Run, Bull, Run, was the cover story of Barron’s magazine in January 2000. The story presented arguments for “another record-breaking year for stocks”. Today, we know that it didn’t happen. Instead, the bull was a bubble and burst a few months later.

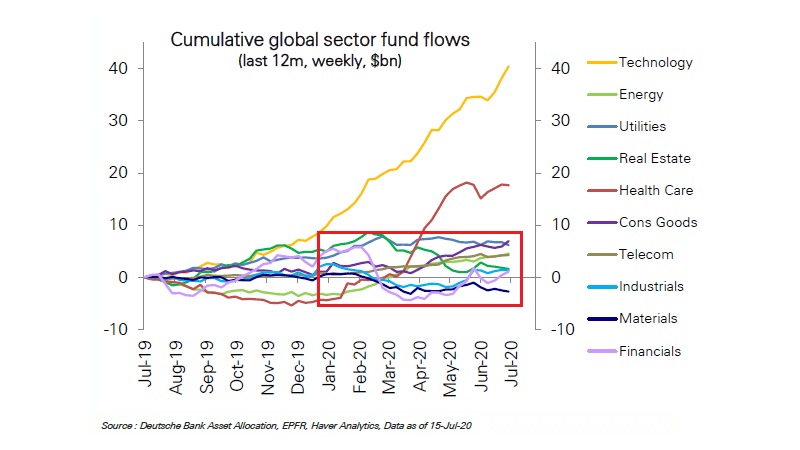

Source: Deutsche Bank, EPFR, Haver Analytics

Tech(no)

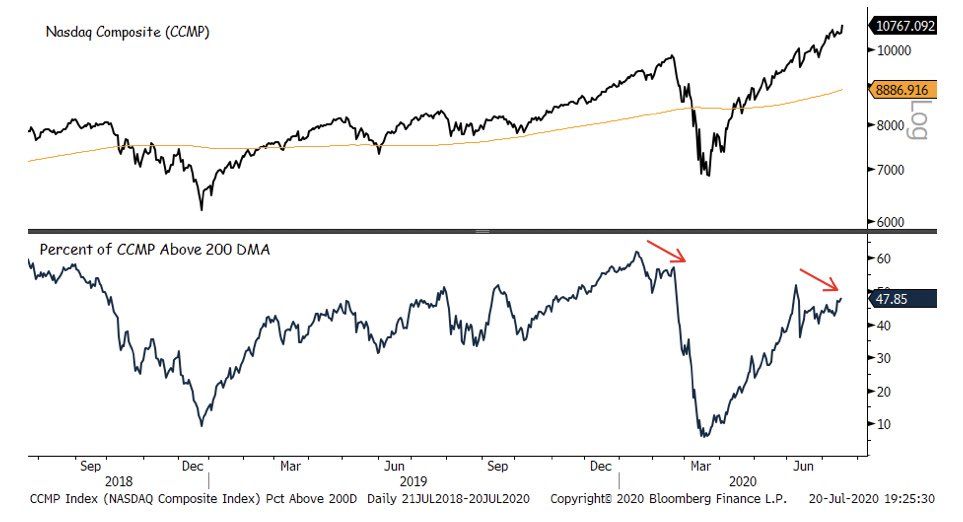

There are striking similarities between investors’ behavior around the millennium change and today. Speculative positioning on the back of extremely optimistic expectations channeled liquidity into the equity market. Investors piled into the tech sector as the first chart above reveals. Meanwhile, eight out of ten key industries flatlined during the same period in terms of fund flows. Digging deeper into the tech sector reveals that not even 50% of its components trade above their 200DMA. The buying is concentrated on very few stocks. A sign that investors are overconfident and pick their darlings among a few stocks from the FAANG+ group.

Source: Carl Quintanilla & Bloomberg Finance L.P.

