Pound steady after hot UK wage growth, CPI next

The British pound is showing little movement on Tuesday, after jumping 0.57% a day earlier. In the European session, GBP/USD is trading at 1.2698, up 0.13% on the day.

UK wage growth higher than expected

UK wage growth excluding bonuses climbed 5.2% y/y in the three months to October, up from an upwardly revised 4.4% in the previous period and well above the market estimate or 4.6%. Pay growth in the private sector hit 5.4%, up from 4.6%.

Wage growth has been accelerating and that is a concern for the Bank of England, which is worried about rising inflation. In October, CPI rose to 2.3% y/y, up from 1.7% a month earlier and hit its highest level in six months. November’s inflation report will be released on Wednesday and is expected to accelerate to 2.6%. BoE policymakers will be keenly focused on services inflation, which has been sticky at 5%, much too high for the BoE’s liking.

The BoE is widely expected to maintain the benchmark rate at 4.75% at Thursday’s rate meeting. The central bank lowered rates for a second time this year in November but will want to see inflation fall closer to the 2% target before resuming rate cuts.

November job growth was much better than expected with a gain of 173 thousand in the three months to October. This was lower than the 253 thousand gain in the previous period but blew past the market estimate of -12 thousand. The labor market is cooling but remains in decent shape, which means that the BoE can focus on inflation data for its rate decisions and not worry about the labor market.

In the US, it was a familiar story as services headed higher while manufacturing slipped lower. The Services PMI rose in December to 58.5 from 56.1 in November and above the forecast of 55.7. This was the highest level in over three years as the services economy is showing impressive expansion.

The manufacturing sector is in dreadful shape and weakened to 48.3, down from 49.7 in November and below the market estimate of 49.8. Output and new orders are down as the demand for exports remains weak.

GBP/USD technical

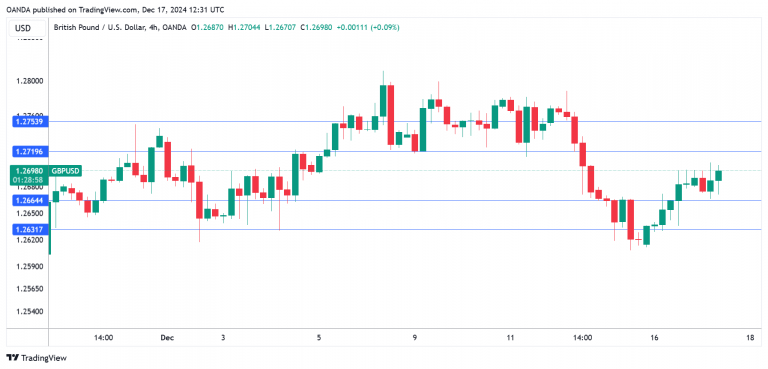

-

1.2719 is a weak resistance line. Above, there is resistance at 1.2753.

-

1.2664 and 1.2630 are the next support levels.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.