The Reserve Bank of New Zealand (RBNZ) has delivered its third consecutive rate cut today (Wednesday, 27 of November), lowering the Official Cash Rate (OCR) by 50 basis points to 4.25%.

The central bank’s decision comes as inflation eases within its target range and economic growth shows signs of weakening. This aggressive easing cycle, totaling 125 basis points in just over three months, positions the RBNZ as one of the most dovish central banks in the Western world. The RBNZ’s decision comes as the Federal Reserve, after a more aggressive rate cut in September, now signals a more gradual approach to monetary easing, as outlined in the minutes of November.

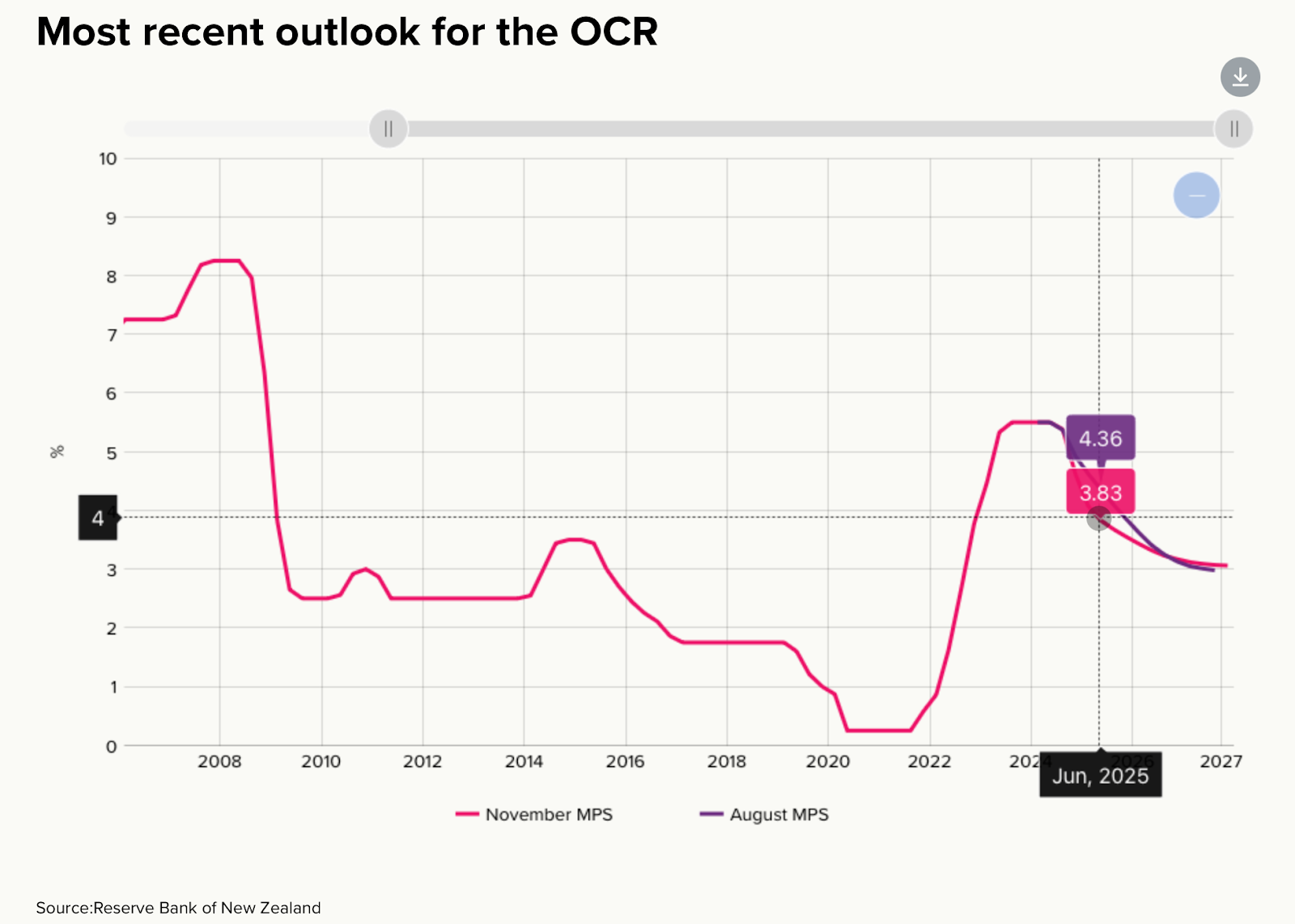

Governor Adrian Orr signaled that further easing may be on the horizon, hinting at a potential 50 basis point cut at the February 19th meeting, provided economic conditions evolve as expected. The RBNZ’s latest forecasts project the average cash rate to decline to 3.83% by June 2025, a significant downward revision from the 4.36% projected in August.

In the following sections, we’ll delve deeper into the RBNZ’s outlook for inflation and economic growth, and explore how traders might use this data.

Inflation is expected to remain within the RBNZ’s target

Inflation in New Zealand has shown significant improvement, with headline consumer price inflation now approaching the Reserve Bank of New Zealand’s (RBNZ) target midpoint.

