Paradigm shift

S&P 500 confirmed Thursday‘s sharp upswing with more strength, and that‘s great for all of our long portfolio bets. Smashing turn continues in a taking no prisoners style (fresh China corona rules easing speculation helped) – the two key fixtures propelling markets higher, are the sharp USD downswing that I called for in Oct, and stabilization in yields – a steep decline taking e.g. the 10-year yield to 3.82% from above 4.20%.

Such an environment is conducive for the badly beaten tech and communications to outperform value on a short-term basis, in essence for as long as the retreat in yields last. Industrials, materials and oil stocks wouldn‘t do badly in the least either, perhaps financials as well. Also, it launches precious metals and commodities out of their sideways consolidation to the upper echelons. Yes, Thursday was an important medium-term catalyst, with strongly bullish implications. While till Oct, you were fine with cash, shorting paper, and long energy with USD, now it‘s the greenback that would suffer more often than not while everything else (apart from the tectonic event overshadowing crypto) mostly rises.

Why do I say only medium-term?

Remember we didn‘t get any Fed pivot, any Fed pause – anhd today‘s cautious Fed words confirm that. The bets are merely on deceleration of rate hikes, correctly so. Fed is still shrinking its balance sheet. More rate hikes are to come in 2023 – the Fed doesn‘t sound to be done, the risks of more tightening are clearly there. The real economy isn‘t yet in a recession, and in Fed‘s view inflation isn‘t defeated. Labor market remains tight, and should it prove a source mirroring heightened inflation expectations (think households), the Fed will take its aim. This Q4 rally that would last into Jan, is running on borrowed time, with strong short-term momentum, but would face the fate of the summer rally. This European morning‘s outlook is being confirmed at the onset of US session.

Today‘s analysis is exceptionally free for everyone to see the typical extensive length content and scope – in recognition of a smashing prior week, one for the record books.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there, but the analyses (whether short or long format, depending on market action) over email are the bedrock, so make sure you‘re signed up for the free newsletter and that you have Twitter notifications turned on so as not to miss any tweets or replies intraday.

Let‘s move right into the charts.

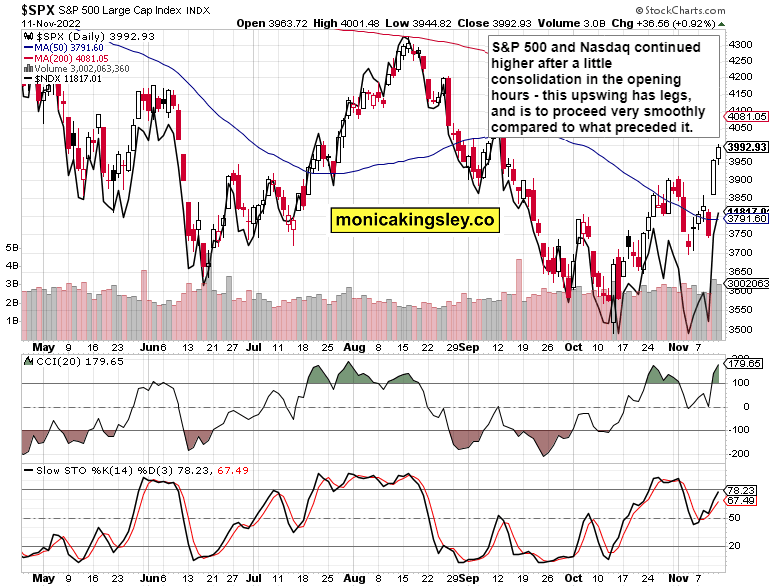

S&P 500 and Nasdaq outlook

Solid S&P 500 and Nasdaq upswings with volume behind them – the momentum is strong, and likely to continue through Nov without much of a hiccup.

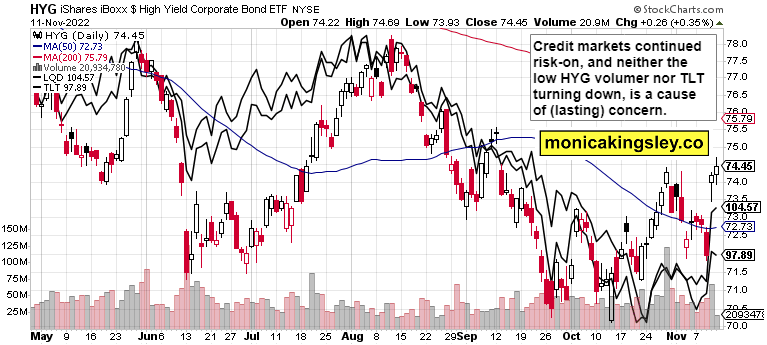

Credit markets

Still risk-on, no warning sign in bonds – the retreat in long-dated yields should continue over the nearest weeks.

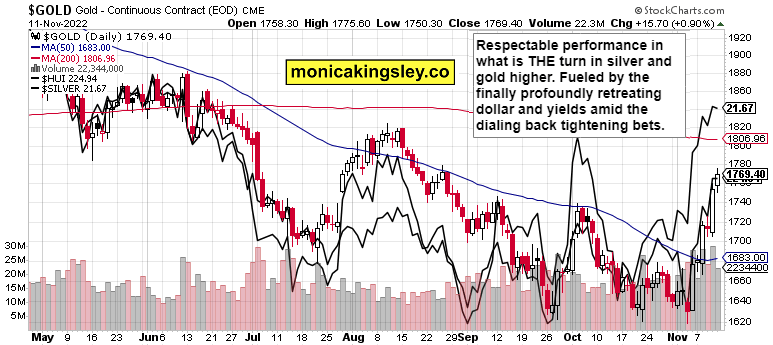

Gold, Silver and miners

This is a very bullish chart, one that got confirmed with a powerful upswing that‘s not yet pausing much. Precious metals are to enjoy the weakening dollar as much as commodities, with silver learding gold.

