RBA rate cut kicks off expected policy coordination from major central banks [Video]

![RBA rate cut kicks off expected policy coordination from major central banks [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/RBA/iStock-941212934_XtraLarge.jpg)

Market Overview

With market fear still at elevated levels, traders and investors around the world are looking out for a coordinated response from the authorities. Central banks assisting with looser monetary policy and perhaps action from governments through fiscal support. There has been an enormous re-pricing of Federal Reserve monetary policy over the past couple of weeks. The CME Group Fed funds futures are now pricing a full -50bps cut from the Fed in its April meeting. A “bull steepener” on the yield curve has resulted as shorter-dated yields price for a dramatic rate cut. At its low yesterday, the US 2 year yield had fallen -70 basis points in seven sessions, whilst the US 10 year yield is around -50bps lower over the same time. The Reserve Bank of Australia has been the first major central bank to make its move with a cut of -25bps overnight (down to +0.50% which was expected, +0.75% last). Other central banks with room to cut (such as the Bank of England) as also being priced in. With Fed chair Powell saying they would “act as appropriate”. Those banks with less room for manoeuvre, such as the ECB or BoJ, are translating to outperformance of their respective currencies. However, the hints of policy co-ordination are helping to stabilise markets, at least in the near term. A huge rally on Wall Street last night (volatility remains massive) is translating to decent gains this morning in Asia and Europe. A rebound on oil has also kicked in.

Wall Street engaged a mammoth rally yesterday, with the S&P 500 +4.6% higher at 3090, whilst US futures are a little more circumspect, around flat this morning. In Asia there has been a little more of a mixed session, with the Nikkei still lower by -1.2% but other markets higher, with the Shanghai Composite +0.7%. In Europe, the outlook is mildly positive initially, with FTSE futures +0.9% and DAX futures +0.8%. In forex markets, there is a mixed look across the major pairs, with EUR giving back some recent gains, but USD is not really that strong, as GBP and JPY are performing better, whilst AUD is also higher. In commodities, there are tentative gains for gold and silver, whilst oil is over 1% higher.

On the economic calendar the big focus will be on Eurozone inflation. However, first up, the UK Construction PMI is at 0930GMT and is expected to improve to 48.8 in February (from 48.4 in January). Flash Eurozone HICP for February is at 1000GMT and is expected to show headline HICP slipping to +1.2% (from +1.4% in January) whilst core HICP is expected to tick higher to +1.2% (from +1.1% in January). Eurozone Unemployment is expected to remain at 7.4% in January (from 7.4% in December).

There one Fed speaker on the agenda today, with Loretta Mester (voter, leans hawk) who is speaking at 1950GMT. Mester will be a good gauge of how dovish the committee could be beginning to become.

Chart of the Day – USD/CAD

As the oil price has (finally) been able to muster support for a technical rebound, we see the Canadian dollar also bouncing. Yesterday’s strong negative candle on USD/CAD reflects a big turnaround on the trend higher, but as yet has achieved relatively little. With a mild tick higher again today, the market is back into a key pivot band between 1.3330/1.3350 once more. The question is whether this will be a sustainable turnaround. The two month uptrend comes in at 1.3250 today, so there is further room in a correction. Furthermore, momentum indicators are topping out, with the sensitive Stochastics crossing lower and RSI ticking back from 70. Again there is room for downside potential in these near term negative momentum signals. With the move back into 1.3330/1.3350 which has been an old key resistance, this is a key moment for the correction. The hourly chart has taken on more of a corrective configuration now on momentum, whilst a move back below support at 1.3305/1.3310 would increase the corrective momentum. There is a lower high that has formed at 1.3395 which the bulls need to overcome to re-engage a positive outlook.

WTI Oil

A bullish outside day in yesterday’s session is a very positive way to start the week. However, now the important session is today’s reaction. Can the bulls now build on this and finally generate some meaningful recovery. There is a notable tick higher on RSI and Stochastics, but this will all still be in the context of a bear market rally unless some technically significant move is seen. This needs to be a move back above $49.30 (the old February support) at least. The hourly chart momentum looks more encouraging for a recovery, but hourly RSI needs to hold above 40 and hourly MACD lines above neutral to maintain conviction in the move. The bulls will be looking at initial support at $46.00/$46.70 which needs to hold for the recovery to also remain on track. Initial resistance is at $48.55 this morning.

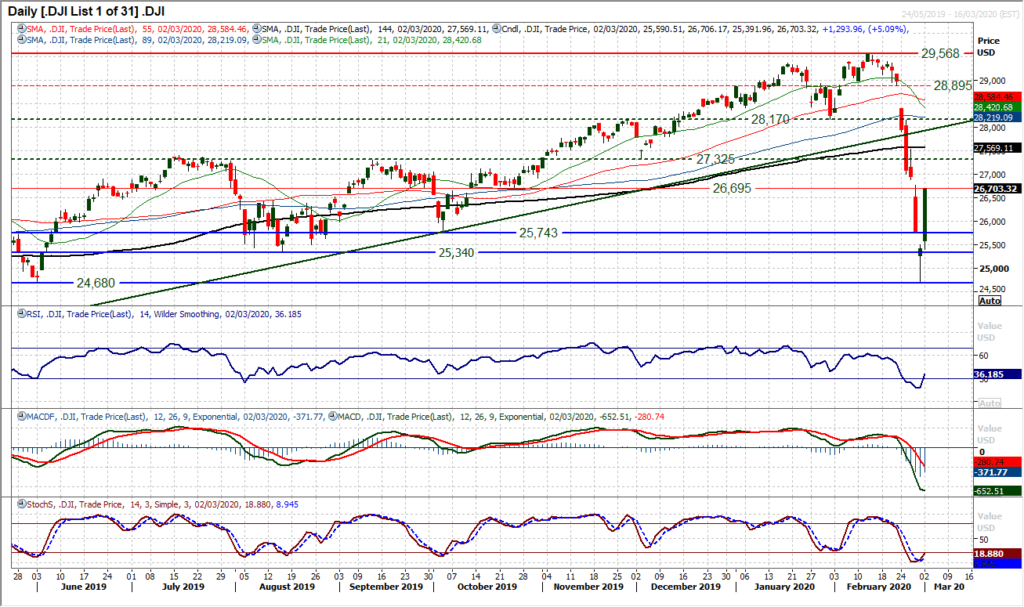

Dow Jones Industrial Average

The levels of volatility on Wall Street right now are enormous. The Average True Range on the Dow is currently 611 ticks, which is well over 2% on a daily range. The market has swung sharply higher to post a 5.1% gain on the day and the biggest positive session since 2008. The wild moves mean that support and resistance lines of any note seem to do little. After such a big one day gain, the futures are moderating the market slightly back early today, but there is little expectation that the volatility is done yet. For what it is worth, there is resistance in the band between the old October pivot at 26,695 and the recent gap down at 26,890. Initial support is 25,860/26,250. If the market can post another positive close then perhaps we can begin to hold a view of greater conviction, but whilst the Dow is flying back and forth, this is a market for the weak of heart.

Author

Richard Perry

Independent Analyst