Patterns: EUR/DKK, USD/DKK

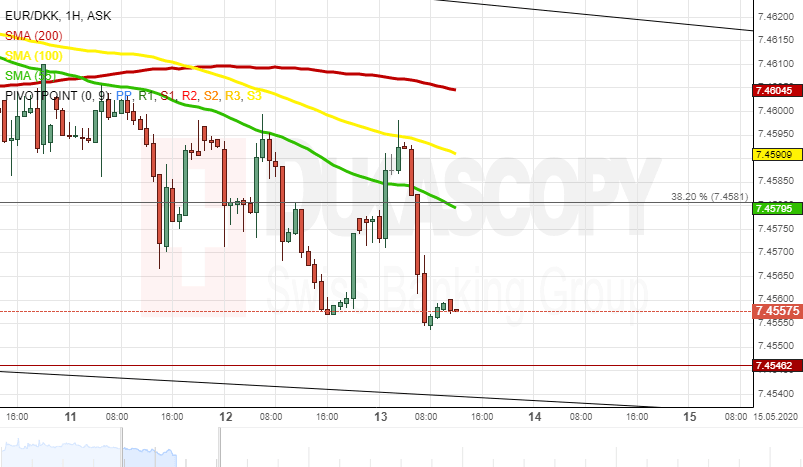

EUR/DKK 1H Chart: Falling wedge pattern in sight

The EUR/DKK currency pair has been trading within a falling wedge pattern since the end of March.

From a theoretical point of view, it is likely that the exchange rate could continue to trade within the given pattern until the middle of June. Then, a breakout north is likely to follow.

However, note that the currency pair is pressured the 55-, 100– and 200-hour moving averages. Thus, a breakout south from the pattern could occur within the following trading sessions. In this case the pair could gain support from the Fibo 61.80% at 7.4485.

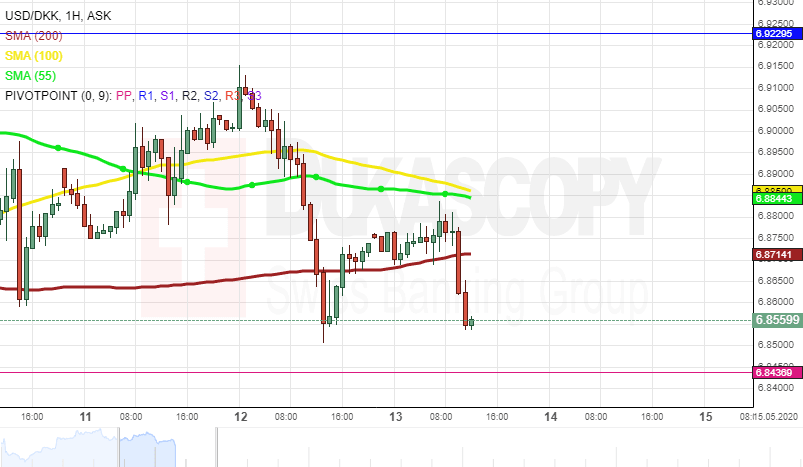

USD/DKK 1H Chart: Rising wedge pattern in sight

The USD/DKK exchange rate has been trading within a rising wedge pattern since the end of March.

From a theoretical perspective, it is likely that the currency pair could continue to trade within the given pattern until the middle of March. Then, it is likely that the pair could breach the given pattern south.

However, note that the exchange rate is pressured by the 55-, 100– and 200-hour moving averages. Thus, a breakout south could occur sooner, and the rate could decline to the monthly S3 at 6.5471.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.