Overconfidence

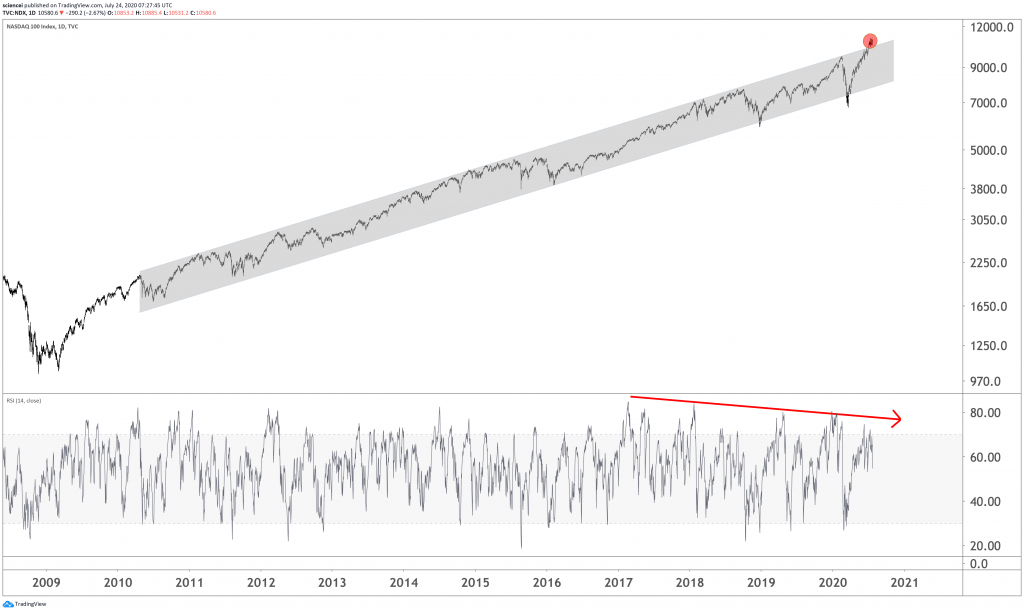

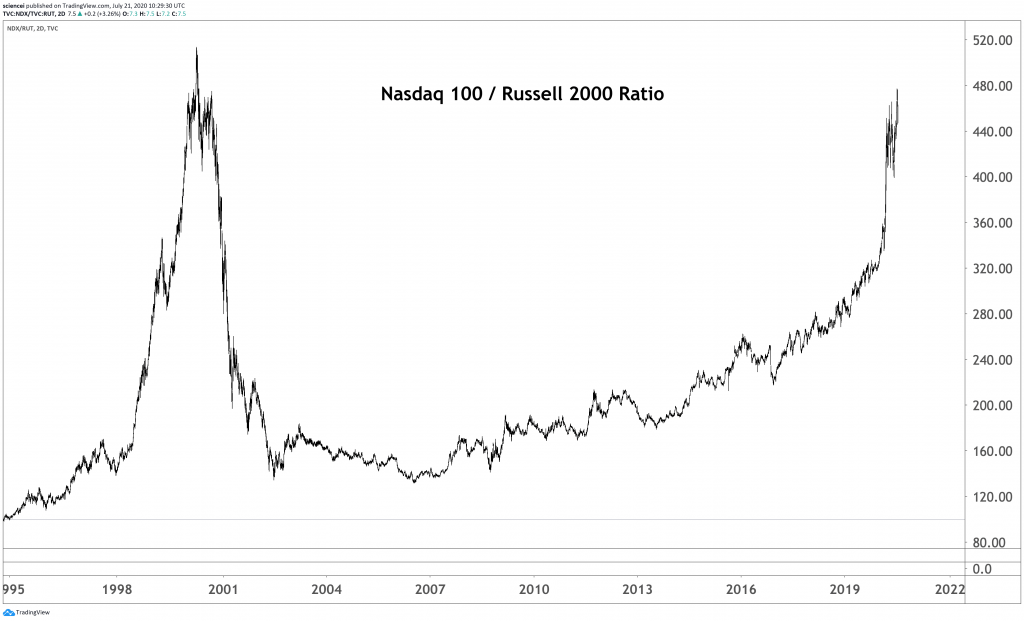

The development led to an overthrow in the Nasdaq 100 index. The pale grey trend had roughly a 19% p.a. total return appreciation over the past decade. That’s already more than double the long-term return history for stocks, which amounted to about 9%. An acceleration of that 19% trend from here on is most likely unsustainable. Moreover, the price premium relative to the 200DMA is the largest since 2000. The Nasdaq 100 has not been as overbought in twenty years according to this metric. Nonetheless, many investors are probably neither aware of technicals nor about the underlying valuations. The chart below shows a Nasdaq 100 to Russel 2000 ratio. It puts tech in relative terms to small caps and shows what happened during the past months. A 50% outperformance accumulated within a short time frame. The last time something similar occurred was during the dotcom bubble in 1998-2000. Once again, investors are partying like it’s 1999. Valuations don’t matter, trends get extrapolated, and the Fed put is part of almost all bullish narratives.

