Policy mistake, Mideast or Yen

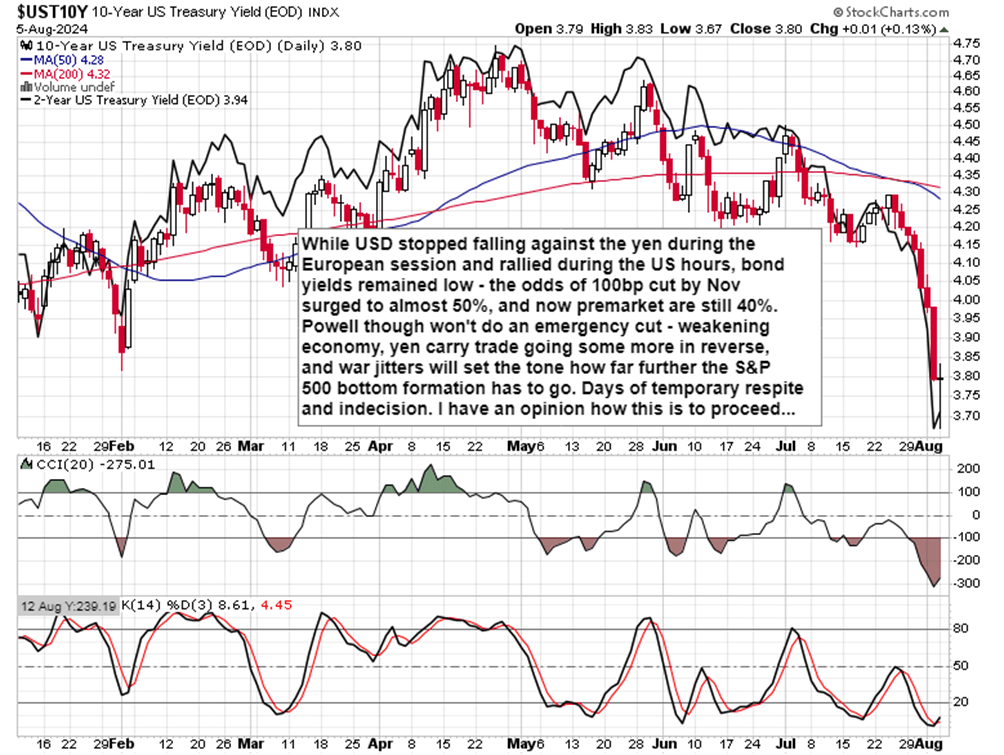

Which one of these is the key culprit? Failure to read the weakening economy and risk-taking negative consequence of yen reversal – the upcoming weeks rather days will reveal the relative weights between these two leading factors behind the 1000 plus slide in Nasdaq and similarly badly hit S&P 500, Russell 2000, cryptos and commodities.

To answer the question in the caption, have a look at VIX, and pay attention to the full details (premium). Look at the VIX candle and ask yourself whether this is the top in.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.