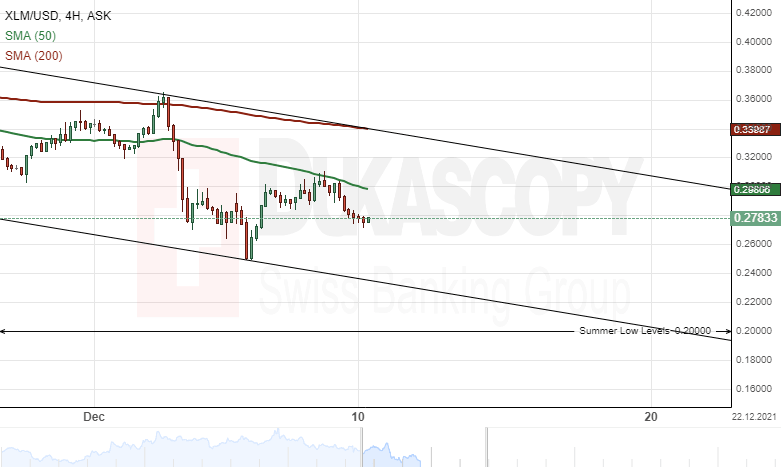

Patterns: XML/USD, EOS/USD

Stellar finds resistance in SMA

At the start of December, the price for Stellar found support in the lower trend line of the channel down pattern, which has guided the XLM/USD rate since the start of November. The following surge reached the resistance of the 50-four hour period simple moving average. The SMA provided enough resistance for a decline to begin.

If the pair continues to decline, it could find support in the lower trend line of the channel down pattern. Meanwhile, note that the 0.2000 mark provided support in Summer.

On the other hand, the rate might make an attempt to pass the resistance of the 50-four hour period simple moving average. A move above the SMA is most likely going to find resistance at the upper trend line of the channel and the 200-period SMA.

EOS bounces off resistance line

The price for EOS has bounced off the trend line, which connects the November and December high levels. On December 10, the EOS/USD rate reached the summer low level at 3.1622. The 3.1622 level appears to have provided both support and resistance in the aftermath of the December 4 crypto flash crash.

If the price reaches below the 3.1622 level, it could look for support in the December 4 low level at 2.4060.

On the other hand, a recovery might find resistance in the 50-four hour simple moving average, before aiming at the November and December resistance line near 3.6000.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.