Source: ESI Analytics

No Technical Knockout (Yet)

The short-term technical picture favors the current situation to persist for a few more weeks as U.S. indices did not break below critical support levels. However, broad-based equity gains are unlikely during the next weeks. The rally is too stretched already despite being likely to hold up here. That changes with a sustained break below 10,300 in the Nasdaq 100, which takes the tech index back inside the pale grey long-term trend. Such action signals a confirmed overthrow failure and has been bearish historically. The S&P 500 has a similarly significant level running around 3,030. A break below that level signals that the sequence of higher highs and higher lows ended for the blue-chips index.

Source: ESI Analytics

Conclusion

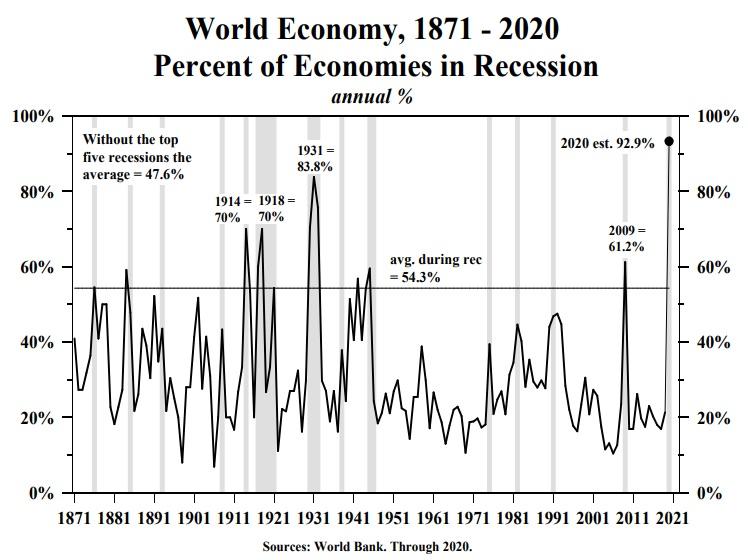

The bottom line is that a bumpy road is the base case during the next few weeks. The major U.S. equity indices are likely to persist at elevated levels as long as the 10,300 and 3,030 levels hold in the Nasdaq 100 and S&P 500, respectively. However, the overheated technical and exuberant sentiment picture probably lead to a cycle high sooner rather than later. There is something different today than in 1999. A record-breaking percentage of economies are in recession worldwide. Recessionary pressure has been the natural predator of bull runs historically. Therefore, long-term investors are best off on the sidelines.

Source: World Bank & Christof Leisinger

The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. Reproduction without ESI Analytics’ prior consent is strictly forbidden.

Recommended Content

Editors’ Picks

USD/JPY refreshes monthly high above 155.00 on BoJ's rates on-hold

USD/JPY is back above 155.00, refreshing monthly highs following the BoJ policy verdict. The BoJ left the short-term rate target unchanged in the range of 0.15%-0.25%. The decision came in line with the market expectations. Governor Ueda's press conference is now awaited.

AUD/USD bounces off two-year lows at 0.6200 as USD takes a breather

AUD/USD rebounds from two-year lows of 0.6200 early Thursday. The pair benefits from a pause in the hawkish Fed cut-led US Dollar uptrend. However, concerns about China's fragile economic recovery and Trump's tariff plans could cap the Aussie's recovery.

Gold sees a dead cat bounce following Fed’s hawkish cut

With the full final week of 2024 almost drawing to a close, Gold price remains vulnerable near one-month lows below $2,600, licking the hawkish US Federal Reserve policy decision-inflicted wounds.

Crypto market bleeds following hawkish rate cut decision by Fed

Bitcoin and the crypto market are down on Wednesday following the Federal Open Market Committee announcement to slow down rate cuts in 2025, with the benchmark federal funds rate declining to a lower range of 4.25% to 4.50%.

Sticky UK services inflation to come lower in 2025

Services inflation is stuck at 5% and will stay around there for the next few months. But further progress, helped by more benign annual rises in index-linked prices in April, should see ‘core services’ inflation fall materially in the spring.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.