Rate cuts on the horizon: What investors need to know ahead of the US election

This week, the market is focused on the Fed's first rate cut since 2020. Based on Fed fund rate futures, there is a 67% chance of a 50bps cut and a 33% chance of a 25bps cut (source: CME Group). A former New York Fed Chairman has also publicly advocated for a 50bps cut. Regardless of the exact cut, interest rates are expected to decline.

The market anticipates aggressive cuts in response to rising unemployment and negative yields returning to zero.

Banks, insurance companies, and trading firms have gained traction, with hedge funds purchasing their stocks at the fastest rate since June 2023 (source: Reuters).

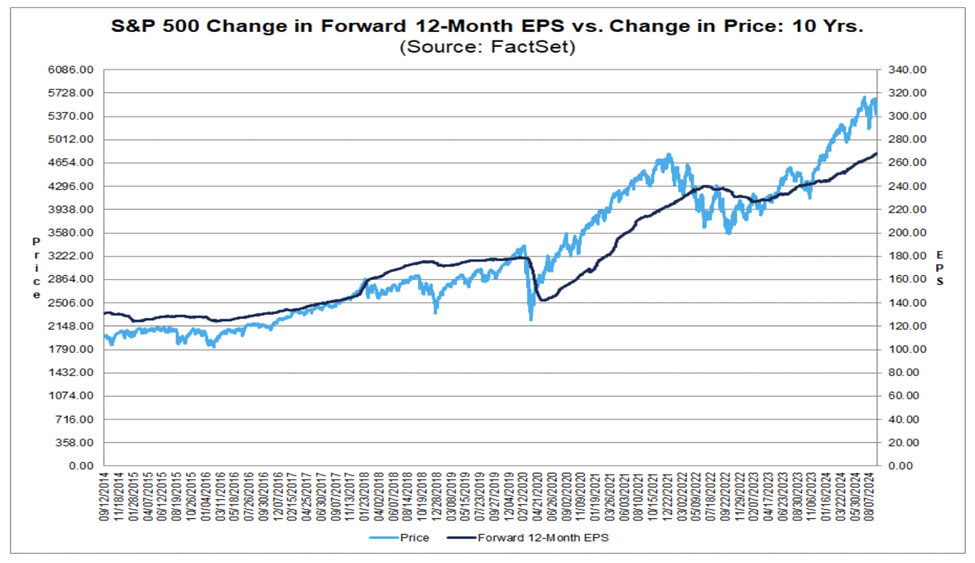

Source: Factset

The upcoming US presidential election could significantly impact both fiscal and monetary policy. When determining future monetary easing, the Federal Reserve must take into account potential shifts in fiscal policy depending on which party gains control of the White House. Tax: Donald Trump may push to make the 2017 tax cuts permanent and reduce corporate tax rates from 21% to 15% (source: Allianz). Kamala Harris plans to raise the corporate tax rate to 28% to ensure "big corporations pay their fair share" (source: Reuters). Goldman analysts estimate this increase could reduce S&P company earnings by 5%, affecting equities markets and employment, forcing the Fed to adjust its monetary policies (source: Reuters).

Trade policy: Both Republicans and Democrats support tariffs to some extent. Donald Trump has vowed to increase tariffs on China and impose broad tariffs on other imports, aligning with his economic nationalism despite inflation concerns (source: CNN). Meanwhile, the Biden administration has locked in steep tariffs on Chinese imports, including a 100% duty on electric vehicles, to protect strategic industries. With more tariffs set to rise on various goods beginning 27 September under the Biden-Harris administration, inflationary pressures could increase, particularly for consumer goods (source: Reuters).

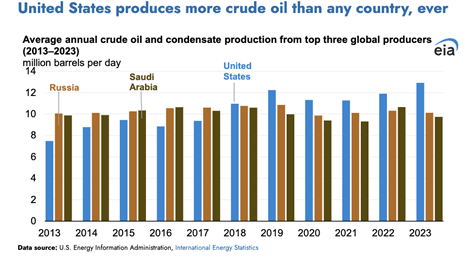

Energy policy: Trump is likely to support fossil fuel production and pipeline construction (source: Allianz). Under the Biden-Harris administration, US crude oil production has not slowed down. Increased crude supply can help to lower oil prices, which in turn helps alleviate inflationary pressures.

The US produces more crude oil than any country.

Source: EIA

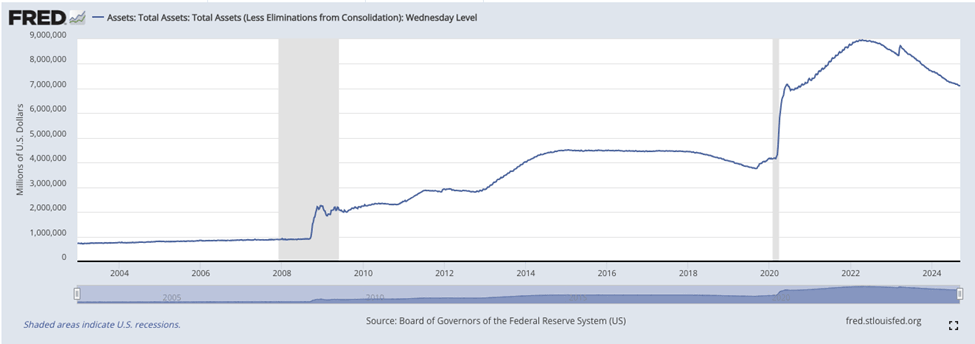

Besides rate cuts and the upcoming election, investors should also focus on when the Fed will end Quantitative Tightening (QT).

