Polish GDP expected to weaken as September Retail Sales slump

While we had expected third-quarter GDP growth to moderate below 3% year-on-year, from 3.2% in the second quarter, the decline in retail sales in September points to an even weaker economic performance. We revise our third quarter GDP growth forecast to 2.5%YoY (from 2.8%) and see downside risks to the 2024 economic growth forecast of 3%.

Retail sales of goods fell by 3.0%YoY in September (consensus: +2.6%), compared to a 2.6%YoY increase in August. Seasonally adjusted data points to a sharp 6.7% month-on-month decline in sales.

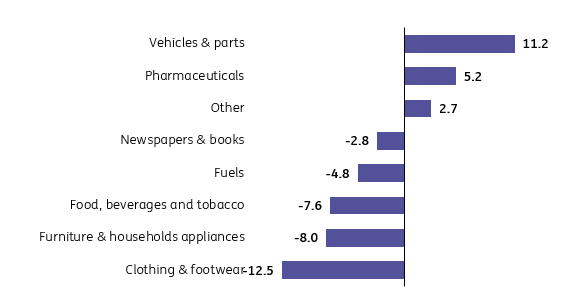

One of the main factors behind the weak sales performance was a sharp drop in food prices (-7.6%YoY), which reduced the annual growth rate of goods sales by approximately two percentage points. September saw a further decline in the annual growth rate of car sales (to 11.2%YoY from 15.7% in August), mainly due to a very high statistical base. Last September, car sales increased by 11.6% MoM.

September saw a return to the seasonal trend with fuel prices dropping by 8.4% month-on-month. Unlike last year, when low prices spurred increased purchases and created a high reference base of 1.7% MoM, demand for durable goods such as furniture, electronics, and household appliances remained weak.

Broad-based deterioration in retail sales in September

Sales of goods (real), %YoY.

Source: GUS.

Today’s data indicates that goods sales increased by approximately 1.3%YoY in the third quarter, compared to growth of around 5%YoY in the first half of the year. Therefore, we estimate that consumption growth slowed to around 3%YoY in the last quarter, from 4.7% YoY in the second quarter of 2024.

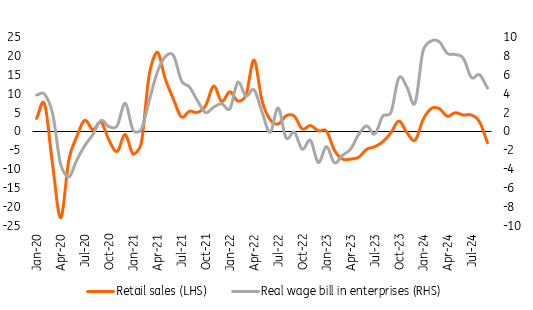

In our view, spending on services remained robust, but it was insufficient to compensate for softer demand for goods. The weaker consumption result in the last quarter is linked to the slowdown in the nominal wage growth rate and the rebound in inflation, which reduced the growth of real wages.

Additionally, higher gas and electricity bills following the withdrawal of the energy shield left less money for other expenditures in household budgets. Severe floods in South-West Poland could also be partially responsible for weaker sales in September. The months ahead should show if the September sales were a one-off or the start of softer consumer demand.

Households' income base deteriorated amid higher inflation and slower growth of nominal wages

Wage bill in enterprises and retail sales of goods.

Source: GUS, ING.

In light of today’s data, we revise our forecast for household consumption in the third quarter to 3.0%YoY from the previously expected 3.8%YoY, and consequently, our GDP growth forecast for the last quarter to 2.5%YoY from the previous 2.8%YoY. Thus, downside risks to the GDP growth forecast of 3% for the whole of 2024 are increasing.

Read the original analysis: Polish GDP expected to weaken as September Retail Sales slump

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.