- Treasury yields fall when PPI does not accelerate.

- US dollar slightly lower as interest rates dip.

- Consumer Price Index increases are expected to moderate in October.

Sometimes what doesn’t happen is the story.

Producer Prices in the US rose at a record pace for the second month in a row, but in markets wary of accelerating inflation this news knocked Treasury yields down to a six-week low.

The Producer Price Index (PPI) rose 8.6% in October, and the core index climbed 6.8%, both the highest annual rates in the 11-year series history, reported the Labor Department on Tuesday. Consensus forecasts were for increases of 8.7% and 6.8% respectively.

Producer prices rose 0.6% in October, as expected up slightly from.5% in September. Core prices added 0.4%, under the 0.5% forecast and double September’s 0.2% increase.

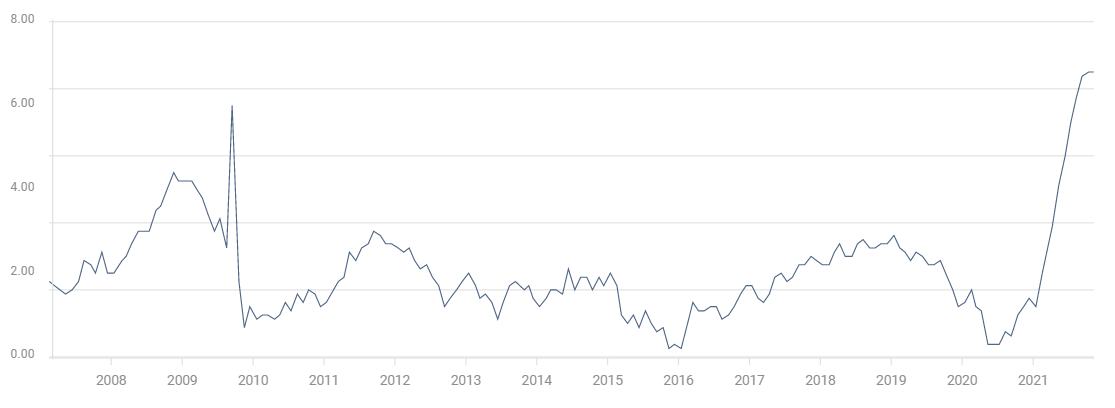

Core PPI

FXtreet

Federal Reserve policy

Inflation has become the primary concern of the Federal Reserve in the last six months as some consumer measures of prices have more than tripled since January.

Fed officials have recently acknowledged that inflation pressures are stronger and longer lasting than they had anticipated. The bank still maintains that the primary causes are the supply chain shocks from the various pandemic dislocations and that prices will gradually subside next year.

The Fed announced at its November 3 meeting that it would reduce its $120 billion of bond purchases by $15 billion each month until the program ends in June, with the cuts after December contingent on US economic progress.

