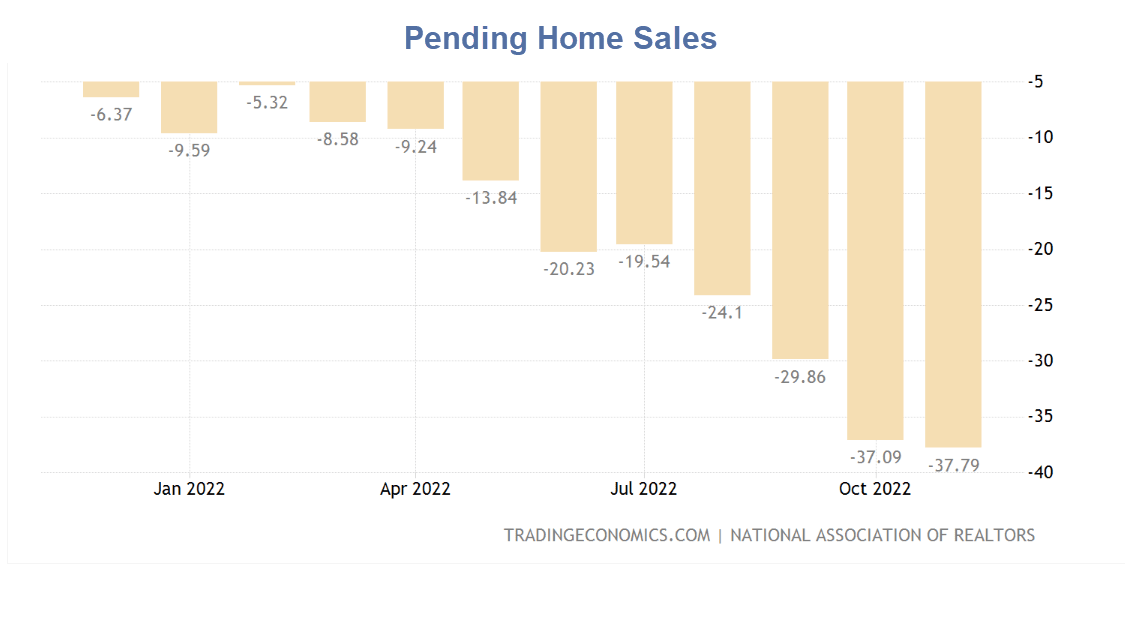

Pending home sales are down another 4.0% from October according to the National Association of Realtors (NAR).

Pending home sales chart courtesy of Trading Economics and the NAR

Pending home sales description

Pending sales are signed contracts where the transaction has not closed. They are a leading indicator of future existing home sales.

In this case, pending home sales for November represents an advance look at closings that will take place in December or January.

Note that existing home sales are reported at closing whereas new home sales are recorded at signing.

Pending home sales slid 4.0% in November

The National Association of Realtors reports Pending Home Sales Slid 4.0% in November

Pending home sales slid for the sixth consecutive month in November, according to the National Association of REALTORS®. All four U.S. regions recorded month-over-month decreases, and all four regions saw year-over-year declines in transactions.

"Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home," said NAR Chief Economist Lawrence Yun. "Falling home sales and construction have hurt broader economic activity."

The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — fell 4.0% to 73.9 in November. Year-over-year, pending transactions dropped by 37.8%. An index of 100 is equal to the level of contract activity in 2001.

Pending Home Sales in the United States decreased 37.80 percent year-on-year in November of 2022. That is the 18th straight month of year-over-year declines.

The NAR will report existing-home sales for December on January 20, 2023. Don't expect the report to be any good.

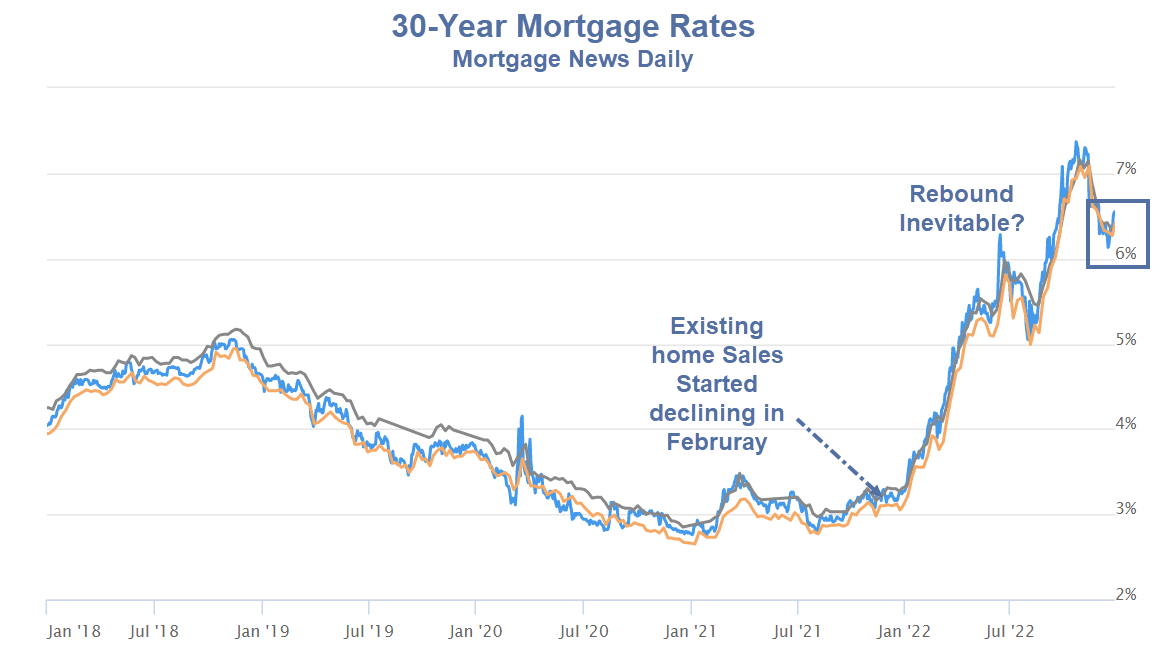

Inevitable rebound?

Nar chief economist (cheerleader) commented "With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth."

There eventually will be a rebound but not in the coming months based on interest rates.

30-year mortgage rates

30-year mortgage rates courtesy of Mortgage News Daily, annotations by Mish

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.