Brexit on focus...

- GBP/USD Forecast 2016. 'Brexit fears could weigh over Sterling' – Omkar Godbole, FXStreet | Dec 23 2015

- 'There's potential for a British Pound collapse in 2016' – Martin Armstrong, FXStreet Interview | Jan 04 2016

- GBP/USD Forecast 2017: Expect yet another murky year for Cable – Haresh Menghani, FXStreet | Dec 22 2016

- 'The Article 50 is triggered; the UK has officially sent its demand to leave the European Union [...]' - Ipek Ozkardeskaya

- 'Traders are nervous about today’s Article 50 triggering that inspired recent strong sell-off (cable is down around 1.5% from Tuesday’s opening until now)' - Slobodan Drvenica

- 'Sentiment remains firmly bearish towards the Pound moving forward and the potential resurgence of hard Brexit fears could ensure price weakness becomes a recurrent theme' - Lukman Otunuga

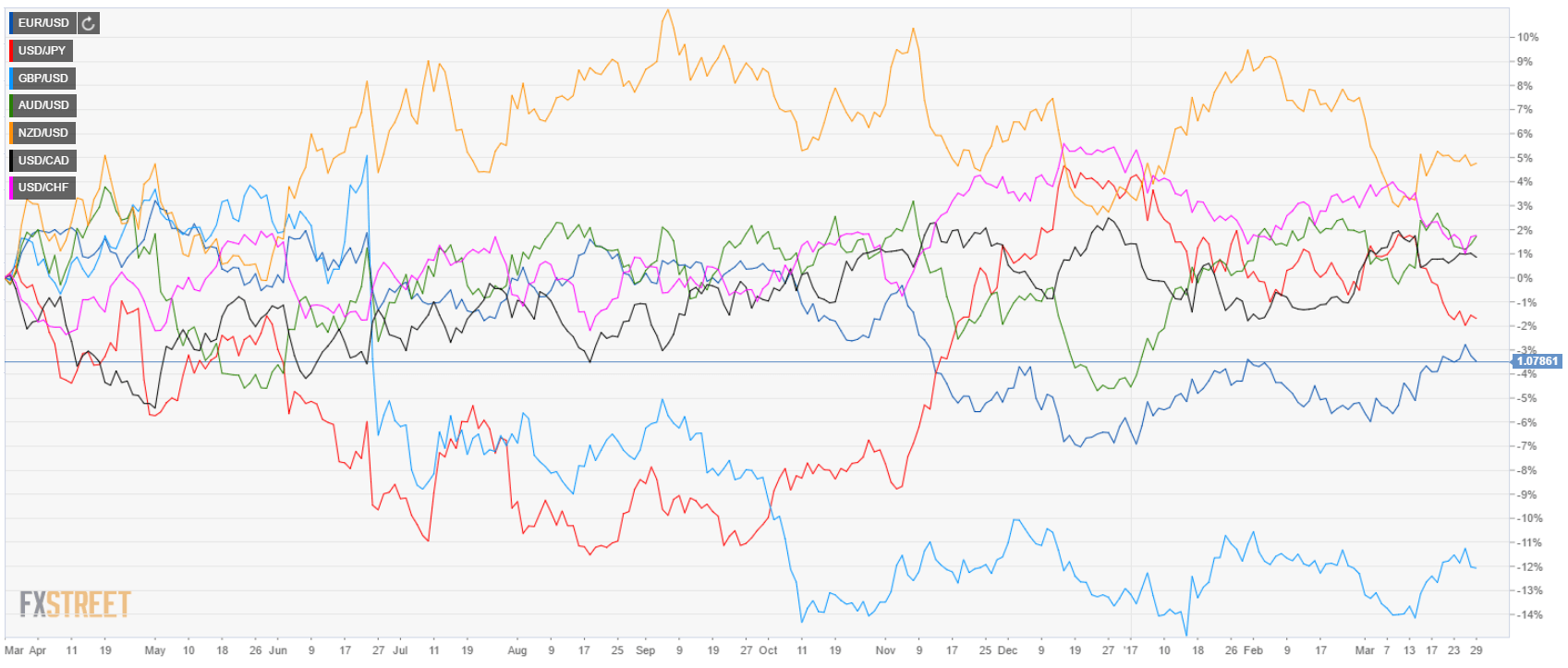

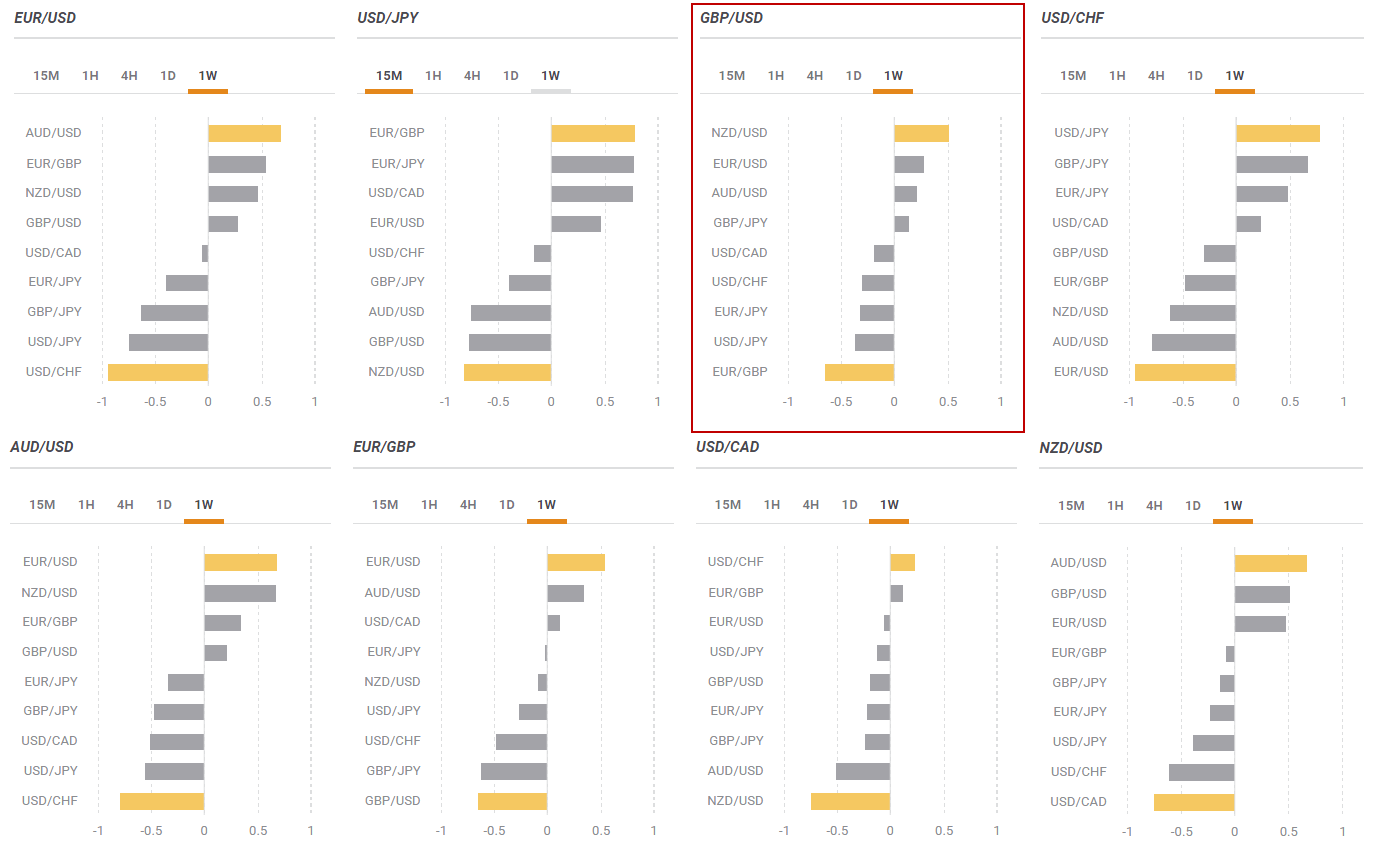

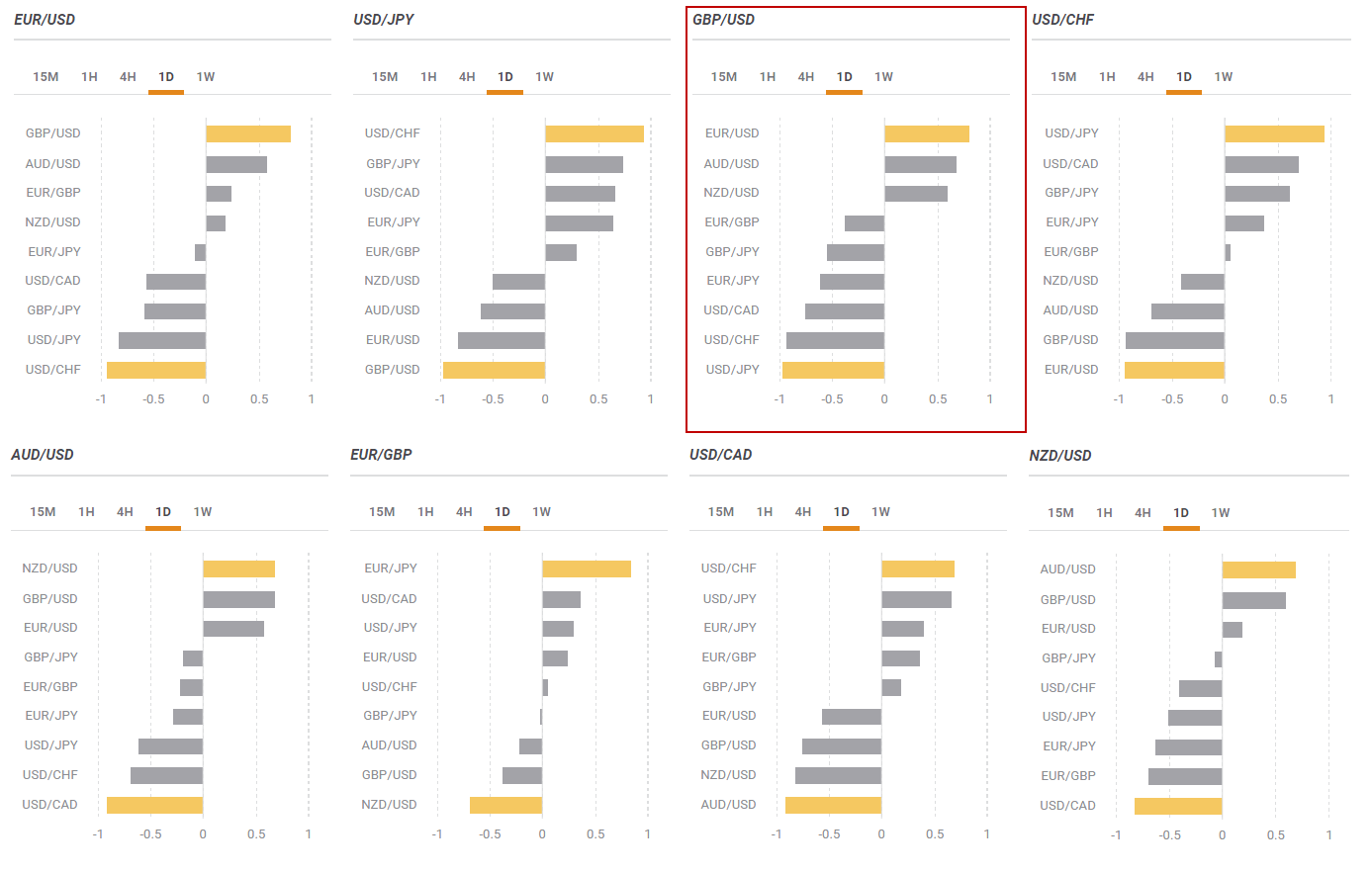

... but there is another way to look at the price behavior

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Fed trims benchmark rate by 25 bps as expected – LIVE

The Federal Reserve (Fed) lowered the policy rate by 25 bps to the range of 4.5%-4.75% after the November meeting. The US Dollar ticked higher after the news. Chairman Jerome Powell's speech awaited for additional clues.

EUR/USD retreats from 1.0800 on Fed's decision

EUR/USD retreats from around 1.0800 after the Federal Reserve announced its decision to cut the benchmark interest rate by 25 bps as widely anticipated. Eyes on Powell's speech.

GBP/USD hovers around 1.2950 after BoE, Fed

GBP/USD trades in positive territory around 1.2950, easing from an intraday peak of 1.3008. The BoE lowered the policy rate by 25 basis points as expected but upwardly revised inflation projections. The Fed also delivered a 25 bps rate cut.

Gold nears $2,700 with Fed’s announcement

Gold recovers following Wednesday's sharp decline and trades near $2,700. Federal Reserve's decision to cut rates by 25 bps is boosting demand for safe-haven assets, such as the US Dollar and Gold.

Outlook for the markets under Trump 2.0

On November 5, the United States held presidential elections. Republican and former president Donald Trump won the elections surprisingly clearly. The Electoral College, which in fact elects the president, will meet on December 17, while the inauguration is scheduled for January 20, 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.