In the September 2024 quarter, headline inflation fell within the RBNZ’s target band, registering at 2.2%. This aligns closely with the central bank’s desired midpoint of 2%, and forecasts suggest that inflation will remain near this level in the foreseeable future. Core inflation measures, which exclude volatile components such as food and energy, are also converging toward the target midpoint, reflecting the broader normalization of inflationary pressures in the economy.

One of the key drivers behind this decline in inflation is the expectation of significant spare productive capacity in the economy over the next 12 months. The RBNZ’s Monetary Policy Committee has expressed confidence that this excess capacity will help alleviate any lingering inflationary pressures. Supporting this optimism are insights from recent surveys and business visits, which indicate that domestic price and wage-setting behaviors are gradually aligning with the goal of keeping inflation sustainably at target. This alignment suggests that businesses and households are increasingly adapting to an environment of stable price growth.

However, despite this positive outlook, the RBNZ has highlighted several uncertainties that could impact inflation dynamics in the medium term. Geopolitical risks, such as global conflicts or trade disruptions, remain a potential source of volatility. Additionally, climate-related challenges, particularly those affecting energy and food supplies, could lead to sudden price spikes in specific sectors. These factors increase the risk of relative price volatility, which could make aggregate inflation less predictable.

The economy is weakening but should bounce back

New Zealand’s economic growth has faced significant challenges recently, with GDP contracting for four consecutive quarters. In the June 2024 quarter, GDP fell by 0.2% compared to the previous quarter and also declined by 0.2% on an annual basis.

This slowdown reflects weak activity across the economy, with households and businesses reducing their spending and a notable decline in new home construction. Sectors most sensitive to monetary policy, such as construction and real estate, have been hit hardest by high interest rates.

Despite this weak performance, the Reserve Bank of New Zealand (RBNZ) anticipates a recovery as interest rates decline, making borrowing more affordable and stimulating consumer and business spending. Lower interest rates are expected to provide the necessary boost to economic growth by improving credit conditions and reigniting investment.

Globally, economic headwinds are adding to New Zealand’s challenges. Growth in key trading partners like the US and China is expected to slow in the coming year, while Europe’s outlook remains lackluster. These external pressures could dampen demand for New Zealand’s exports, which are critical for the local economy.

The labour market has softened, with unemployment rising as businesses scale back hiring amid weaker economic conditions. Job advertisements have declined, reflecting reduced demand for labor, and pay increases are slowing compared to recent years due to lower inflation and a tighter job market.

While the unemployment rate is expected to rise further in the near term, the RBNZ forecasts that it will decline as the economy begins to recover in 2025. Historically, the labor market tends to lag behind economic output, meaning that improvements in GDP may not immediately translate into job growth.

Migration patterns have also shifted, contributing to labor market challenges. Net immigration to New Zealand has dropped significantly from historically high levels, with fewer migrants arriving and more New Zealanders moving to Australia in search of better job opportunities. Australia’s stronger labor market and economic conditions are attracting workers, further reducing New Zealand’s available workforce.

The NZD/USD technical outlook on Wednesday 27th of November

Weekly Chart of the NZD/USD from the ActivTrades’ Online Trading Platform

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66-79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. ActivTrades PLC is authorized and regulated by the Financial Conduct Authority, registration number 434413. ActivTradesPLC is a company registered in England &Wales, registration number 05367727. ActivTrades Corp is authorized and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B. ActivTrades Corp is a subsidiary of ActivTrades PLC. ActivTrades Europe SA, Public Limited Company, is authorized and regulated by the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. ActivTrades Europe SA is a company registered in Luxembourg, registration number B232167. ActivTrades Europe SA is a subsidiary of ActivTrades PLC.

Recommended Content

Editors’ Picks

EUR/USD regains 1.0500 and beyond as US Dollar wilts ahead of data

EUR/USD is extending the rebound above 1.0500 in the European session on Wednesday. Traders cash in on the US Dollar long positions ahead of a series if top-tier US data, lifting the pair. The USD/JPY sell-off also adds to the US Dollar downside.

GBP/USD holds gains near 1.2600, US PCE data eyed

GBP/USD extends the bullish momentum to trade near 1.2600 in European trading on Wednesday. The pair remains underpinned by a sustained US Dollar weakness and risk-off sentiment as traders turn cautious ahead of top-tier US data releases.

Gold price climbs above $2,650 on trade war concerns, sliding US bond yields and softer USD

Gold price sticks to modest intraday gains near a two-day high, above the $2,650 level, through the first half of the European session as geopolitical risks and US President-elect Donald Trump's tariff plans drive haven flows for the second straight day.

US core PCE inflation set to hold steady, raising doubts on further Federal Reserve rate cut

The United States Bureau of Economic Analysis (BEA) is set to release the Personal Consumption Expenditures (PCE) Price Index data for October on Wednesday at 15:00 GMT.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-638682913064752116.png)

-638682913280339329.png)

-638682913538885073.png)