Patterns: AUD/NZD, EUR/NZD

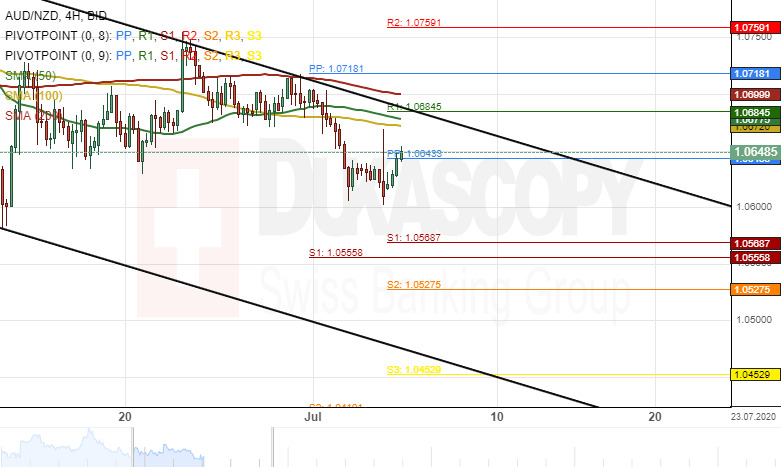

AUD/NZD 4H Chart: Likely to maintain channel

The Australian Dollar has declined by 2.22% against the New Zealand Dollar since June 2. The currency pair is currently trading in a narrow descending channel pattern.

All things being equal, the AUD/NZD exchange rate could continue to trade in the descending channel pattern. Bearish traders will most likely target the psychological level at the 1.0500 area within this week's trading sessions.

However, the support cluster formed by the weekly S1 and the monthly S1 at 1.0568 could provide support for the currency exchange rate in the short-term.

EUR/NZD 4H: Selling bias

The common European currency has declined by 4.02% against the New Zealand Dollar since June 1. The currency pair was pressured lower by the 200– period simple moving average.

As for the near future, the EUR/NZD exchange rate could continue to decline during the following trading sessions. The potential target for bearish traders would be at the 1.7000 level.

However, a support cluster formed by the weekly S1 and the monthly S1 at 1.7077 could provide support for the currency exchange rate within this week's trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.