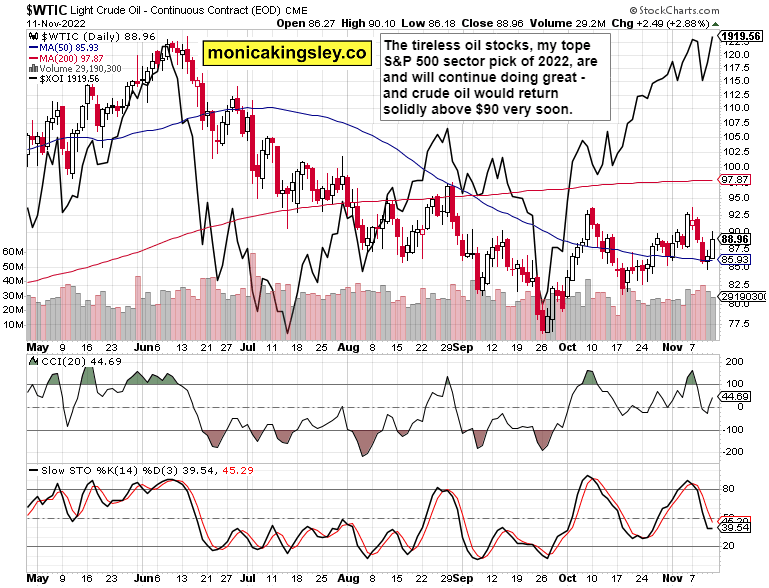

Crude Oil

Crude oil has been bidding its time over the week just gone, but it‘s well positioned to extend gains by breaking out of the recent long consolidation. Note the symmetry to the left and right of the Sep bottom – pretty nicely coiled spring now.

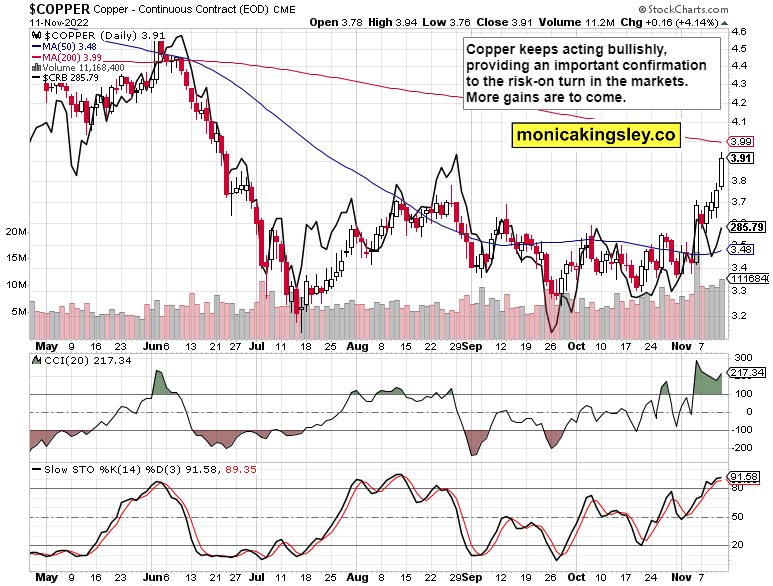

Copper

Copper is surging, and my Oct long call has been vindicated – the red metal is leading the commodities sector, which is an important sign.

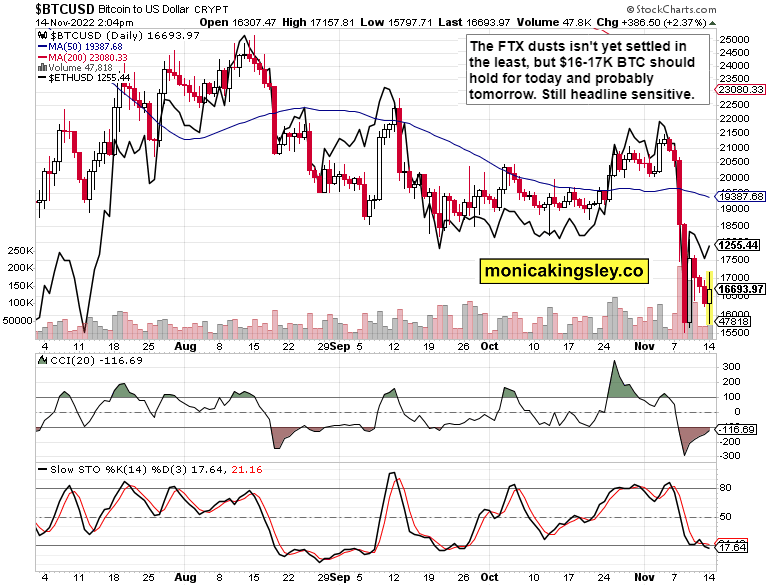

Bitcoin and Ethereum

Encouraging short-term sign is the double bottom holding, but I‘m not counting on this being the ultimate crypto low.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.