Peculiar FOMC Minutes reaction

S&P 500 ignored soft landing supprotive data (JOLTS, manufacturing PMI), and instead sold off following – not on – FOMC minutes even if these contained slowdown of the balance sheet shrinking. Russell 2000 took the key hit, and it was led by regional banks rather than biotech, in a way connected to the XLRE (meaning real estate – commercial and not necessarily single family homes).

Meanwhile the 30 min, 4 hour and daily ES charts are screaming still danger and dust unsettled ahead even if VIX duly retreats (except yesterday, closing above 14) – my first 4,755 support level is slowing the descent, but 4,735 is to act as a magnet, especially considering continued (big) tech weakness and smallcaps not catching their breadth.

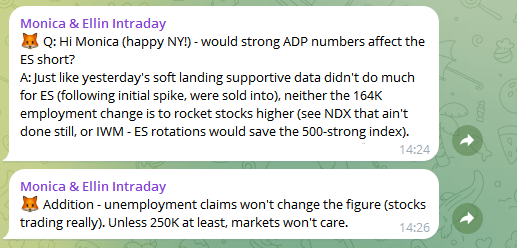

Ignore not the USD upswing and rise in yields over the last couple of days either – more than tax selling seems to be going on. And as regards today‘s data, here‘s my commentary from our intraday channel.

Let‘s move right into the charts – today‘s full scale article contains 2 of them, featuring S&P 500 and precious metals.

S&P 500 and Nasdaq outlook

Wave goodbye to the 4,755 support slowing the sellers, here comes the 4,735. It‘s been a relatively uneventful day yesterday, marked chiefly by incoming data and minutes which should have worked for the buyers, but didn‘t – and that‘s in itself telling, caution warranting.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.