Rates spark: Lagarde clear about not committing to cuts

The European Central Bank decided to keep rates on hold as expected, and markets received little forward guidance. We see a continuation of the global macro trend for steeper curves, driven by the prospect of future cuts. We saw something similar for the Gilt curve on the back of cooling labour market data.

ECB makes no commitment to a September cut

The ECB meeting ended with markets showing little reaction – the Governing Council unanimously decided to keep rates on hold. Very front-end rates with a view to September – if anything – nudged up slightly toward 20bp of easing priced for that month’s meeting and more towards 46bp for the year as a whole. The key sentence in the press conference was that the decision in September was “wide open”. While the market is already very much tilted to a cut, it got no further affirmation of that view out of Thursday's meeting. The ECB maintains a data-dependent and meeting-by-meeting approach and has not provided any forward guidance.

The slightly more dovish follow-through observed in pricing beyond the next few months might be due to the ECB no longer attributing downside risks to growth to just the longer-term outlook. Also, while Lagarde highlighted wage growth is likely to remain elevated, she added that this view had already been fully taken on board in the June projections when the ECB cut rates for the first time. However, these more dovish interpretations were dashed later in the afternoon on the back of Bloomberg reporting that policymakers were becoming less confident about two further cuts this year.

As a result, 2Y Bund yields moved only marginally lower. The 10Y Bund yields ended the session somewhat higher at 2.43%, but not before yields tested the upside towards 2.45% ahead of the press release. 2s10s thus steepened slightly as did 10s30s, steeper by a more noticeable 2bp – the macro trend towards steeper curves appears to be firmly in place.

Macro case for steeper curves firming up

Looking across the developed market space, UK gilts were the best performer over the past session, which followed on the heels of the jobs data confirming views of a cooling trend. Gilt yields dropped up to 6bp led by the front end; the 10Y Gilt now yields 4.03%.

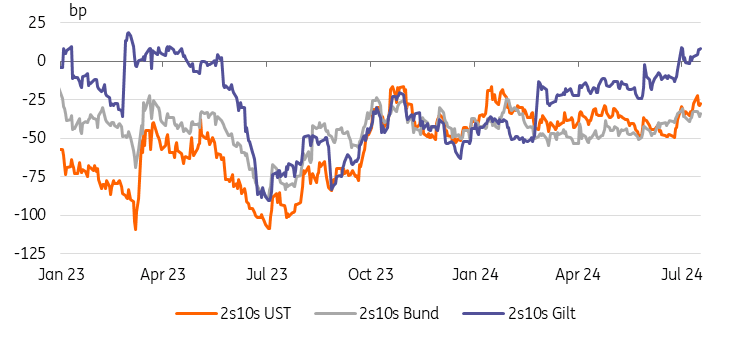

Over in the US rates remained largely range bound. The initial jobless claims numbers nudged somewhat higher, thus providing more evidence of a cooling jobs market also here. But the US curve steepening push on the back of the “Trump-trade” has levelled off after 2s10s more or less ratcheted already 20bp steeper since late June, as seen in the chart below. It may also be that some of the perceived inevitability of a Trump presidency requires some reassessment when yesterday’s headlines prove true that Biden may exit the race soon.

While there are still crucial questions about the pace of cuts as seen in EUR, the overall macro trend towards steeper curves still appears to be firming up given the prospect of central bank cuts – crucially, this is also already reflected in forwards, which still renders steepening positions expensive with a relatively high cost of carry.

Global steepening as rate-cut narrative builds

Read the original analysis: Rates spark: Lagarde clear about not committing to cuts

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.