In June 2024, the Fed reduced the pace of QT from $60 billion to $25 billion. While QT reduces long-term debt assets, it leads to a steeper yield curve, affecting the reliability of long-term treasury yields as a recession predictor.

Source: Fred

Although there’s still room to shrink the balance sheet, Fed Chair Jerome Powell indicated plans to slow and eventually stop this process once reserve balances are above the level considered ample (source: Brookings). The Fed monitors the repo market to assess if reserves are sufficient; reluctance from banks to lend into this market signals a shortage.

Despite creating the Standing Repo Facility in July 2021 to provide emergency cash, the Fed couldn't prevent the Silicon Valley Bank crisis in March 2023. From October 2014 to September 2019, bank reserves dropped 15%, causing turmoil in the repo market. Since 2022, the balance sheet has shrunk by 20.3%, raising the possibility that the Fed may consider further slowing or ending QT.

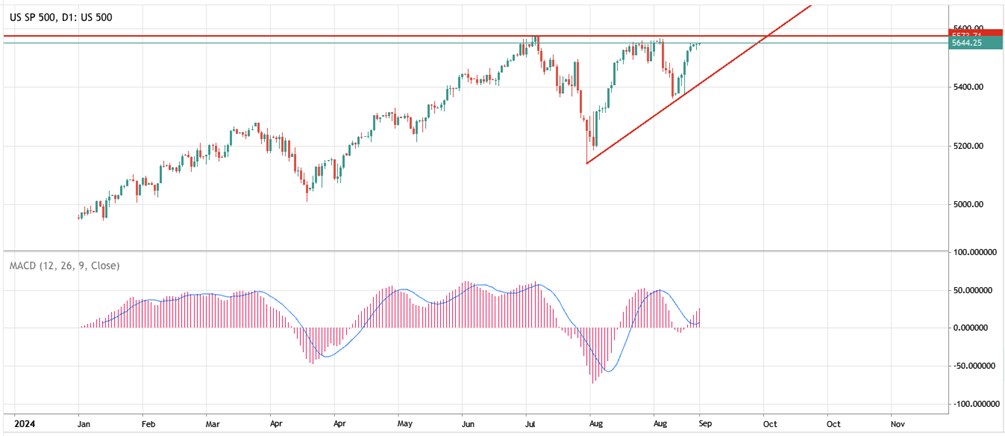

On the daily S&P 500 chart, a triangle consolidation pattern is forming, with the market awaiting liquidity impacts from central bank rate decisions including the ECB, BoC, BoE, Fed, and PBoC.

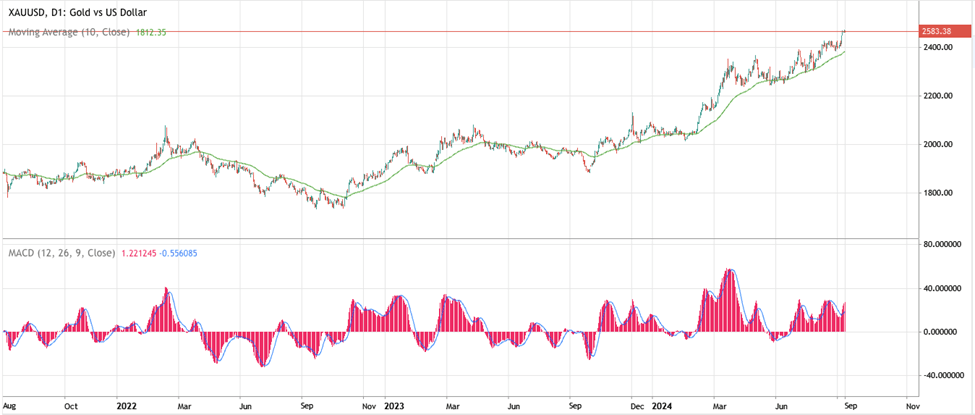

On the gold daily chart, prices are responding to central bank easing policies. The MACD is trending upward without divergence. On the weekly chart, gold has broken out of a cup and handle pattern, signaling more upward potential as liquidity increases. Gold’s next targets are 2620 and 2680.

Conclusion

As markets await the Fed’s rate decision and global central bank policies evolve, interest rates and liquidity will be key. The US election will also shape fiscal decisions, impacting sectors and investor sentiment. Gold and equities reflect the market’s sensitivity, with central bank actions likely to influence further outcomes.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.