Personal Consumption Expenditure Price Index September Preview: Transitory inflation becomes permanent

- Annual PCE rate forecast to rise, monthly results to moderate.

- CPI at 13 year high in September, wages and oil higher in September.

- Federal Reserve bond taper logic aided by rising PCE inflation.

Inflationary pressures in the United States economy have not abated with the heat. Continuing supply-chain restrictions, labor shortages and commodity price increases are set to make the fall and winter as uncomfortable for consumers as the summer.

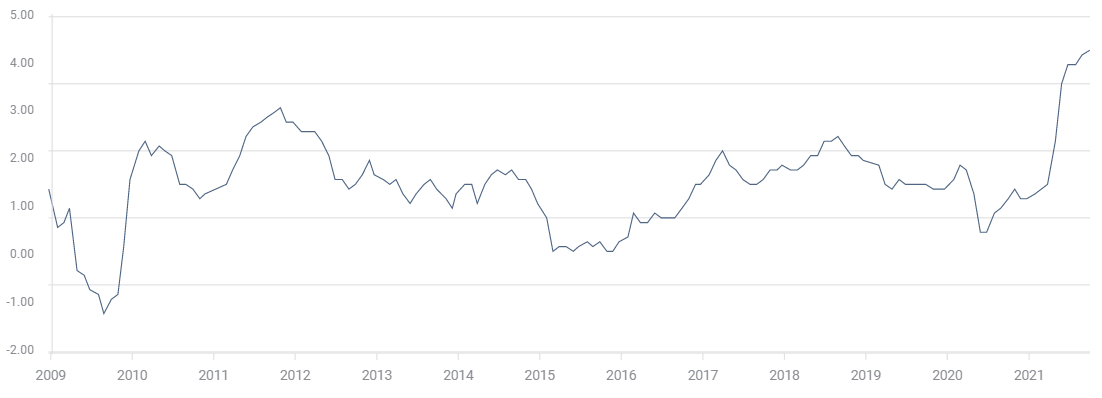

The Personal Consumption Expenditure Price Index (PCE) is expected to rise 0.3% in the month of September and 4.7% in the year after 0.4% and 4.3% increases in August. The core index is slated to rise 0.2% following a 0.3% gain in August and 3.7% annually after a 3.6% increase in August.

PCE Price Index

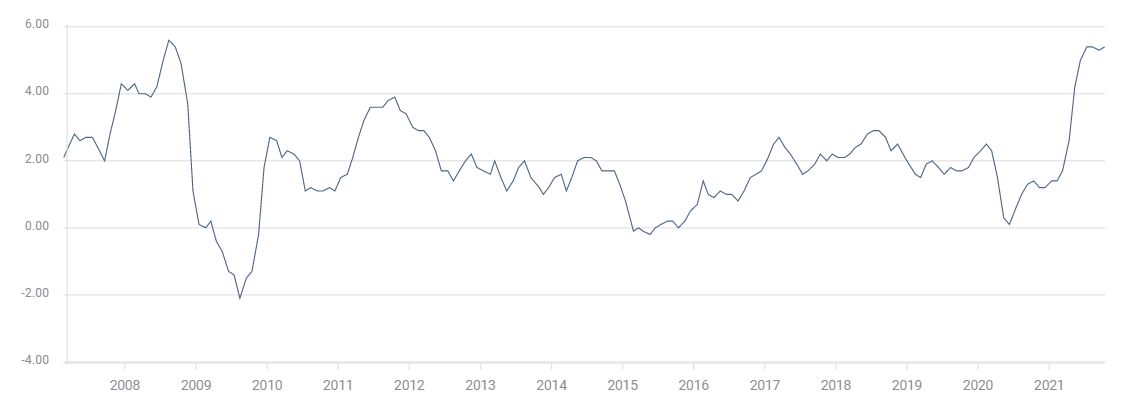

CPI and PPI

The gains in consumer prices that have seen annual CPI more than double in the six months from March have moderated somewhat.

CPI

FXStreet

In September the 5.4% rate was no higher than June and July, though 0.1% up from August. The monthly increase of 0.4%, also 0.1% higher than August, is still just half the 0.8% average increase in the second quarter.

Core rates have also been tempered from their 0.8% monthly average in the second quarter, rising just 0.2% in September. Annual gains of 4% were unchanged last month, lower than 4.3% in July but higher than the 3.8% second quarter average.

Prices in the production process continue to move higher, promising more consumer inflation as retailers pass these costs to purchasers.

The annual Producer Price Index (PPI) rose to 8.6% in September, up from 8.3% prior, for the highest rate in 13 years. Core PPI jumped 6.8%, the most on record. Headline PPI has soared 506% since registering 1.7% in January. Core PPI is up 340% after starting the year at 2%.

