Polish inflation rises as energy price freeze extended into 2025

We have confirmation that Polish CPI rose to 5% YoY in October despite some moderation in core inflation. Authorities plan to extend the electricity price freeze into 2025, which improves the inflation outlook but it’s unlikely to change monetary policy prospects. We still think we’ll see the first rate cute in the second quarter of next year.

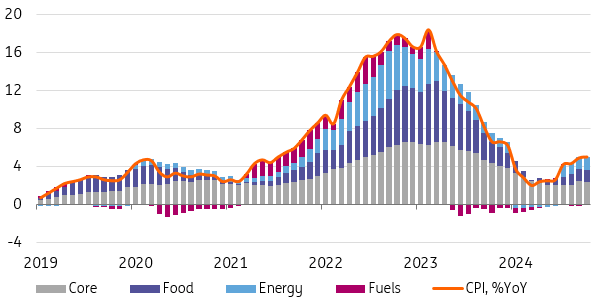

Poland's StatOffice has confirmed its flash estimate of October CPI inflation at 5.0% YoY. Prices of goods went up by 4.3% YoY, while services prices jumped up by 6.7% compared with 4.2% and 6.8% respectively the previous month. The increase in the annual inflation rate compared to September was mainly driven by food and fuel prices. In the latter case, this was primarily due to a low base effect, as we had promotional prices at petrol stations in October 2023.

We estimate that core inflation, excluding food and energy, moderated to 4.1% YoY in October from 4.3% YoY in September, but the upward pressure on core price increases persists. The monthly increase in core prices remains high, at around 0.4%. By the end of 2025, CPI inflation is projected to remain around 5% YoY. Authorities announced they plan to continue freezing electricity prices for households in 2025. That suggests that the expected local peak of inflation in March 2025 should not exceed 6% YoY, contrary to the pessimistic scenario of the NBP. We assume that the result of government works will be the extension of the current levels of electricity prices for households into next year, but any reduction will be difficult.

Headline CPI up despite lower core inflation

% YoY

Source: GUS, ING.

The November inflation projection presented a pessimistic inflation path (an average annual price increase of 5.6% in 2025) based on the assumption of a full unfreezing of energy prices. In our view, assuming measures to freeze energy prices will indeed be implemented, the average annual inflation could be closer to 4%. This means that the March projection will likely show a significantly more favourable scenario for consumer prices than the current one, allowing the Monetary Policy Council (MPC) to start discussing interest rate cuts at that time.

We expect this to result in the first decision to cut rates by 25 basis points in the second quarter of 2025 when the Council is convinced of a disinflationary trend. Given persistently high core inflation, we expect cautious moves in 25bp steps. Throughout 2025, NBP rates could be reduced by around 100bps. The easing cycle of cuts will likely continue in 2026, but much depends on the pace of wage growth. A slowdown in wage growth is necessary for a decline in core inflation, which in both NBP projections and our forecasts, remains high in 2025 but could slow in 2026 if wage growth falls to around 6%.

Read the original analysis: Polish inflation rises as energy price freeze extended into 2025

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.