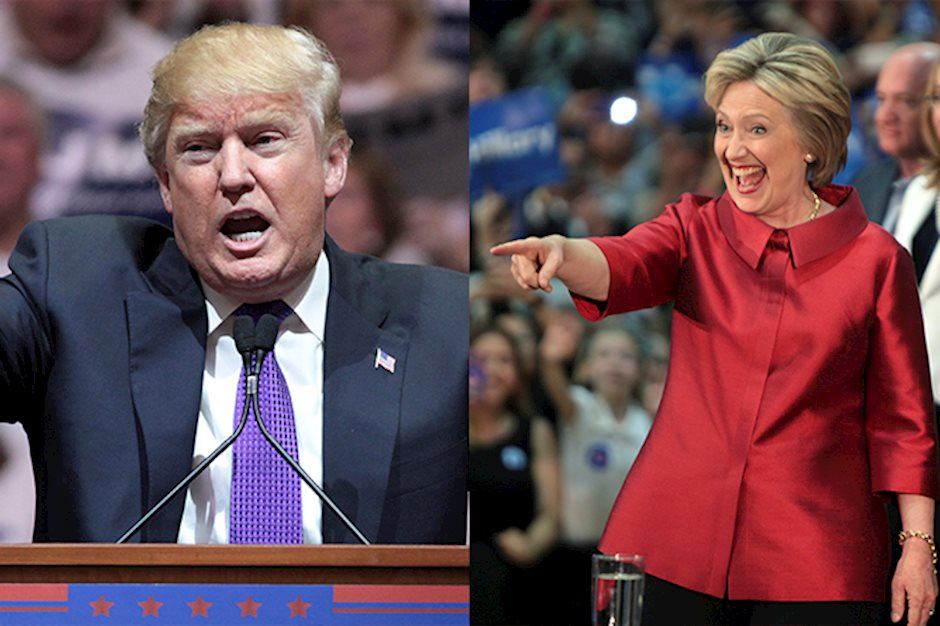

Pricing Uncertainty: How Will Stocks React If Trump Wins? If Hillary Wins?

CNNmoney author Patrick Gillespie quotes Macroeconomic Advisers’ senior managing director Joel Prakken: Stocks Would Fall 8% if Trump Wins.

Prakken cites “uncertainty” under trump vs. stability under Clinton. What a hoot. Is uncertainty worse than ruinous policies?

If Donald Trump wins in November, U.S. stocks would fall about 8%, erasing all its gains for the year.

That’s according to models from forecasting firm Macroeconomic Advisers, which estimates that a Trump victory would cause stocks to head south dramatically, riled by the uncertainty of his economic policies, which include threats against Mexico and China, two of America’s top trade partners.

“There’s just a lot of uncertainty surrounding a Trump presidency,” says Joel Prakken, senior managing director at Macroeconomic Advisers. “There’s all kinds of stuff to be worried about there.”

Markets hate uncertainty. And Trump’s policies — or lack of detail about them — raise eyebrows, Prakken says. Conversely, if Hillary Clinton wins, stocks would bounce up about 2%, according to Macroeconomic Advisers. Since her policies are considered similar to President Obama’s and her odds of winning are higher, her victory would cause less of a stir in either direction.

Down 8 vs. Up 2

Apparently, absurdly priced equities and bonds do not even matter.

Speaking of uncertainty, Is Hillary going to directly intervene in Syria? Start a war with Russia with her ridiculous no fly zone proposal? Will Hillary’s global trade prosecutor idea be any better than Trump’s wall?

That last question was a trick question.

There will be no wall with Mexico because Congress will not approve it.

If stock markets hated uncertainty, they would never rise.

Knowing the Unknowable

A few days ago someone accused me of predicting a stock market collapse this year. Nope. In fact, I specifically warned against such thinking.

Flashback December 15, 2015: Knowing the Unknowable; Reflections on the Fed Hike.

In the past week, two readers, one of them a blogger, professed to “know” something that cannot possibly be known.

“Epocalypse” Now

The first person, an economic blogger, tells me a global economic collapse of biblical proportion is coming. He labels the collapse an “epocalypse” and offered a guest-post article that I passed on.

I responded “No one knows the precise timing of a collapse. There might not even be one. Stocks could do a slow decline like Japan for years.”

You can start a countdown, because yesterday he pinged back “Check in with me at the end of the week.”

Crunch Time

Reader “BL” wrote … “Hello Mish, It is crunch time. What are you afraid of? Speak the truth. Stocks are overvalued and will continue to be so until the crash. When will the crash occur? You know the answer. You have always known the answer. Tell the truth. The crash may occur before the next presidential election. Speak the truth or be buried by the truth. Your choice. Sincerely BL”

On December 16, the Fed hiked rates for the first time since June 29, 2016. Here’s is the conclusion to my “unknowable” post.

Gaming the Reaction

What will the reaction be to a range of 25-37.5 basis points? To a range of 25-50 hike with an initial target of 25? With an initial target of 37.5?

How the hell can anyone possibly know? The Fed doesn’t even know.

Any reaction is possible tomorrow, including nothing. And a big yawn would wipe out both PUTs and CALLs by everyone who thinks something must happen. The winner in that scenario would be the option sellers, not buyers.

It’s all a guess. I have no particular edge as to what happens over the course of the next two weeks let alone three days. I believe I do have an edge as to what happens over the long haul when valuations get as stretched as these.

The important point is neither sentiment nor valuation is a timing mechanism. To that one can add baby step interest rate hikes that are fundamentally meaningless.

I strongly advise market participants to not act as if they know that which is simply unknowable.

Price of Uncertainty

Today, we are told the price of “uncertainty” is a swing of 10%.

“That’s according to models from forecasting firm Macroeconomic Advisers, which estimates that a Trump victory would cause stocks to head south dramatically, riled by the uncertainty of his economic policies.”

Did Macroeconomic Advisers use the phrase “head south dramatically” or did Gillespie concoct it on his own?

Supposedly 8% would be a “dramatic” decline. Mercy! Would 10% be a calamity? 15% devastating?”

Neither Gillespie nor Prakken bothered to address the obvious overvaluation of the stock market. Fundamentally, stocks ought to drop far more than 8% regardless who wins.

Will stock decline? In what timeframe? I don’t know. And neither does anyone else.

Incessant Bid for Stocks

What’s behind the incessant bid for equities?

For discussion, please consider Stock Buybacks Fueling the Stock Market? By How Much?

Inquiring minds may also wish to consider Central Banks Wage War on Markets: Bill Bonner Says They Will Lose; Fed Up Yet?

Although no one knows the timing, we do know manias eventually end.

Meanwhile, complacency is so extreme the primary concern seem to be ubiquitous uncertainty that might cause a “dramatic” 8% decline.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc