Powell and the FOMC: Is it really about the fed funds rate?

- The Federal Reserve leaves rate and bond policies unchanged.

- Fed funds consensus shifts but rate remains stable through 2023.

- Estimates for GDP expansion, inflation and unemployment improve.

- Equities and bond yields move higher, dollar falls.

The Federal Reserve executed a deft sleight of hand on Wednesday, sharply raising its economic projections, keeping expectations for a fed funds hike beyond 2023 and ignoring the steepening of the yield curve that has been underway in earnest since the New Year.

Officially the US central bank left its base rate unchanged at 0.25% where it has been for a year, and will continue buying $120 billion in bonds each month, mostly in the short end of the yield curve.

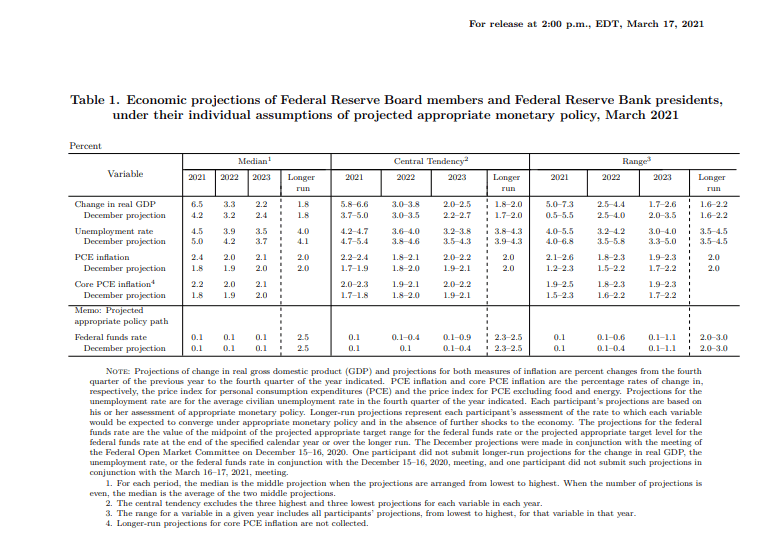

Projection Materials

In the estimates of future economic growth and inflation, which will, of course, determine Fed policy the governors were optimistic. The US economy is now expected to expand 6.5% this year, more than 50% higher than the 4.2% prediction in the December assessment. Core PCE inflation, the Fed's bete noire, is forecast to reach 2.2% for this year, up from 1.8%. The December 2021 unemployment rate will be 4.5%, improved from 5% and its current 6.2%

Market Response

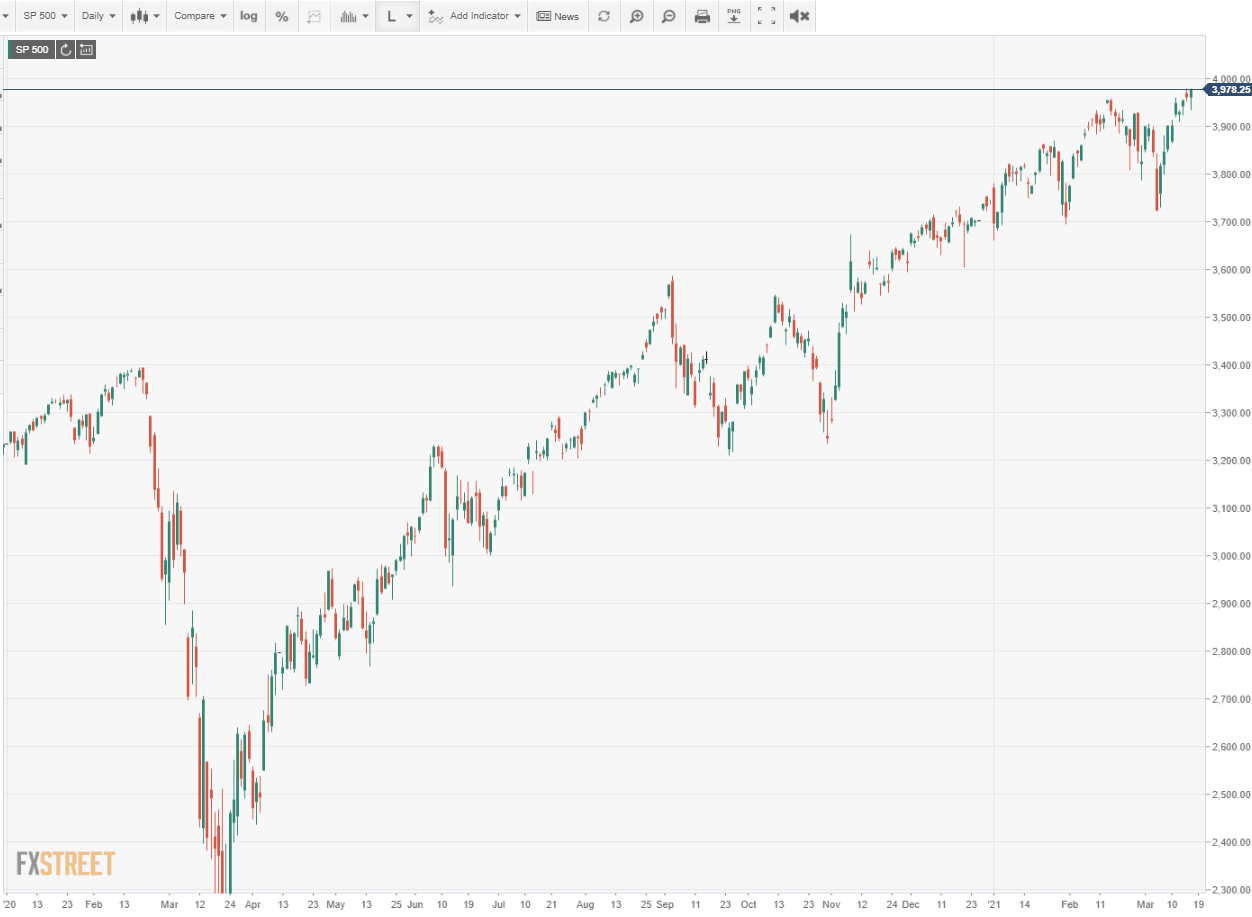

Markets were generally pleased with the combination of positive economic predictions, low, stable rates and the policy rationale from Fed Chairman Jerome Powell.

All three major US equity averages rose. The S&P 500 added 0.4% to 3,974.12, a new record close. The Dow jumped 189.42 points to 33,015.37, its first finish over 33,000 and also a record. The NASDAQ climbed 0.4%, 53.64 points to 13,525.20, ending about 4.5% below its all-time high due to the sell-off in technology stocks over the past month.

S&P 500

Treasury yields were largely unaffected by the 2:00 pm Fed announcements. The 10-year ended at 1.646%, unchanged from the morning but up three points from Tuesday's finish and a new pandemic high. The 2.42% return on the 30-year long bond was also a new pandemic top bringing the yield back to its level in August 2019.

10-year Treasury yield

CNBC

Not surprisingly, given the Fed's focus on near term rates the yield on the 2-year Treasury slipped a little more than one basis point from Tuesday's close to 1.37%.

2-year Treasury yield

CNBC

Currency markets extracted a dollar penalty for the Fed's status quo policy. The euro gained about 80 points on the day to 1.1978 and the USD/JPY lost about 10 points to 108.86. Both pairs had seen recent gains by the greenback and the Fed meeting was a likely excuse to take profits.

The burst of economic growth foreseen by the Fed will subside gradually to trend, 3.3% next year and 2.2% in 2022. Unemployment will continue to improve, returning to its pre-pandemic level of 3.9% in 2021 and its half-century low of 3.5% the following year. Inflation will remain at target for the specific years of the projections, 2.0% and 2.1%.

Inflation

Markets have been watching inflation in the past several weeks as the $3 trillion in stimulus spending is expected to collide with rising consumer demand from government checks and returning employment.

Chairman Powell downplayed the need to react quickly even if inflation does rise. "The fundamental change in our framework is that we are not going to act preemptively based on forecasts for the most part, and we are going to wait to see actual data. I think it will take people time to adjust to that and to adjust to that new practice."

Dot Plot

Although the vote for policy at the Wednesday meeting was unanimous, there was a shift in the rate expectations.

Four of the 18 FOMC members were looking for a rate increase next year compared to just one at the December meeting. In 2023 seven members expect an increase in contrast with five in December.

The 2-10 spread

In repeated questioning about the potential for inflation Chairman Powell noted, “We've said we'd like to see inflation run moderately above 2% for some time. And we've resisted, basically, generally, the temptation to try to quantify that."

The Fed may want to delay rate action until it sees actual inflation but markets have already begun to price its return.

From the December FOMC to Wednesday's the spread between the yield of the 2-year Treasury and the 10-year has almost doubled from 80 basis points to 152 points.

After the December 16 Fed meeting the 2-year returned 0.119% and the 10-year was at 0.92%. At the close on Wednesday the 2-year had added less than 2 points to 0.135% while the 10-year has jumped 73 points to 1.65%.

That difference is the US economic growth and inflation premium.

Conclusion

The steepening of the yield curve that has been underway since January is the market response to potential inflation and the promise of a surging economy in the next several quarters.

There is no central bank logic that pairs 6.5% economic growth with a 0.25% fed funds rate. The rate increases at the farther reaches of the yield curve lessen the risks of an overheating economy and inflation.

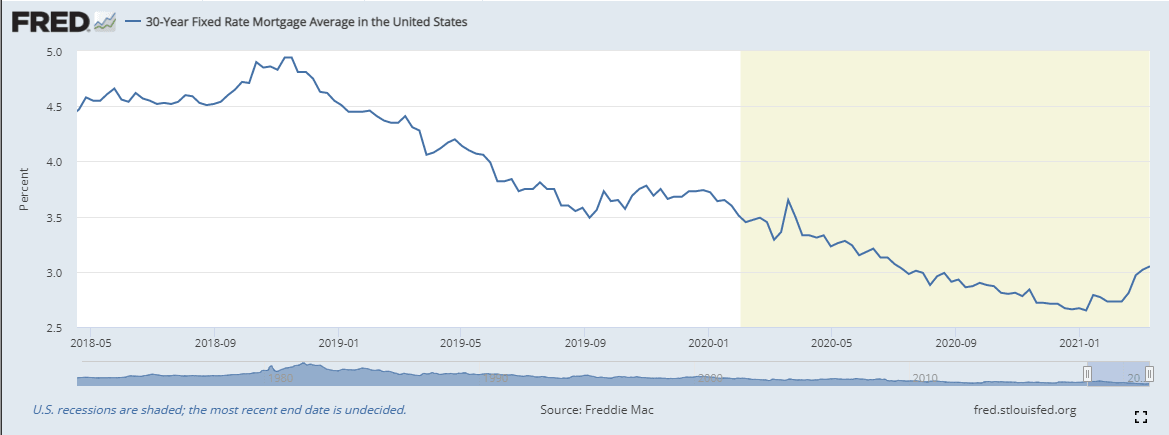

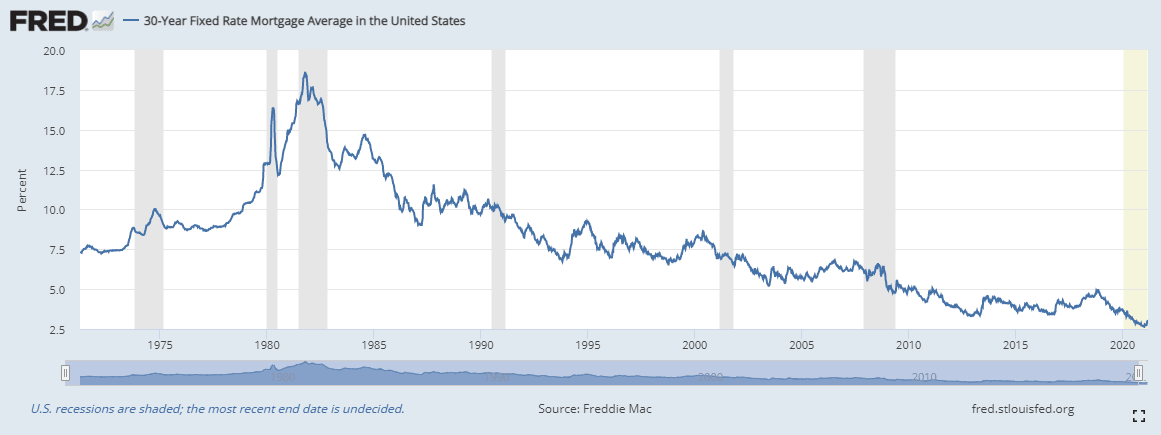

Commercial interest rates key on the longer side of the curve. The national average for a 30-year fixed rate mortgage has gone from 2.65% on January 7 to 3.05% on March 11. Even at that rate the cost of buying a house is lower now than at any time in US history prior to last July.

The Fed governors and Chairman Powell know that the US economic recovery and the full return of the labor market do not turn on keeping 5 and 10-year Treasury rates at record lows.

Rising interest rates are a sign of a healing economy.

That is why the Fed has kept its rhetorical focus on the fed funds rate while letting the credit market inch its way back to normality.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.