RBA provides less hawkish forward guidance

AUD: RBA seems like providing dovish comments guidance

The Australian dollar has been the biggest mover amongst G10 FX rates overnight. As for me, I've noticed that it has fallen by approximately -2.20% against the US dollar and -0.64% against the New Zealand dollar. As a result, the AUD/USD rate has fallen below the 0.6600-level and the AUD/NZD rate has gone back towards the 1.0770-level. The primary reason for the Aussie sell-off at the start of this week, in my opinion, was firstly the announcement made over the weekend from China, stating that it has set a modest growth target of around 5.0% for this year. The sell-off has since been reinforced by the RBA's latest policy update yesterday afternoon. The RBA raised their policy rate by a further 0.25 point in line with consensus expectations, lifting it up to 3.60%. However, the updated policy statement did provide a less hawkish policy signal over the need for further tightening, which has weighed on the Australian dollar. As for me, I think the RBA acknowledged that growth is slowing and is expected to remain below trend for the next couple of years, following the release of the softer than expected GDP report for Q4. I'm concerned about the outlook for household consumption in response to the negative impact from tightening financial conditions and falling house prices.

I've noticed that at the same time, the RBA sounded more confident that inflation has likely peaked following the weaker than expected CPI report for January. As for me, I think the RBA expects inflation to continue falling in the coming years and displayed less concern over the risk of wage price spiral. The RBA also tweaked its forward rate guidance, saying that further "tightening" may be needed, which was less hawkish than the guidance used at the last meeting in February when they confidently stated that further "increases" could be necessary over the coming months. In my opinion, the updated policy statement has sent a less hawkish signal that the RBA is moving closer to pausing their hiking cycle, but they still plan to deliver at least one more hike. As for me, the timing and scale of further hikes will be more data-dependent going forward. I expect one further 25 base points hike in April or May. Based on the developments overnight, I believe the Aussie is vulnerable to further weakness in the near-term.

EUR/USD: Powell testimony & easing energy shock in Europe

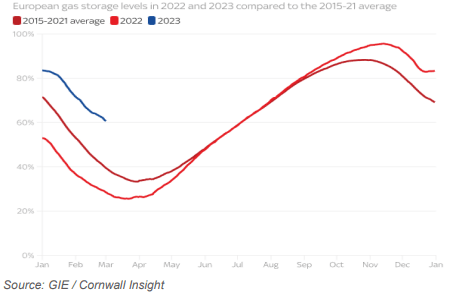

I've noticed that the weakness of the US dollar at the start of this week has helped to lift EUR/USD back up towards the 1.0700 level. As for me, one positive fundamental driver for the stronger Euro at the start of this year has been the ongoing easing of fears over the size of the hit to Europe's economy from the energy supply crisis. In my opinion, those fears have eased as the warmer winter has meant that gas prices have fallen sharply back towards pre-Ukraine conflict levels. I also saw that a report was released yesterday by energy consultancy Cornwall Insight that forecasts that gas storage facilities across Europe will end the winter between 45% and 61% full, with an average of 55% capacity. It is on course to beat the previous end of winter record of 54% in 2020. As for me, this provides a stronger than expected starting point for European countries to rebuild gas inventories ahead of next winter. The positive developments are continuing to help ease downside risks to growth in the region and European currencies.

Warmer winter still helping to ease energy shock for Europe

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Author

ACY Securities Team

ACY Securities

ACY Securities is one of Australia's fastest growing multi-asset online trading providers, offering ultra-low-cost trading, rock-solid execution, technologically superior account management and premium market analysis. The key pi