Orange juice a glass half full or empty?

S2N spotlight

I thought I would share an experience that happened 7 years ago. I was running PsyQuation, the trading analytics platform I co-founded with my partner Vladimir. I was very into looking at ways I could incorporate a trader’s emotions into our analytic engine so that we could provide users with alerts as to when not to trade. I came up with 2 that really grabbed my interest. The one was keystrokes. I loved this idea and still do. I collaborated with a postdoctoral keystroke researcher and made some progress, but shelved the project for various reasons. To be continued…..

The second area we focused on was wearables. We loved the idea of giving all our traders bracelets that would provide us with the right data to do some serious data science with. We hunted high and low for a startup that would work with us and give us exclusivity. We found an eastern Europe startup led by a talented female engineer and 5 other engineers. We got our exclusivity agreement signed, and suddenly we felt like we were in the wearables industry. I remember the biggest challenge they were encountering was processing the complex data readings that were coming from the wrist. The wrist is a very active part of the body; you do a lot with your hands, and developing the technology that could read and interpret the data was a major challenge.

It was around this time that Apple launched its watch, and the growth in wearable technology just exploded. The startup just couldn’t compete, and they folded. The reason I bring this up is because of the amazing advancements in the world of AI and large language models. I think today a small startup like the one we partnered with could probably develop the required software to compliment their hardware and produce the kind of results we were looking for.

This week Anthropic launched Sonnet 2.7, Claudes smartest brain. This one is using AI reasoning a new breakthrough technology, that was not present in previous versions. I am a huge fan of Claude, I find that it is the smartest of all the AI chatbots. I am also keen to try Grok 3, Musk says it is the smartest of all of them, I will be the judge of that thank you. I tried Grok 2 for the first time this week and was somewhat impressed. Not enough hours in the day to get through all these ideas.

Happy weekend; the opportunities for creative minds has never been more exciting.

S2N observations

I was giving a talk last night and someone raised the question that gold was overvalued. He was challenging my statement that gold was “real money.” I said gold will continue to appreciate as a hedge against inflation and store of wealth and is not necessarily overvalued.

In the chart below, I address the question by adjusting gold by inflation. As I suspected by doing the correct manipulation to the data and presenting it this way you can see that gold has grown on average by 5.30% per annum since 1981 and 2.42% in real terms when adjusting for inflation. This 2.42% can be described as the risk and scarcity premium built into the gold complex, and I would argue is not a reason to believe that gold is over valued.

I just asked my wife to add orange juice back onto our shopping list, we can finally afford to drink some OJ.

