Powell’s hawkish tone fuels Dollar’s strength

The Fed Chair’s stern warning indicated that the Fed’s monetary tightening efforts are far from concluded, prompting a resurgence of the dollar’s strength.

Jerome Powell's speech yesterday sent ripples through the financial markets, disrupting the U.S. equity markets' winning streak. The Fed Chair's stern warning indicated that the Fed's monetary tightening efforts are far from concluded. This statement prompted a resurgence of the dollar's strength, with market speculation pointing towards a sustained period of elevated interest rates. In a contrasting move, the cryptocurrency market witnessed an exuberant surge. Reports of BlackRock taking initial steps toward filing for a spot Ether ETF fueled this excitement, driving Ether prices to their highest levels since May.

Market movements

Dollar Index

The US Dollar staged a significant rebound following Federal Reserve Chair Jerome Powell's hawkish statement, affirming the potential retention of a tightening monetary cycle to counter persistent inflation. Powell emphasised the Federal Open Market Committee's commitment to achieving a policy stance capable of gradually reducing inflation to the targeted 2%, citing current inflation levels surpassing this goal.

The Dollar Index is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 66, suggesting the index might enter overbought territory.

Resistance level: 106.10, 106.75.

Support level: 105.40, 104.80.

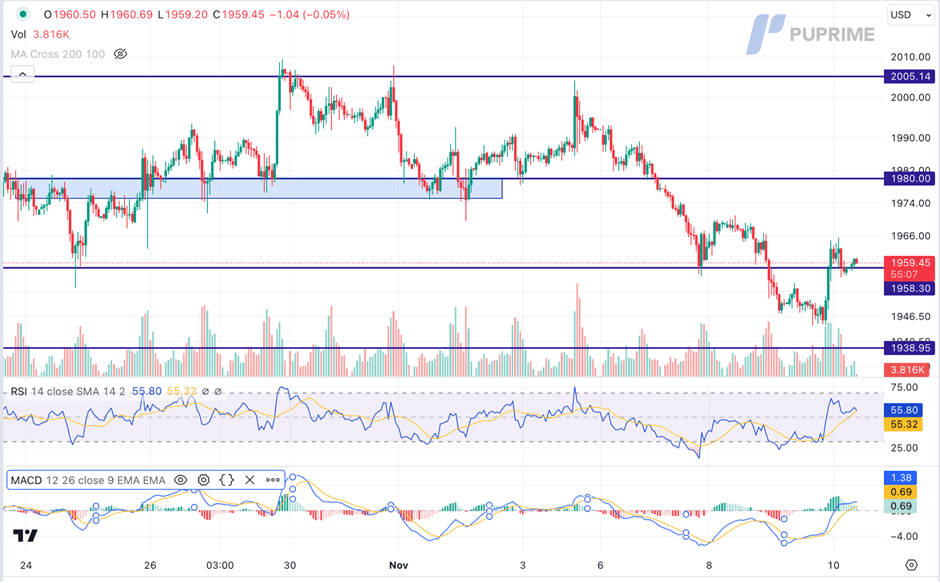

XAU/USD

Gold prices staged a notable recovery, driven by a disappointing US Jobs report that highlighted the persistent challenges in the American labor market. The report indicated that US Initial Jobless Claims exceeded expectations, dampening prospects for job market recovery. However, the gains in gold prices were tempered by the Federal Reserve's hawkish stance. The simultaneous rise in US Treasury yields and a strengthened US Dollar contributed to a diminished appeal for the safe-haven asset.

Gold is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 1980.00, 2005.00.

Support level: 1960.00, 1940.00.

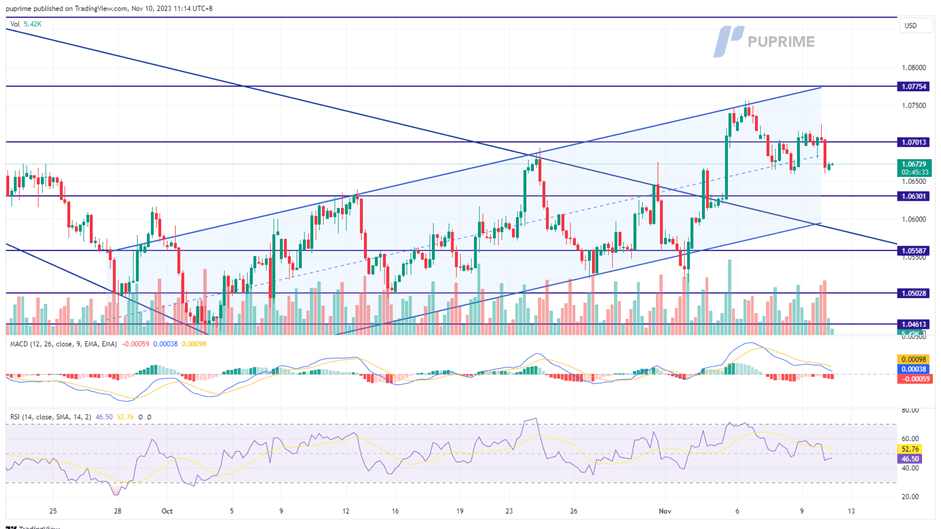

EUR/USD

Jerome Powell's speech revitalised the dollar's strength yesterday, fostering optimism for additional rate hikes from the Fed, especially if U.S. inflation is persistently high. In contrast, ECB's Chair countered market narratives, defending the euro's strength alongside other ECB officials who pushed back against recent dovish sentiments. These contrasting tones highlight the complex dynamics shaping the global currency markets.

