Think the second version of the U.S. GDP report doesn’t have much of an impact on forex price action? Think again!

For the newbie traders just tuning in, you should know that the U.S. economy typically releases three versions of its GDP report: advanced, preliminary, and final. While the advanced GDP release tends to have the strongest market impact since it provides the first glimpse of how the economy fared in the reporting period, revisions for the second and third releases also usually have an effect on long-term dollar movement.

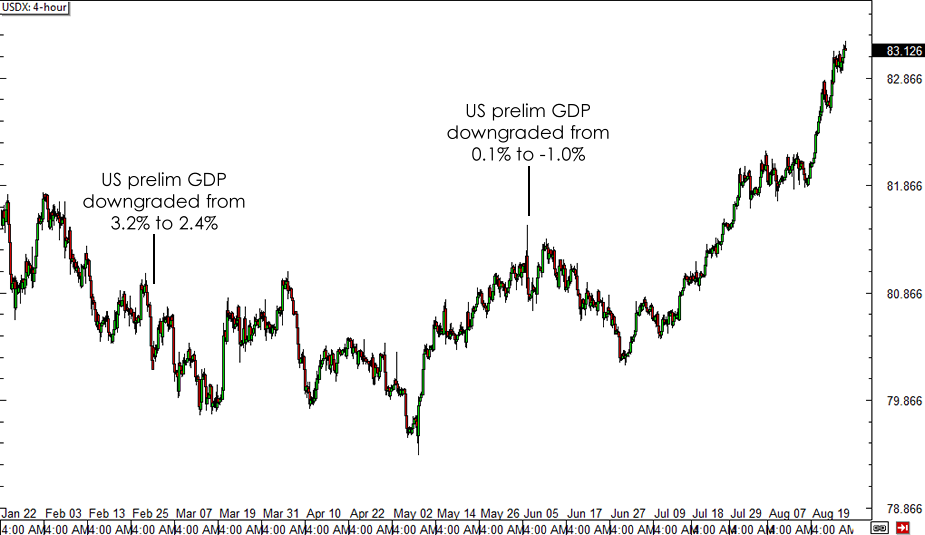

A quick review of past releases on the economic calendar reveals that the U.S. preliminary GDP report happens to contain significant revisions from the initial release. Heck, the GDP reading was dramatically downgraded from 0.1% to -1.0% in the previous quarter! Prior to that, the Q4 2013 GDP reading was revised from 3.2% to 2.4% while the Q3 2013 figure was upgraded from 2.8% to 3.6% during the second release.

With that, market participants are probably bracing themselves for a potential revision on the latest U.S. GDP reading, which showed a 4.0% expansion for Q2 2014. Economic experts predict that only a small downgrade to 3.9% might be seen for now, as retail sales figures have been lowered. Some expect to see upgrades in business investment and net exports, which might be enough to keep the GDP reading steady.

Another sharp downgrade could force the Greenback to return some of its recent losses, as previous downward revisions have resulted to dollar weakness in the weeks that followed.

On the other hand, no revisions or an upgrade could allow the U.S. dollar to extend its gains against its forex counterparts, as many are already taking a bullish dollar bias in anticipation of a rate hike next year. Strong growth figures could add support to these speculations, which might then lead to better business and consumer confidence. Eventually, this could lead to higher spending and investment, adding more fuel to growth prospects and potential Fed tightening.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.