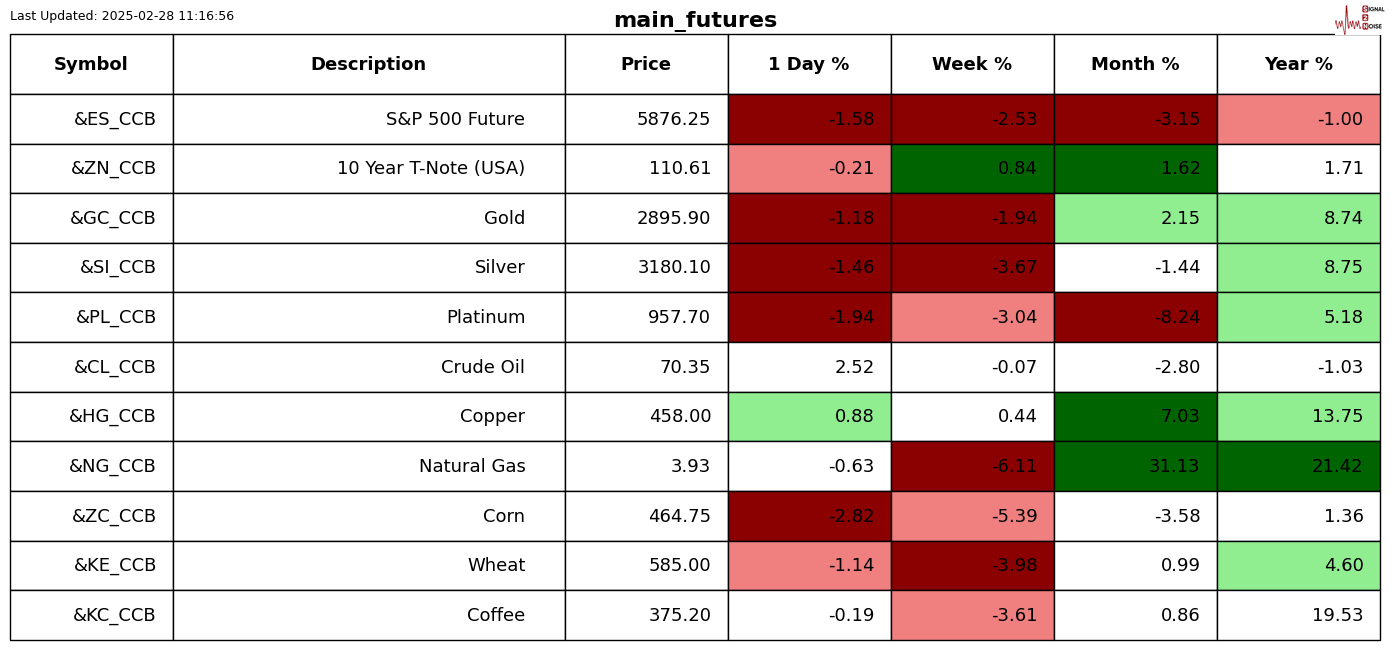

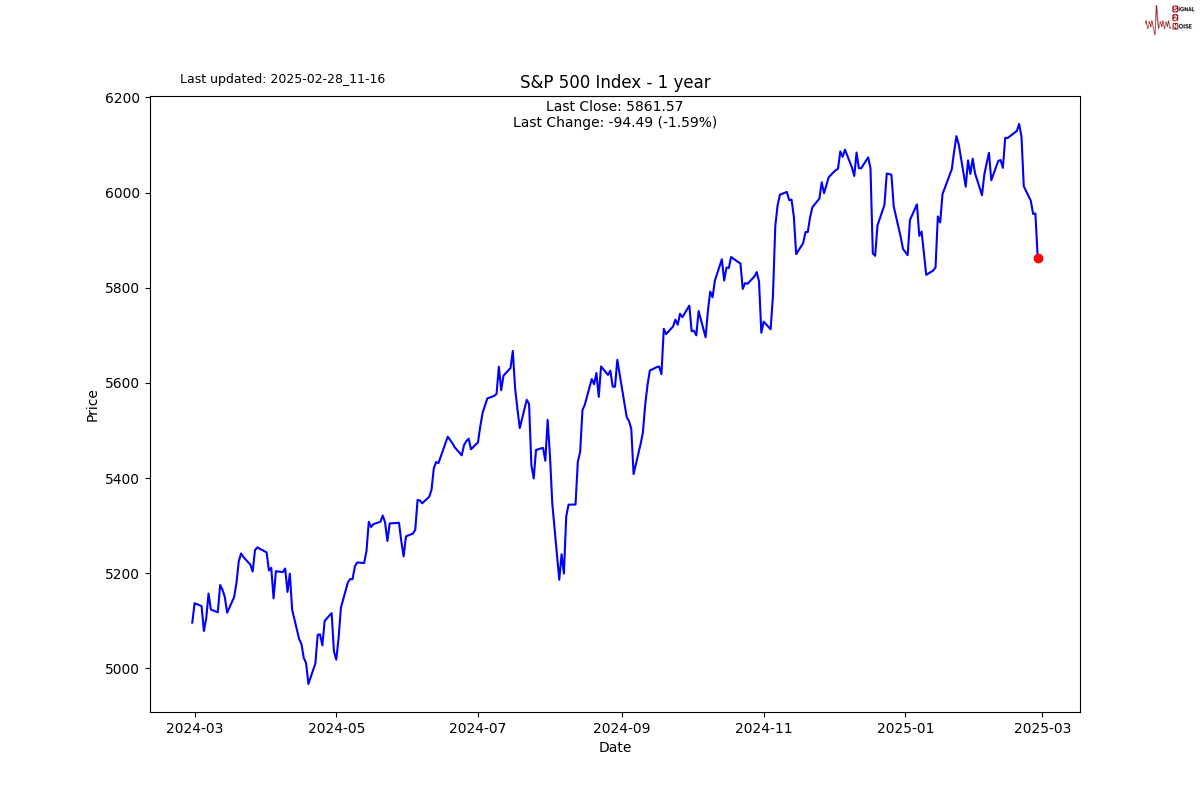

The Nasdaq dropped -2.75% as more nervousness crept into the markets. I will give Michael Saylor a break today, it is not right to enjoy someone else’s demise. $67,000 is all that I will say. As you can see its been only 46 days since a 3% drop. 3% drops happen more often than you probably realise. Nothing to see here, moving on.

I share this chart with year to date price journeys to help visualise how things are playing out so far. Stocks dipped into negative territory for the year.

