Patterns: ADA/USD, BAT/USD

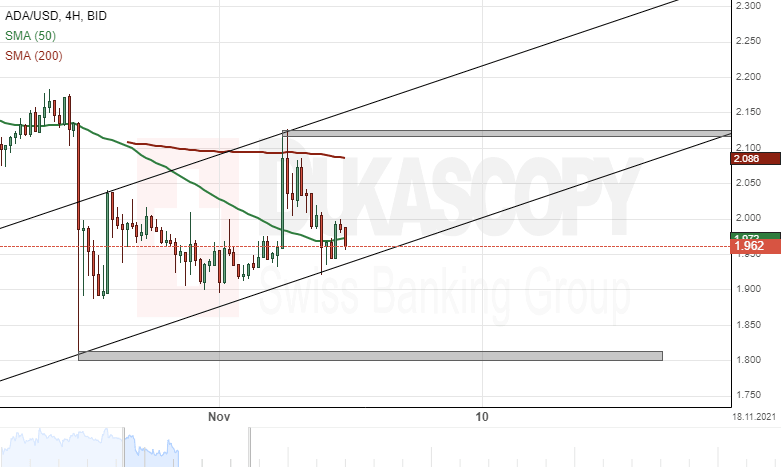

ADA/USD trades in ascending channel

On November 4, the price for Cardano confirmed the existence of a channel-up pattern. Namely, one can draw the pattern by connecting the October 28 and November 3 high levels as resistance and the October 27 and November 4 low levels as support. The pattern has been guiding the rate's recovery since the drop on October 27.

In the case that the rate continues to surge in the borders of the channel pattern, it could face the resistance of the 200-period simple moving average near 2.0860. Above the SMA, the November 3 high level at 2.1280 might act as resistance.

Meanwhile, a potential decline would have to first pass the support of the 50-4 hour simple moving average before testing the support of the channel-up pattern.

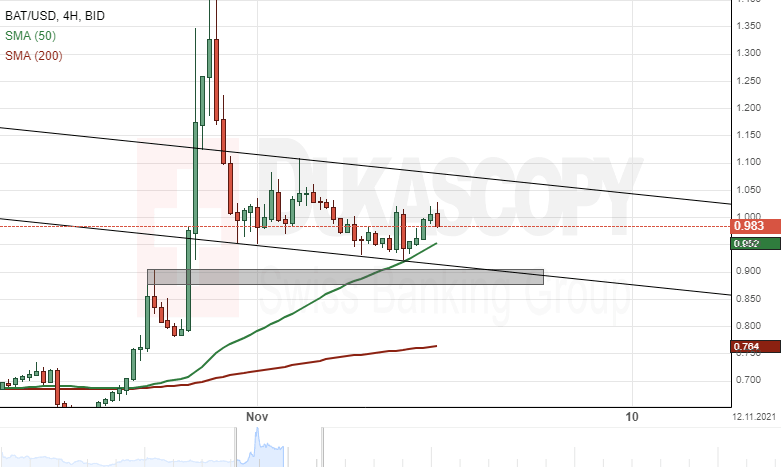

BAT/USD finds support in SMA

The price for the Basic Attention Token has been declining supported by a descending trend line. Most recently, the support of the 50-4 hour period simple moving average approached the trend line.

It caused a surge, which could encounter resistance at 1.0750. Near that level, a potential upper trend line of a channel down pattern is located. The channel is drawn by connecting the November low levels and setting the upper trend line at the November 2 high level.

If the BAT/USD pair passes the resistance of the channel down pattern, the pair could aim at the November 2 high level at 1.1096.

On the other hand, a potential decline would find support in the 50-period SMA near 0.9520. Below the SMA, the lower trend line of the channel pattern could provide support. In addition, the October 29 high levels might act as support.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.