RBA Preview: COVID running a muck? An Exy Aussie? Nah, no worries mate!

- RBA on hold but less optimistic about the immediate economic outlook and that of H1 2021.

- A week of multiple domestic events to keep AUD active, while bearish swing trade opportunities could be set.

The Reserve Bank of Australia is set to meet this Tuesday and here we will delve into what we might expect from the meeting and how it might impact the Australian dollar.

First and foremost, let's get the Aussie slang definitions out of the way, shall we?

- Running a muck - Australian slang - Out-of-control behaviour; meaning overly fun or disruptive or partying behaviour or outlandish, rebelling behaviour; revelling.

- Exy - Australian slang - expensive

- No worries mate - Australian slang - "do not worry about that", "

that's all right".

In other words, this week's interest decision from the RBA is likely to see it set to keep monetary policy unchanged, despite a resurgence of the virus and how high the currency has travelled since their last meeting.

However, the target cash rate should remain at 0.25% given the Minutes of the July meeting stated there is “no need to adjust the package of policy measures in Australia in the current environment”.

Nonetheless, that is not to say that this event will be a non-event for the markets, far from it.

The meeting will follow a dovish dose of reality from the Federal reserve outcome last week, so it should be expected to follow suit and, in all probability,y weigh on the prospects for a strong Aussie for the foreseeable future.

However, the nuts and bolts may well follow later in the week from the Statement on Monetary Policy (SoMP) on Friday.

A different playing field

It should be noted that quite a bit has gone on since the RBA was last vocal bout its forecasts for the near and medium-term future, and there is enough to suggest that it will be a little less positive about the now and in 2021 than it was before.

Crucially, the market will be looking for their outlook with regards to unemployment because as a consequence to the recent spike in the virus in the 'big smoke', the RBA will probably admit to the reality that it will take quite a bit longer to drop below 7%.

Before the second wave hit

The Aussie dollar has been one of the most impressive stories, bar the US stock market recovery, of the coronavirus crisis, pertaining, in part, to the fact that Australia managed the initial wave of the pandemic better than expected.

This is something that the RBA board acknowledged this in its June statement:

- It is possible that the depth of the downturn will be less than earlier expected.

- The rate of new infections has declined significantly and some restrictions have been eased earlier than was previously thought likely.

- And there are signs that hours worked stabilised in early May, after the earlier very sharp decline.

- There has also been a pick-up in some forms of consumer spending.

The RBA was thus expecting a more positive outcome for the economy in the near and medium-term, something for which was addressed in the minute of the July board meeting

- The downturn had been less severe than feared a few months earlier.

- Consumer spending in May and June had been stronger than expected, and had also held up better than in most other countries. Manufacturing and construction activity had also been less affected in Australia than elsewhere.

- Similarly, the contraction in the labour market had been less severe than expected in May.

However, we have seen a second wave since these minutes were published and that will likely play a roll in the RBA revising its outlook for H2 of this year and the early part of 2021.

Uncertainty prevails, but reluctant to move too soon

COVID numbers are rising rapidly in many other countries around the world.

The RBA would be expected to take heed from what has happened in the US and note how uncertain this fluid situation is for Australia and the global growth outlook.

A higher AUD will also be a factor for the RBA to consider although iron ore prices have continued to rise favourably so.

However, the currency is a great deal stronger than the RBA assumed in May.

There is now a TWI value of 61.7 against an assumed level of 57 and an AUD/USD rate of more than 0.7100 against an assumed level of 0.64.

The last time the RBA looked dove the strength the Aussie, it took off in a strong rally vs the greenback.

This will be a factor in the meeting to watch out closely to see if the RBA changes its relaxed tune over the strength of the currency.

All in all, the most straightforward move from the RBA could be to simply to reiterate the current accommodative stance and the determination to do more if needed.

Any further tapering comments could well underpin the currency, but they will be less effective in calming the market's caution over the virus situation in Victoria.

The week in Australia is also packed with other releases, with trade and retail sales data from June, and with the RBA Statement of Monetary Policy later in the week, it could be a choppy time ahead of the currency.

AUD may only marginally benefit from any data surprise.

AUD/USD on the charts

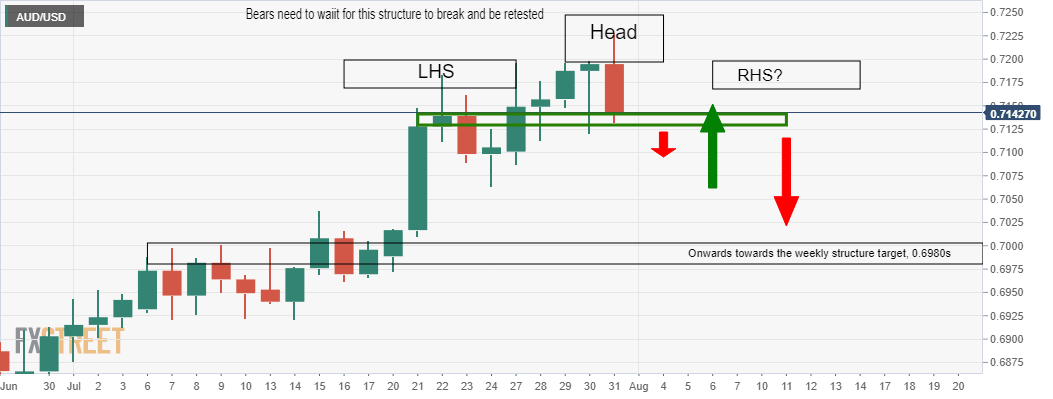

In the attached article and technical analysis, prospects for a bearish head and shoulders have been identified.

During the course of events this week, traders may wish to monitor for a bearish swing opportunity should the scenarios outlined within the analysis indeed play out.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.