US PCE prices ebb in April, a sign that inflation is slowing?

- The Core Personal Consumption Price Index rose 4.9% in April, down from 5.2% in March.

- Personal Spending was stronger than forecast as consumers drew on savings.

- Real disposable personal income was flat in April.

- Equities rally, Treasury yields are mixed, dollar fades.

The Federal Reserve’s chosen inflation measure rose 4.9% in April, while prices that consumers actually pay were 6.3% higher than a year ago.

Inflation in the Core Personal Consumption Expenditure Price Index (PCE) came in at forecast last month down from the March pace of 5.2%. The 0.3% monthly increase was unchanged.

Core PCE Price Index

Core inflation excludes food and energy costs which have been a major source of price inflation.

Overall consumer prices, including food and energy, rose 6.3% in April, down from 6.6% in March and missing the prediction for no change. Monthly prices were up just 0.2%, far below the 0.9% jump in March.

PCE Price Index

FXStreet

Consumers continued to spend in April, mitigating one of the main worries for the US recovery. Personal Spending, from the Bureau of Economic Analysis (BEA), climbed 0.9%, ahead of the 0.7% forecast though less than the upwardly revised 1.4% gain in March. Personal Income rose 0.4% on the month, a bit less than the 0.5% addition in March and the April estimate.

Real personal income and spending

April income and spending figures corrected for inflation, also from the BEA, were similar for consumption but notably less for income.

Real personal spending (PCE) rose 0.7% in April, 0.2% lower than the unadjusted figure.

Real disposable personal income, however, dropped to flat last month after inflation’s price gains were removed.

Over the period from December to April, real disposable income has fallen an average of 0.42% per month. In contrast, the uncorrected personal income figure averages a positive 0.42% for the same five months.

Real disposable income explains why consumers were again forced to draw on savings to maintain spending levels. In that, the pandemic disruptions of the last two years have been a help, as Americans have amassed a kitty of at least $2 trillion in savings.

Personal Income and Spending

BEA

Inflation: April and May

Inflation has been rocketing higher for 13 months. The headline PCE price index was, as above, 6.3% in April. It jumped from 3.6% in April last year to 4.0% in May and has been above 5.0% for seven months and 6.0% for four.

The older Consumer Price Index (CPI) rose 8.3% in April and has been at or above 5.0% for a year, above 6.0% for seven months, above 7% for five months and above 8.0% for two.

CPI

Price data for the two indexes is obtained from different sources. The CPI information comes from consumers, that is retail pricing, while the PCE figures are extracted from businesses.

The Fed considers PCE a better measure of inflation trends but the CPI numbers are closer to what consumers actually pay and are a more accurate reflection of the impact of inflation on household budget and spending. The European Central Bank (ECB) targets overall inflation not the core rate.

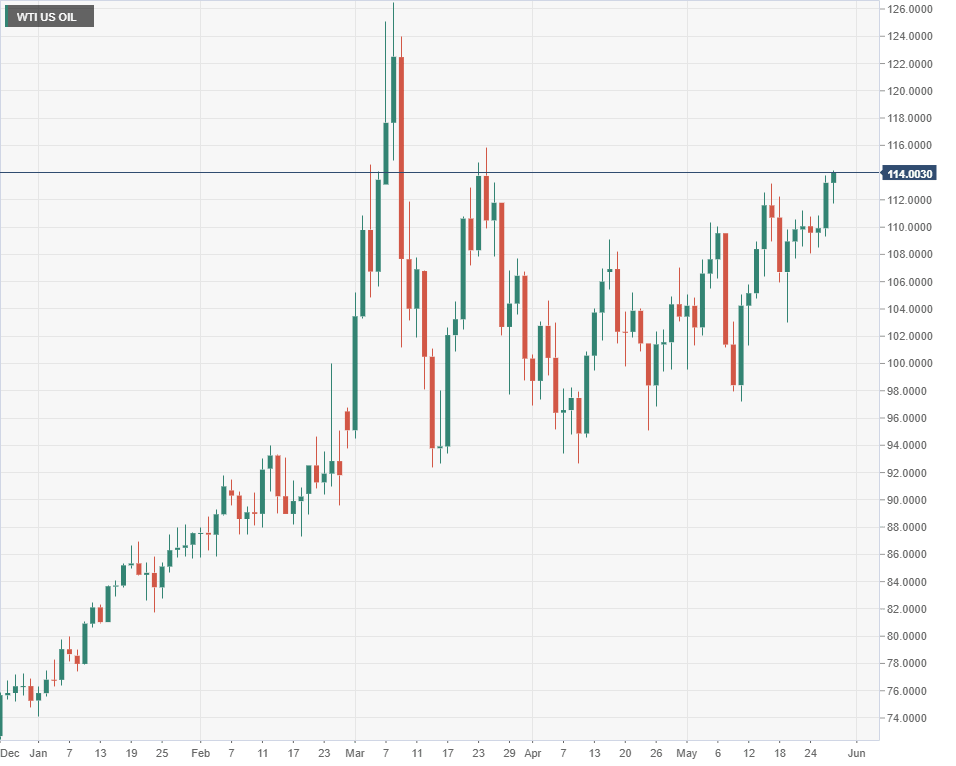

While the drop in headline PCE and CPI inflation in April was positive it may not last. Oil prices have climbed sharply this month after a relatively quiet April.

West Texas Intermediate (WTI) rose 3.08% from April 1 to April 29, $100.35 to $ 103.44. So far this month WTI is up 10.2% from $103.44 to $114.00.

The crude price increase is reflected in gasoline charges. One month ago the national average for a gallon regular was $4.134, on Friday it was $4.599, an 11.2% addition. On the year retail gasoline prices are 51.2% higher.

Diesel fuel, which powers the truck based distribution network across the country, is 8.6% higher on the month and 74.0% higher in 12 months.

American Automobile Association

Markets

Equities responded to the inflation decline with the fifth daily rally in a row, resulting in the first positive week in eight.

In mid-afternoon trading the Dow was ahead 326.19 points, 1.0% to 32,963.38. The S&P 500 was up 69.75 to 4,127.76, 1.72%. The NASDAQ, which had been down 23.09% on the year at the open, had climbed 2.52%, 295.09 points to 12,035.34.

Treasury returns were mixed with some minor yield curve flattening. The 10-year yield was off 1.7 basis point to 2.741% and the 30-year was down 2.4 points to 2.968%. The 5-year yield was up 0.9 basis points to 2.726% and the 2-year was down 0.4 points to 2.484%.

The dollar was down in all major pairs, trivial amounts versus the euro, the yen, the sterling and the Swiss franc, and registering more substantial losses against the commodity currencies. The aussie, kiwi and loonie were supported by rising oil and commodity prices.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637892728450700203.png&w=1536&q=95)