The EUR/USD pair is still trading within the uptrend channel, but the bullish momentum has waned. The RSI has gradually moved lower from near the overbought zone while the MACD is approaching the zero line from above.

Resistance level: 1.0700, 1.0775.

Support level: 1.0630, 1.0560.

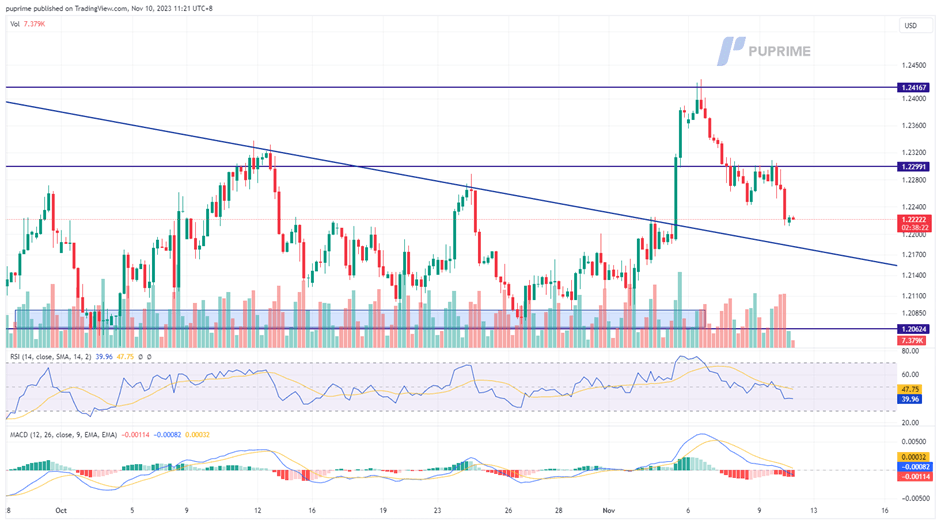

GBP/USD

The British Pound remains under pressure against the USD, struggling to surpass its robust resistance at 1.2300. Divergent views from central bankers contribute to the Pound's woes. BoE's Chief Economist Huw Pill has hinted at the possibility of a rate cut, while Jerome Powell's speech yesterday reinforced the dollar's strength. Powell emphasised the Fed's commitment to ongoing monetary tightening, starkly contrasting policy outlooks. This disparity in central bank statements has intensified downward pressure on the Cable.

The Cable continued to face downward pressure and kept below its strong resistance level at 1.2300. The RSI continue to retrace, and the MACD is on the brink of breaking below the zero line, suggesting a growing bearish momentum.

Resistance level: 1.2300, 1.2410.

Support level: 1.2060, 1.1830.

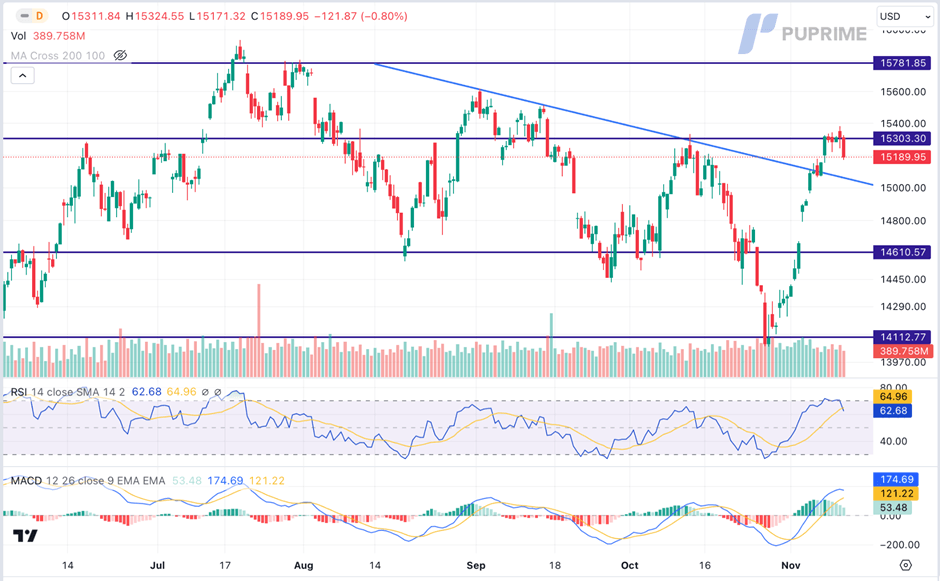

Nasdaq

The US equity market halted its winning streaks following Powell's hawkish statement, triggering a sharp rebound in US Treasury yields. Notably, the S&P 500 snapped its eight-session run of advances, while the Nasdaq ended a nine-session winning streak, representing the longest streaks for each since November 2021.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 63, suggesting the index might enter overbought territory.

