Playing the Whipsaws and the Stock Rebound Ahead Profitably

Bouncing off yesterday’s new 2020 intraday lows, the S&P 500 closed higher on the day. But what about today’s premarket action? The bulls didn’t add to their gains in the overnight trading. With the futures back below 2400, where next for the stock market?

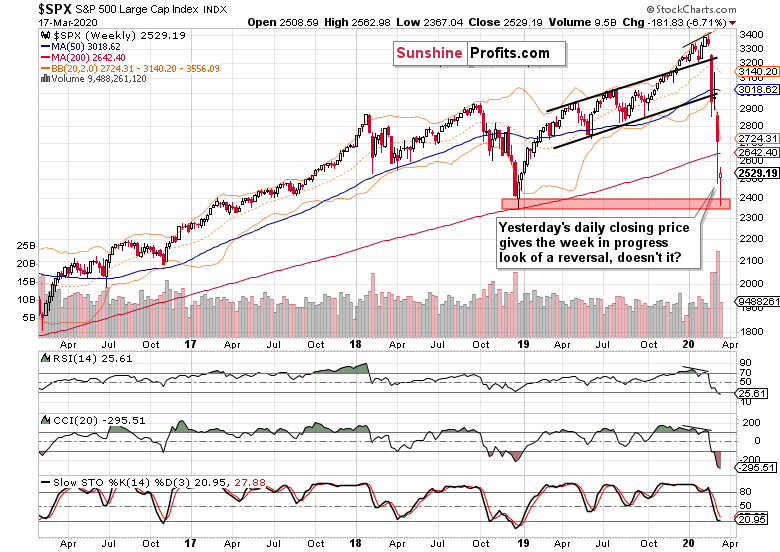

Let’s start with the weekly chart to see the shape of things this very moment (charts courtesy of http://stockcharts.com).

While the week is far from over, the price action smacks of a reversal in the making. Accounting for yesterday’s session, the volume appears on track to beat last week’s one. Should weekly closing prices stick around this level, that would support the likelihood of a turnaround. But what kind of a turnaround? It’s our opinion that this would most likely mark a temporary respite only.

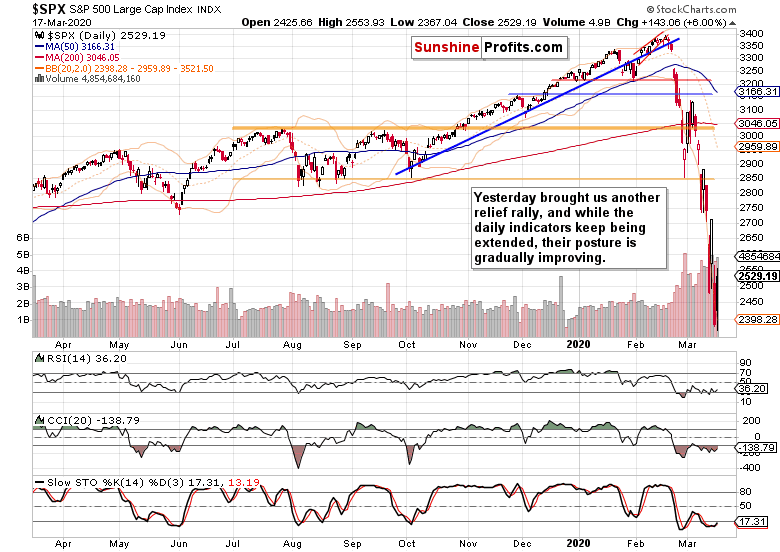

Let’s move on to the daily chart.

Similarly to Friday, stocks rebounded yesterday. While that appears encouraging, let’s examine whether our yesterday’s notes remain up-to-date also today:

(…) The daily indicators maintain their very extended posture. While that’s no guarantee of a stock rebound, another relief rally might be due in short order.

The potential for a rebound is stronger today than has been yesterday, and it’s not just because of the potential next Fed move later today that might spur buying. It’s the daily indicators – they’re refusing to budge much lower with each daily slide (that speaks to prices being overextended to the downside), and Stochastics has even flashed its buy signal. While the signal came in its oversold area and thus is not as reliable as the one generated outside this range, it’s still notable.

That’s because should prices remain roughly unchanged today, or even move higher, Stochastics is likely to wave goodbye to its oversold area, lending more credibility to its buy signal. And that would increase the likelihood of more traders jumping in on the unfolding upswing.

Therefore, the current price point offers an opportune entry point from the risk reward perspective – just like our yesterday’s profitable long trade did. Time for some more profits! The full details are reserved for our subscribers.

Summing up, while the bears have the upper hand, the potential for an upswing is growing day by day. And we plan to cash in on that just like we did yesterday. This is primarily supported by the daily indicators’ posture. Our subscribers have the trading position details.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.