PPI

FXStreet

Commodities and oil

For whatever period one charts over the past 19 months commodity prices have been on a tear.

In September the Bloomberg Commodity Index (BCOM) added 4.9%. Those gains continued in October with another 3.9% rise. For the year commodity prices are up 29% and from the April 2020 low they have soared 73.8%.

BCOM

Bloomberg/MarketWatch

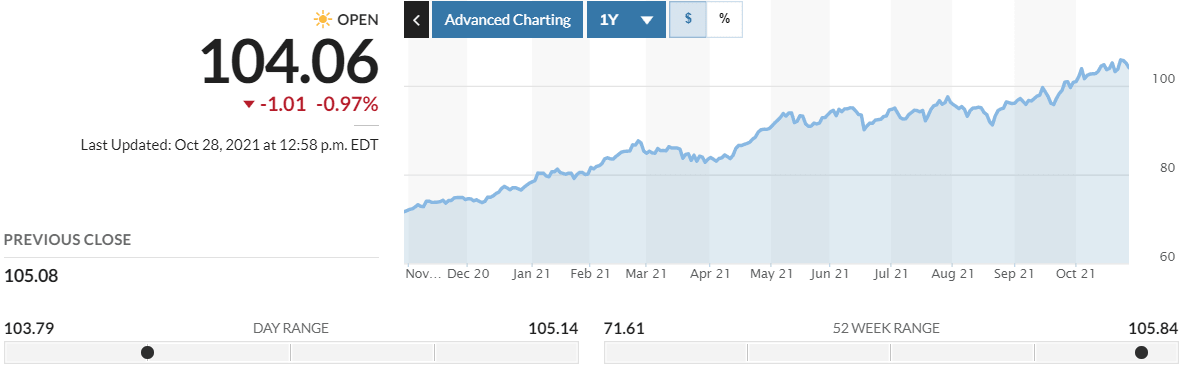

West Texas Intermediate (WTI), the crude oil pricing standard for Western hemisphere, is an even more extreme example of price inflation. From the November 2, 2020 open, WTI has climbed 126%, from January 4 it is up 68%. In September it is higher by 10%. From the most recent low on August 20 WTI has climbed 31%.

WTI

Commodity price increases such as these have a wide ranging impact on an industrial economy. Energy costs are at the base of every production process. When input price increases are as endemic as they have been this year, the carry to consumer prices is inevitable. As long as produce pieces are rising, so will consumer costs.

Federal Reserve inflation expectations and the economy

The Federal Reserve's hope that price increases would be transitory, was based on the assumption that the base effects from last year’s lockdown would recede quickly and the impact of supply and labor disruptions would reverse in short order.

This has not, at least so far, been proved true.

Labor shortages, puzzling perhaps to the Fed and many economists, have continued. People have not returned to work in the numbers equal to the pre-lockdown economy. This seems to be a particular US problem, since the Canadian labor economy returned to full employment in September. The labor shortage has crimped the output of factories and the resulting product scarcity has added to inflation.

Commodity price gains have also proved to be more enduring than anticipated with raw material shortages driving down capacity implementation.

Oil supply has not kept pace with rising demand. The restricted supply has been partially driven by US policy, which has made a normal production recovery far more difficult.

In 2019 the US shale industry had become the world’s primary swing producer. That ability has been largely eliminated by Washington. American shale firms have been willing and able, in the past, to increase production in response to rising prices. For political reasons, that is not true of OPEC and Russia, the other two producers with excess capacity.

The vulnerability of just in time manufacturing processes, which by design hold few raw materials or components, has been exposed. As long as the supply chains and delivery times are reliable, it is a standard of efficiency. But a supply link intended to deliver a steady though limited quantity of goods, materials and components, cannot be easily enlarged to accommodate the needs of a global restocking. Even if the parts and materials could be found, the increased ship tonnages attempting to unload at US ports have created long and so far, insurmountable, delays.

Commodity inflation is a large ingredient in overall price hikes and it is unlikely to dissipate much over the next six to 12 months.

Conclusion: Inflation and the taper

The problem for the Fed's transitory inflation narrative is that the base effect changes that keyed on the collapse in price in last year's lockdown have passed. Prices are now being driven by the types of pressures from wages, material costs, product scarcity and rising consumer demand that are typical of economically determined inflation. While these pressures may eventually wane, for the near and intermediate term they seem destined to remain in charge of the price structure.

The Fed’s reluctant acknowledgement of these changes will not affect their prospective taper announcement at the Nov 3 Federal Open Market Committee (FOMC) meeting. If anything, greater PCE inflation pressures, even if officially discounted by the averaging policy adopted last September, will encourage the Fed not to delay the reduction in bond purchases

Is the Fed happy that inflation is soaring? Probably not. Do the governors appreciate the added policy logic? Not publicly.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.