Resistance level: 15305.00, 15780.00.

Support level: 14610.00, 14115.00.

BTC/USD

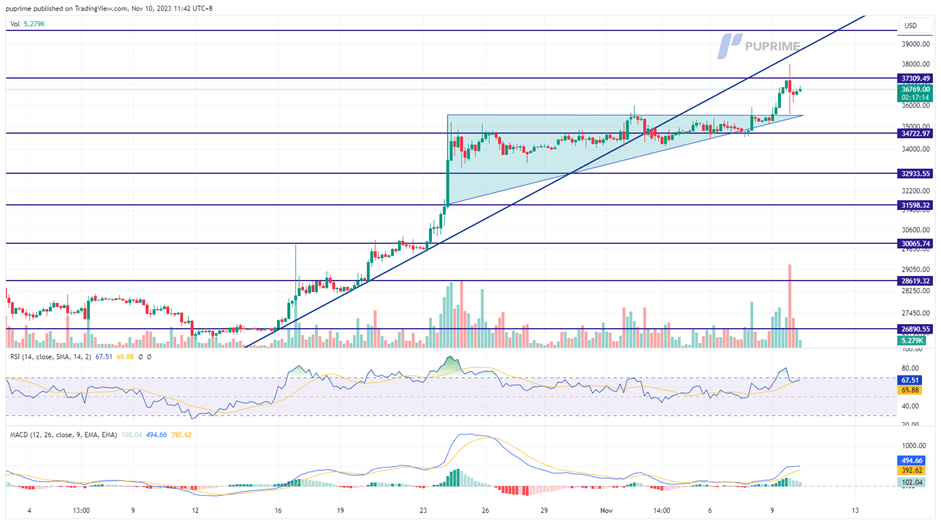

BTC prices experienced substantial volatility, with wide fluctuations as buying and selling forces clashed at higher price levels. The surge in BTC prices was fueled by exciting news that BlackRock, a leading investment company, is in the process of filing an application for a spot ETH ETF. This development has heightened optimism within the crypto market, attracting increased attention from investors navigating the dynamic landscape of digital assets.

BTC broke above the bullish flag price pattern, given a bullish signal. The RSI remain in the overbought zone while the MACD continues to move upward, suggesting the bullish momentum is strong.

Resistance level: 37400, 39700.

Support level: 34700, 33000.

USD/JPY

USD/JPY surged to a one-week high ensued in response to Powell's hawkish tone, accentuating the yield differential between Japan and the US. Market vigilance remains high as investors monitor potential interventions to bolster the Japanese currency, which had approached a one-year low of 151.74 earlier this week.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 151.70, 152.70.

Support level: 150.40, 149.30.

CL Oil

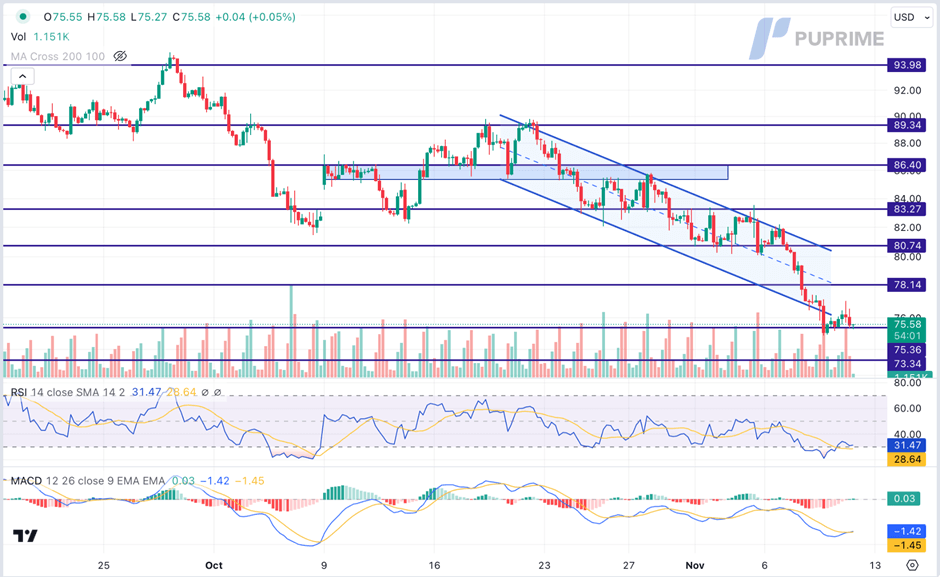

Despite an initial rebound in oil prices driven by bargain hunting, concerns over global economic growth slowdowns tempered bullish investor sentiment, exerting downward pressure on the commodity's appeal. Moreover, Powell's hawkish stance contributed to a surge in the US Dollar, rendering dollar-denominated oil more expensive.

Oil prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the commodity might enter oversold territory.

Resistance level: 78.15, 80.75.

Support level: 75.35, 73.35.

Author

PU Prime team

PU Prime

PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities, Indices, Share CFDs and Bonds.