Readying for hawkish Fed

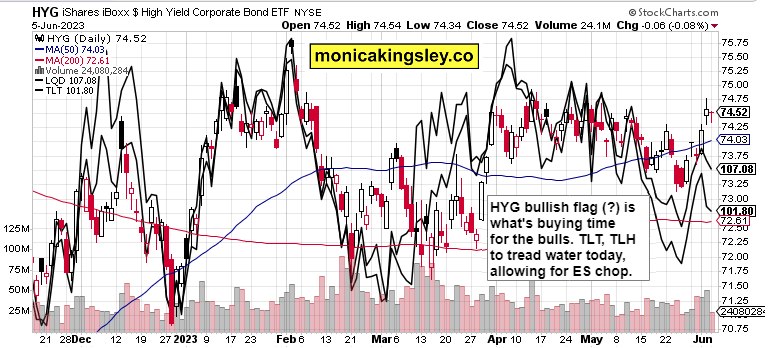

S&P 500 made two runs over 4,300, yet was rejected in each. Bonds though didn‘t paint universally negative picture – only the sectoral composition of the decline did. Whatever caught up Friday and before, saw progress dialed back yesterday. Not on huge volume, and given the HYG price action, we‘re likely to see buyers stepping in after the opening bell‘s selling.

Encouragingly, stocks didn‘t tank on RBA or poor German data, precious metals remain relatively strong, but cracks in the tech dam are starting to emerge – AAPL, and NVDA a bit. Thus far, the market is more likely to offer intraday opportunities in line with my latest offering than a real tactically shorting one (that‘s approaching, but not yet quite here). Seems though 4,320 to be a tough nut to crack in June...

Check out the extensive Sunday‘s analysis if you hadn‘t done so already.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts – today‘s full scale article contains 4 of them.

S&P 500 and Nasdaq outlook

Junk bonds held up actually well yesterday, and as long as $74.20 holds today, ES buyers can come back later this week. Low volume session in a tight range would be ideal for such an outcome.

Junk bonds held up actually well yesterday, and as long as $74.20 holds today, ES buyers can come back later this week. Low volume session in a tight range would be ideal for such an outcome.

Junk bonds held up actually well yesterday, and as long as $74.20 holds today, ES buyers can come back later this week. Low volume session in a tight range would be ideal for such an outcome.

Junk bonds held up actually well yesterday, and as long as $74.20 holds today, ES buyers can come back later this week. Low volume session in a tight range would be ideal for such an outcome.

The call for decreasing momentum and consolidation of Friday‘s sharp gains worked out, and stocks broke even below 4,283 test, doing so after (and not before) heading for the 4,305 resistance. That gives slight upper hand to the sellers today, but 4,247 should hold (and not even be seriously approached).

Credit markets

Junk bonds held up actually well yesterday, and as long as $74.20 holds today, ES buyers can come back later this week. Low volume session in a tight range would be ideal for such an outcome.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.