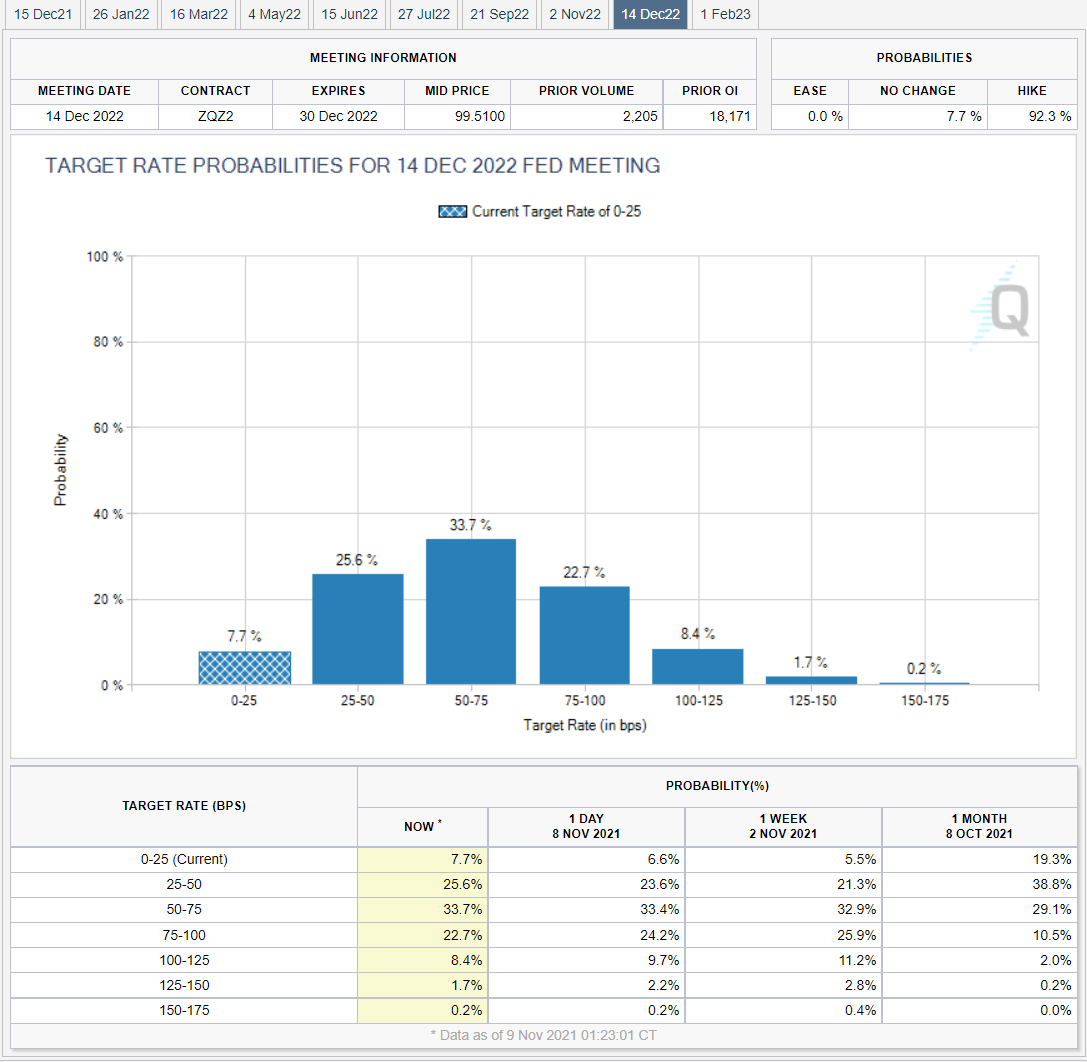

Fed rate projections released at the September 22 meeting show one fed funds increase in 2022. Market estimates are more agressive with the Chicago Board Options Exchange (CBOE) fed futures exhibiting one 0.25% increase in June and one in December.

CBOE

Market response

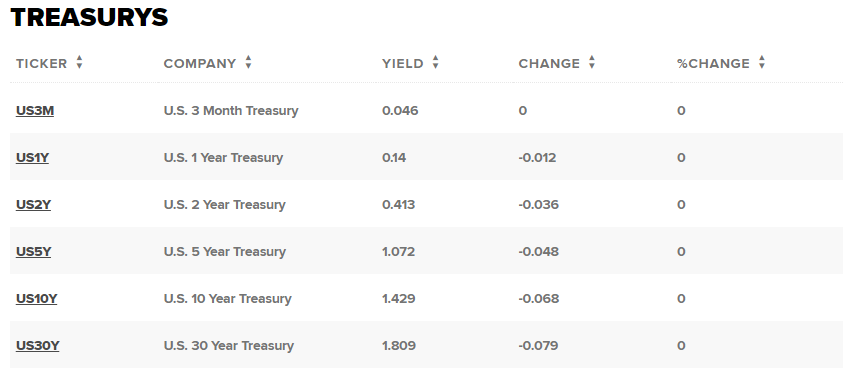

Treasury yields moved lower in all durations except the shortest of three months. The 10-year note was off 7 basis points in early afternoon trading to 1.429%. The return on this commercially important bond has shed 14 basis points since the closing rate of 1.577% on November 3 after the Federal Open Market Committee (FOMC) meeting.

Treasury yields

CNBC

The dollar was lower on currency exchanges, losing small amounts against all the majors.

The USD/JPY fell below 113.00to 112.90 its lowest level in three weeks while the euro was unchanged at 1.1590.

PPI and CPI

Soaring gasoline prices, up 6.7% in October, supplied almost two-thirds of the 1.2% increase in good prices while the service price index added just 0.2%. Wholesale food prices fell 0.1% as beef and veal costs dropped 10.3%. Trucking costs rose 2.5% last month..

Labor compensation rose the most on record in the third quarter. A small business survey reported that 32% of owners said they plannned to increase employee compensation in the next three months.

The PPI is the first of two important inflation gauges released this week.

On Wednesday the Labor Department will issue its Consumer Price Index (CPI) which is predicted to show a 0.5% monthly increase and 5.3% annual gain with 0.3% and 4% for Core CPI. September's rates were 5.3% for the headline index and 4% for core.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD attracts some sellers to near 0.6300 ahead of Chinese PMI release

The AUD/USD pair weakens to near 0.6300, snapping the three-day winning streak during the early Asian session on Monday. China’s fresh stimulus measures to promote its development of index investment products fail to boost the China-proxy Australian Dollar.

USD/JPY remains depressed amid hawkish BoJ and risk-off mood

USD/JPY kicks off the new week on a weaker note, though it manages to hold above the monthly low retested last Friday. US President Donald Trump's decision to impose steep import duties on Colombia revives trade war fears and benefits the safe-haven JPY amid the BoJ's hawkish rate hike.

Gold loses ground to near $2,765 on renewed US Dollar demand

Gold price edges lower to around $2,765 during the early Asian session on Monday, pressured by the renewed US Dollar demand. However, the potential downside for the precious metal might be limited amid the cautious mood and uncertainty surrounding tariff measures by US President Donald Trump.

Week ahead: Fed, BoC and ECB meet amid Trump tariff threats

Three central bank decisions awaited as tariff reality sets in. Fed set to go on pause, ECB and BoC to likely cut again. But US GDP and PCE inflation could steal the limelight. Australian CPI and China PMIs also on tap.

ECB and US Fed not yet at finish line

Capital market participants are expecting a series of interest rate cuts this year in both the Eurozone and the US, with two interest rate cuts of 25 basis points each by the US Federal Reserve and four by the European Central Bank (ECB).

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.