Pre-Christmas US Data Preview: Core PCE and Durable Goods may extend US Dollar retreat

- The United States releases an extensive data dump just ahead of the Christmas holidays.

- Core Personal Consumption Expenditures is set to show inflation moderating, following the lead of CPI data.

- Durable Goods Orders are projected to flatten after rising beforehand.

- US Dollar could move on low liquidity trading if both releases come out in the same direction.

Will markets give us one more volatility gift before Christmas? The past year has been wild in foreign exchange markets, but there are a few more days to go – and a last-minute data dump from the United States as the Bureau of Economic Analysis (BEA) will publish the Personal Consumption Expenditure (PCE) and the US Census Bureau will do the same with Durable Goods Orders data, both to be released on Friday at 13.30 GMT. The mix of low liquidity and last-minute adjustments by money managers may trigger more action than usual, weighing on the US Dollar.

There are two main events and they both need to move in the same direction to trigger more than just choppy trading.

1) Core PCE

The Personal Consumption Expenditure is a gauge of inflation using a different methodology than the Consumer Price Index (CPI). While the CPI report is released before the PCE one, the Federal Reserve (Fed) prefers the latter. The Fed focuses on Core PCE, which excludes volatile energy and food costs.

Core CPI for November was published on December 13, and it surprised to the downside with 0.2% vs. 0.3% projected. That release shaped estimates for Core PCE, which is forecast to have increased by 0.2% last month. That may seem to make sense, but there is a catch.

CPI data runs hotter than PCE, and the pandemic has not altered that gap. Core PCE hit 5% in October, while Core CPI was 6.1% in the same month. Therefore, Core PCE has room for a downside surprise, which could come out at 0.1% to maintain the gap.

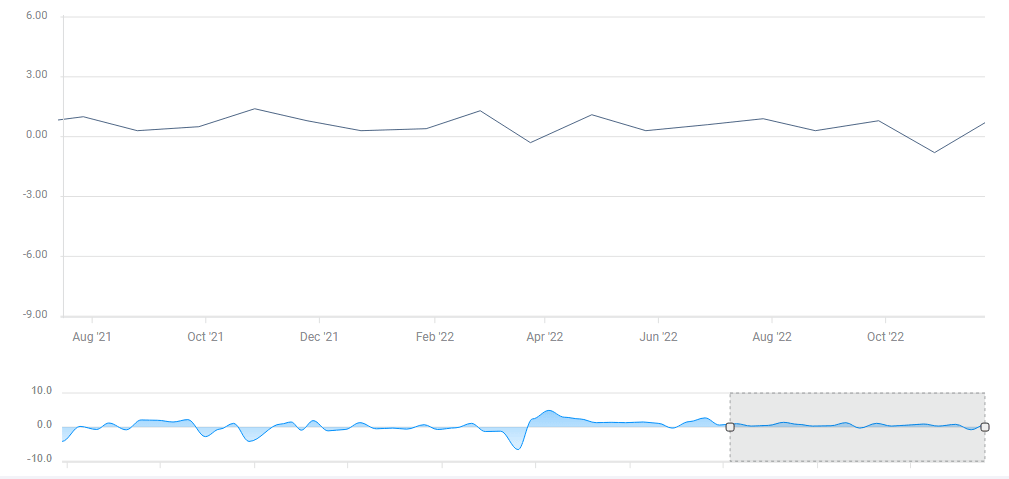

Core PCE is down but still not out:

Source: FXStreet

Even a confirmation of the 0.2% read would still reflect a decline in inflation also according to the Fed's preferred gauge, reducing the need for large rate hikes. The fate of February's rate decision is in the air, with markets and the Fed contemplating both another 50 bps hike or a drop to 25 bps.

2) Durable Good Orders

Durable Goods Orders reflect investments, thus entering Gross Domestic Product (GDP) calculations. Headline orders tend to be volatile due to big-ticket items such as aircraft. After a jump of 1.1% in October, the economic calendar is pointing to no change for November.

More importantly, the non-defense ex-aircraft gauge – aka "core of the core" – is projected to remain flat as well, after a more moderate increase of 0.6% beforehand. Here is where a downside surprise could occur.

As the chart below shows, also the core figure tends to fluctuate significantly, and a drop cannot be ruled out. Once again, even an "as expected" figure would be a disappointment. A lack of increase in investment implies that the Federal Reserve's tightening is causing businesses to cut back, cooling the economy.

Source: FXStreet

Low liquidity market might impact the US Dollar

As described above, there are reasons to expect both Core PCE and Durable Goods Orders to cast doubts about America's economic might, weighing on the US Dollar. Another reason to expect a decline is the season – markets tend to be cheerful ahead of Christmas, opting for risky assets and dying away from the safe-haven Greenback.

Last but not least, the world's reserve currency has had a successful year, rising across the board and remaining at elevated levels despite the decline in the autumn. Ahead of the holidays, some profit-taking may occur.

Final thoughts

Liquidity is low around this time of the year, implying the potential for one big order to knock currencies out of balance only for the move to dissipate later on. This phenomenon is most intense around 16:00 GMT – the London Fix. Trade with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.