Rates spark: Markets speculate on 2025 central bank cuts

European Central Bank speakers have dampened some of the rising expectations for easing. A 50bp cut in December is still on the table, but Friday’s PMIs will be crucial. Alongside the US, we think markets have turned too hawkish on Bank of England rate cuts.

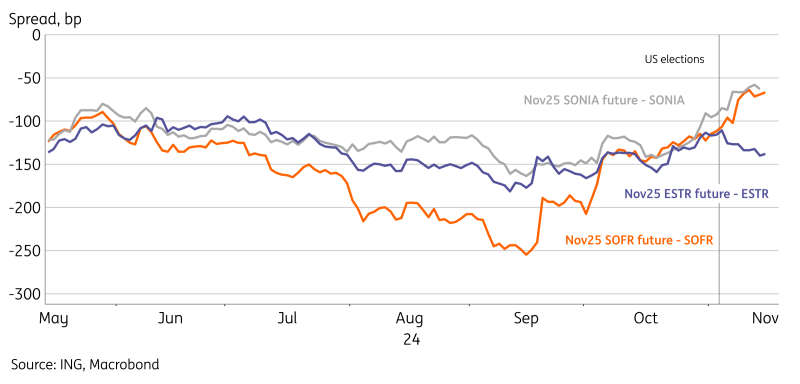

Expectations of ECB cuts in 2025 keep moving around

Markets are convinced that the next rate cut by the European Central Bank will be in December and are eyeing over 125bp of cuts by November next year, in contrast to the more hawkish sentiment in the US and UK. The divergence has clearly accelerated since Trump’s election win two weeks ago, and with little data to work with since then, we wouldn’t be surprised if the spread continues to widen. Having said that, on Monday markets gave some pushback, shaving off some 8bp from the ECB’s landing zone, whilst expectations from the Fed and Bank of England budged little.

A 50bp cut for December is still on the table and Friday’s PMI report could be the missing piece of the puzzle to make that happen. On Monday, three ECB speakers voiced concerns about growth due to possible trade tensions, and this could also potentially play a role in the ECB’s rate-cutting decisions. However, markets appear reluctant to move on speculation about Trump’s presidency and thus the macro data will for now be a more important driver of front-end rates.

We think markets have turned too hawkish on Bank of England cuts

The most notable line in the chart below is actually the expectations about the landing point of the UK GBP overnight rate SONIA. The UK budget announcement on 30 October may be playing a role in the hawkish sentiment, but even after the US elections, the rate cut expectations from the BoE were reduced drastically. The rise in the short end of GBP rates also explains most of the increase in 10Y Gilt yields. We think those should find their way back to below USTs and hit 4% in mid-2025, significantly lower than the current 4.5%.

Overall, we think that the front end of the GBP swap curve is looking particularly stretched and expect this to recalibrate lower. But with few catalysts that could persuade markets of this move in the near term, we may have to wait until 2025 to see this materialise. On the data front, in particular, we would need a series of better services inflation numbers to convince markets of the BoE’s ability to cut more than the meagre two or three total cuts currently priced in.

Trump election marked divergence in rate-cutting expectations

Read the original analysis: Rates spark: Markets speculate on 2025 central bank cuts

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.