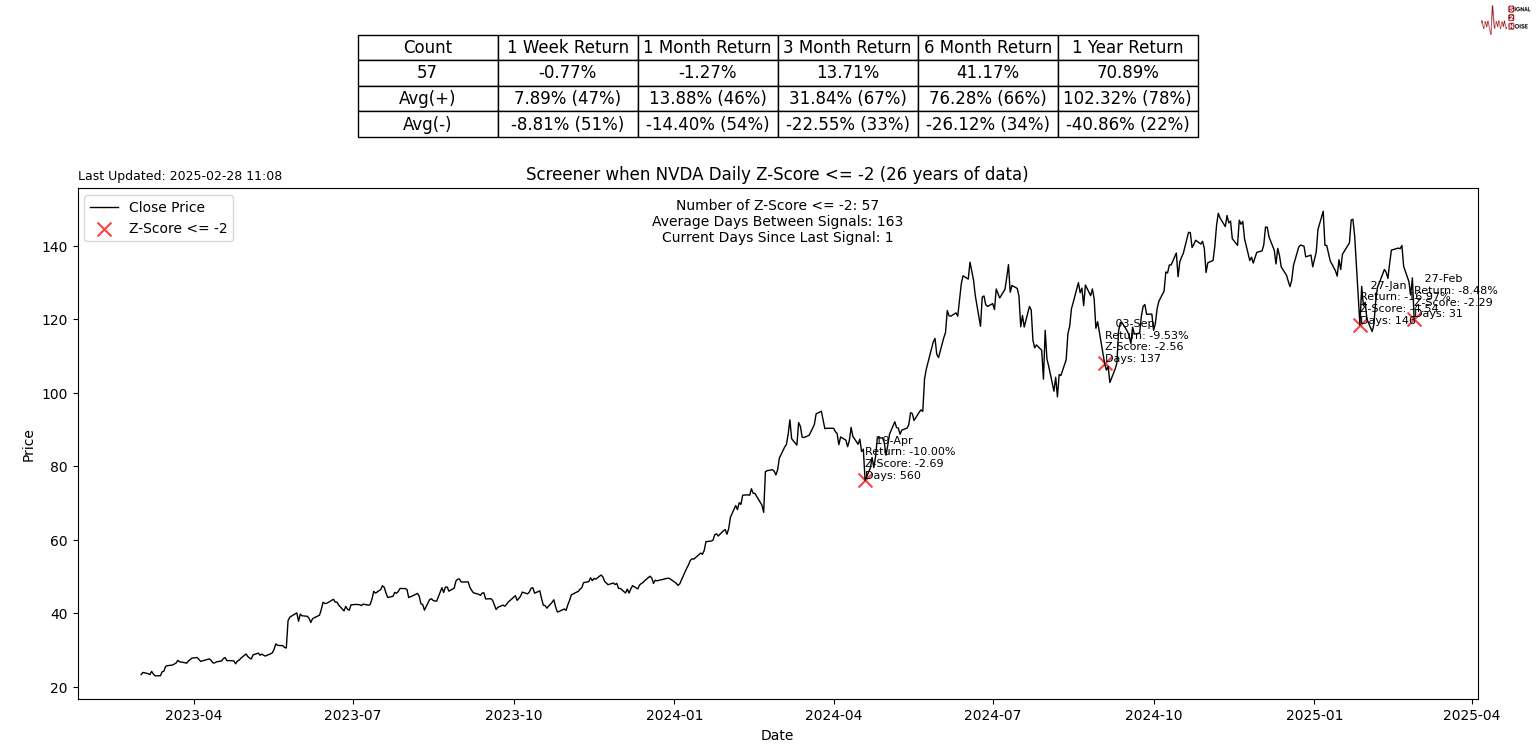

