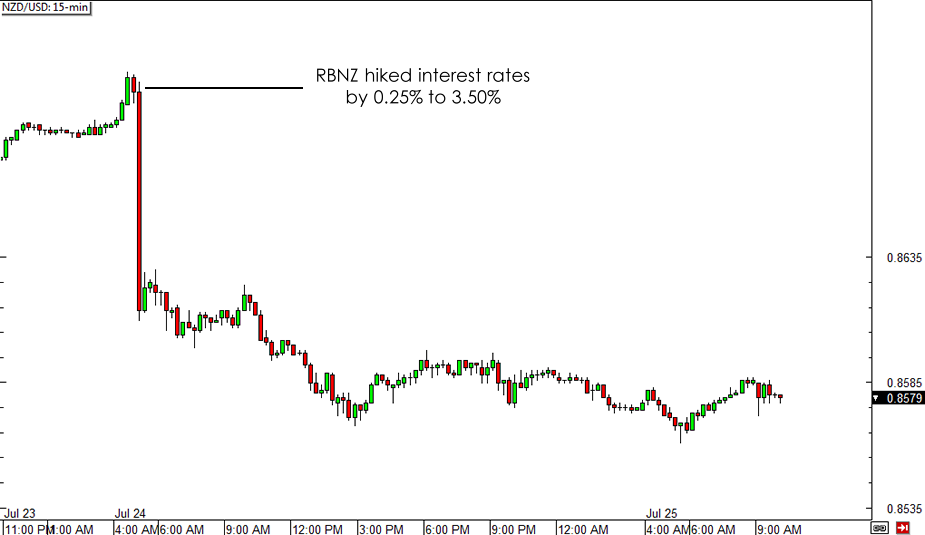

As you can see from the 15-min chart of NZD/USD below, the pair dropped by close to a hundred pips right after the announcement then continued to edge lower for the rest of the trading sessions.

Apparently, RBNZ Governor Graeme Wheeler hinted that this might be their last rate hike for the year, as he mentioned that they would pause from tightening to assess the impact of their latest moves. “It is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level,” he said. “The speed and extent to which the OCR will need to rise will depend on the assessment of the impact of the tightening in monetary policy to date, and the implications of future economic and financial data for inflationary pressures.”

With that, analysts priced in lower odds of seeing another rate hike in the next few months, as some projected that the next increase might not happen until March next year. After all, inflationary pressures have been subdued, particularly among wages and in the dairy sector.

In fact, falling commodity price levels have been such a persistent concern for the RBNZ that they decided it’s time to jawbone their currency again. According to the central bank’s official statement, the trading level of the Kiwi is “unjustified and unsustainable” and there is “potential for a significant fall” as it has to adjust to weakening commodity prices.

This isn’t something new from the RBNZ, as Wheeler has a record of jawboning and has even staged a secret currency intervention last year. At that time, NZD/USD had been trading around the .8700 levels and dropped by roughly 300 pips in a few days.

If the RBNZ is all bark and no bite though, it won’t be long before market participants realize that the New Zealand central bank can’t afford to intervene in the currency market for now. Who knows? Perhaps Wheeler and his men are simply waiting for the Kiwi rallies to retreat before going on another rate hike streak.

For now, the shift in the RBNZ’s stance to a more cautious one could keep any Kiwi gains at bay. It doesn’t help the higher-yielding commodity currency that geopolitical tension has allowed risk aversion to extend its stay in the markets. Sooner or later though, market participants could be drawn back to the positive interest rate differential of buying the Kiwi against lower-yielding currencies and allow the longer-term climb to resume.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.