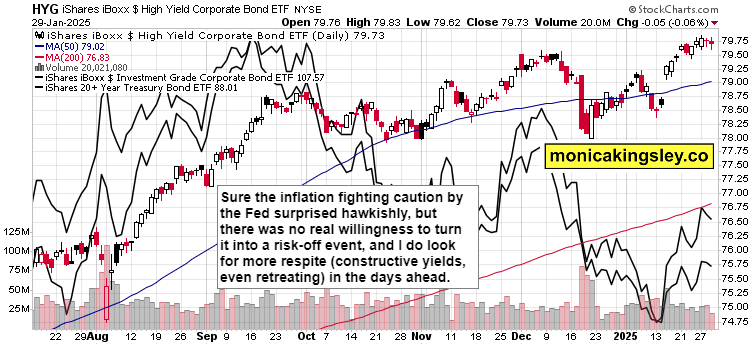

S&P 500 presented the bull trap I talked Wednesday premarket, and FOMC brought another curveball. Powell is truly setting us up for a replay of spring 2019 – satisfaction with inflation fighting progress had been dropped, job market stance also changed, yet hawkish perceptions were talked down during the conference.

S&P 500 though didn‘t reach the 6,035 support area after breaking below low 6,070s – where does that and yields‘ unwillingness to follow in the Fed‘s preferred path leave us? With ECB cutting by 25bp today, we‘re going to see more USD appreciation, and it pays to watch the yen (that it remains within the latest range).

The incoming data of today won‘t rock the boat, and AAPL earnings will help equities higher (AMZN price action won‘t be a disappointment either while META keeps winning) – yesterday‘s earnings were also decent, and financials premarket reporting, did fairly well too.

Treat yourselves to today‘s packed video, and check these charts – what does it say about recession odds and equity risk premium as we‘re seeing some semiconductors revival?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.