Polish GDP growth slows due to weak domestic trade and external demand

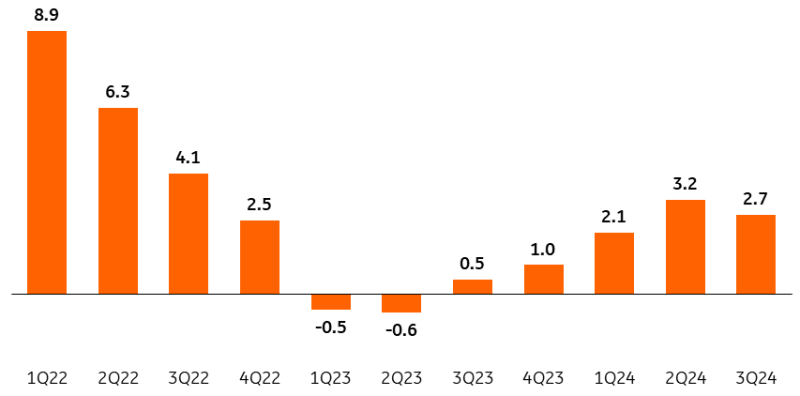

Economic growth slowed to 2.7%YoY in the third quarter, as domestic retail trade deteriorated and demand from abroad was weak. We think the slowdown is temporary and expect some improvement in 2025. Poland still has domestic growth engines that should allow it to withstand stagnation in the euro area and risks posed by Trump’s protectionist policies.

As expected, the third quarter brought a slowdown in economic recovery. Seasonally adjusted data indicate a GDP decline of 0.2% quarter-on-quarter, following a 1.2%QoQ increase between Apil and June.

The detailed GDP composition data will be released at the end of the month, but available monthly indicators suggest that the slower growth was primarily due to poor developments in retail trade. Retail sales of goods fell by 1.5%YoY in 3Q24, after a 4.8%YoY increase in 2Q24. Industrial production remains close to stagnant (0.6%YoY growth after +0.8%YoY in 2Q24), while construction remains in recession (-6.8%YoY in 3Q24 vs. -1.0%YoY in 2Q24).

Economic growth in Poland moderated below 3% in 3Q24

GDP, %YoY.

Source: GUS.

We think household consumption growth moderated to around 3.0%YoY from 4.7%YoY in the previous quarter. Investments likely fell slightly in annual terms, unless there was a significant increase in defence spending. This was accompanied by a negative contribution from net exports, as indicated by the deteriorating foreign trade balance. The picture was likely complemented by a positive contribution from the change in inventories.

The slowdown in consumption stems from slower real disposable income growth since mid-2024, caused by a rebound in inflation. At the same time, we are also observing a gradual slowdown in nominal wage growth. The increase in electricity and gas bills, following the partial unfreezing of prices, likely limited consumer spending on other purchases. However, the slowdown in consumer spending was greater than suggested by income developments. At the end of the third quarter, Poland experienced one-off events (flooding) that could have also affected consumer behaviour and/or the quality of statistical data.

We forecast that economic growth in 2024 will amount to 2.7%, and without a clear recovery in Europe, achieving 3% GDP growth this year is unlikely. Stagnation in Germany prevents a significant rebound in Polish manufacturing and exports. At the same time, high interest rates and delays in the implementation of projects financed by the National Recovery Plan (KPO) and EU structural funds translate into low investment activity.

Polish consumer purchasing activity also slowed in the second half of 2024. In 2025, we expect consumption growth to remain similar to the second half of 2024, but project a clear rebound in investments, as EU funds finally start flowing into the economy. We assume that in 2025, around 60 billion PLN from the KPO will reach final beneficiaries, compared to around 20 billion PLN in 2024.

At the same time, structural funds absorption should improve as well. We forecast that economic growth will accelerate to 3.5% in 2025. Poland has domestic growth drivers that allow it to resist stagnation in the eurozone and the risks posed by Trump’s protectionist policies.

Read the original analysis: Polish GDP growth slows due to weak domestic trade and external demand

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.