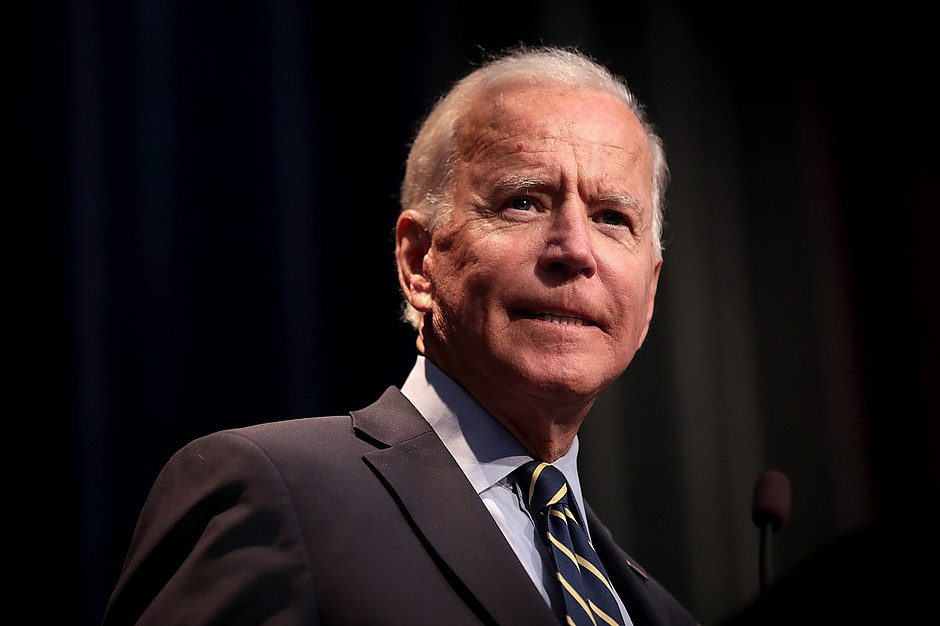

President Joe Biden: The markets and the first 100 days

Four years have passed, and now we usher in a new United States President: Joe Biden. A complete U-turn from what Donald Trump stood for. Nationalism is now replaced with Progressive politics. The question arises, how will President Joe Biden’s 100-day agenda affect the markets?

Joe Biden And Eliminating The Coronavirus

President Biden is a firm believer that for the United States economy to prosper; they first need to control and eliminate the Coronavirus. He has previously described America’s Coronavirus vaccine rollout as “a dismal failure thus far” and vowed to “move heaven and earth to get people vaccinated.”

Many analysts and critics feel his frustration, as they had a whole year to prepare for a Vaccine eventuality, only for the infrastructure not to be ready once the vaccine was.

Coronavirus’ Effort and its potential effect on the markets

President Biden vows a goal of 100 million shots by the end of his 100 days. The market will most definitely hold him to his word. Assuming 100m citizens are vaccinated, almost 1/3 of the United States population, they would have taken a closer step to herd immunity. The effects of herd immunity will most likely be laggard – however, it will ultimately be a tailwind for equities and a possible short term tailwind for risk-off assets such as Gold.

Joe Biden’s $1.9 Trillion Stimulus

President Biden’s $1.9 Trillion stimulus would see $1,400 direct payments to American citizens to help the American economy going again. Some of that stimulus will go to state governments to help them support their citizens.

The $1.9 Trillion Stimulus and its potential effects on the markets:

Analysts predict the influx of money in circulation will cause inflation concerns to rise even further. This will bring the US’ total spending for the Coronavirus to 5.4 Trillion. This may push the US dollar further lower. We should see an initial push up in equities due to the confidence boost stimulus gives. However, this may already be priced in due to the Democrats’ power in the senate.

Progressive, Globalized Foreign Policy and Climate Change

President Joe Biden promises to rejoin the World Health Organization and the Paris Climate Accord, which Donald Trump was against and withdrew from. Furthermore, President Biden plans to sign an executive order to formulate a plan to achieve a 100% clean energy economy and net-zero emissions by 2050.

Progressive Politics, Climate Change actions and its effect on the markets

Assuming progressive politics induces global competition to American exports, we should see pure American companies, specifically manufacturing companies to suffer under this rhetoric. Furthermore, Climate Change actions may see investment flow out and legislation against non-renewable companies, making it harder for them in the future.

The first 100 days will set the tone for the Biden Presidency. What are you looking for in these 100 days?

Author

Kyle Quindo

Blackbull Markets Limited

Kyle is a Research Analyst with BlackBull Markets in New Zealand. He writes articles on topical events and financial news, with a particular interest in commodities and long term investing.