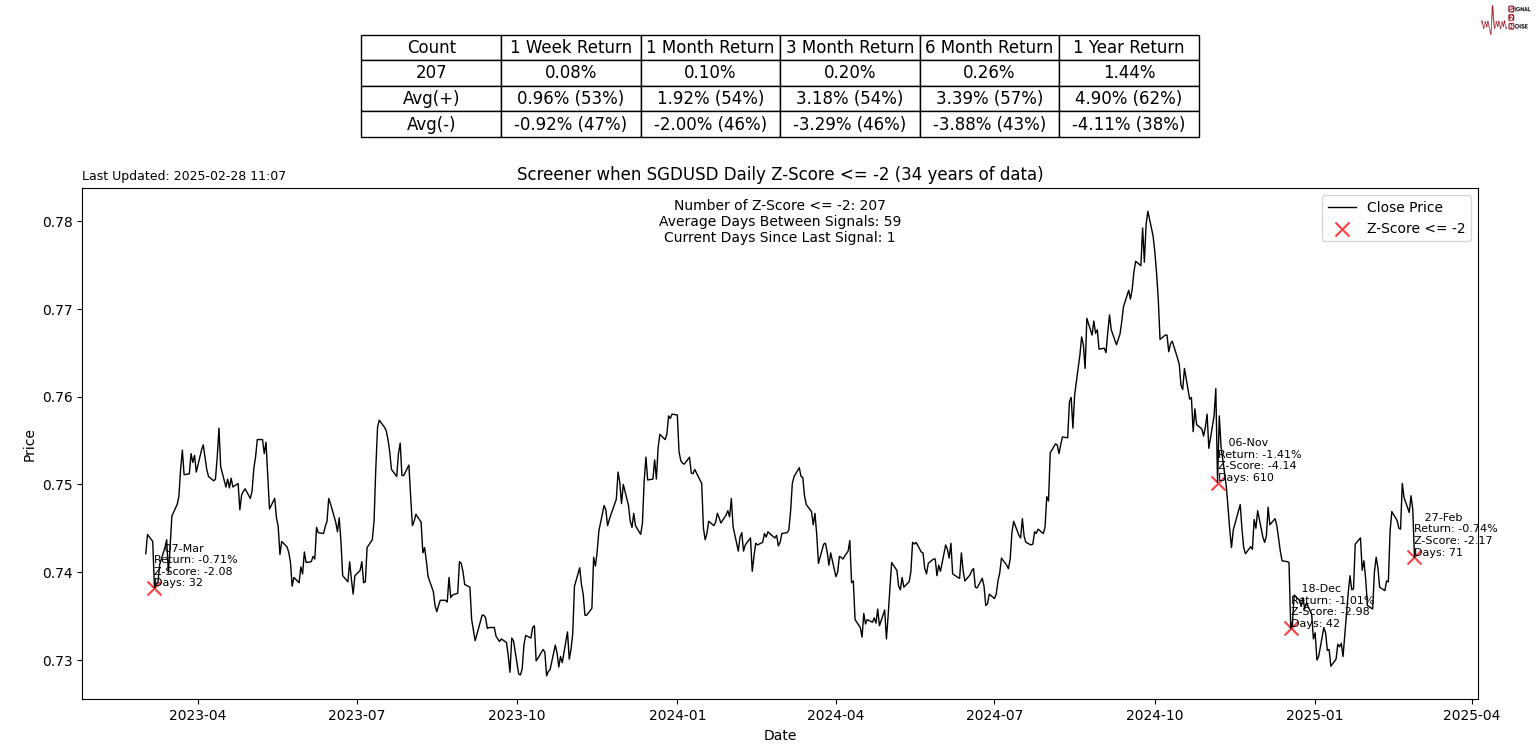

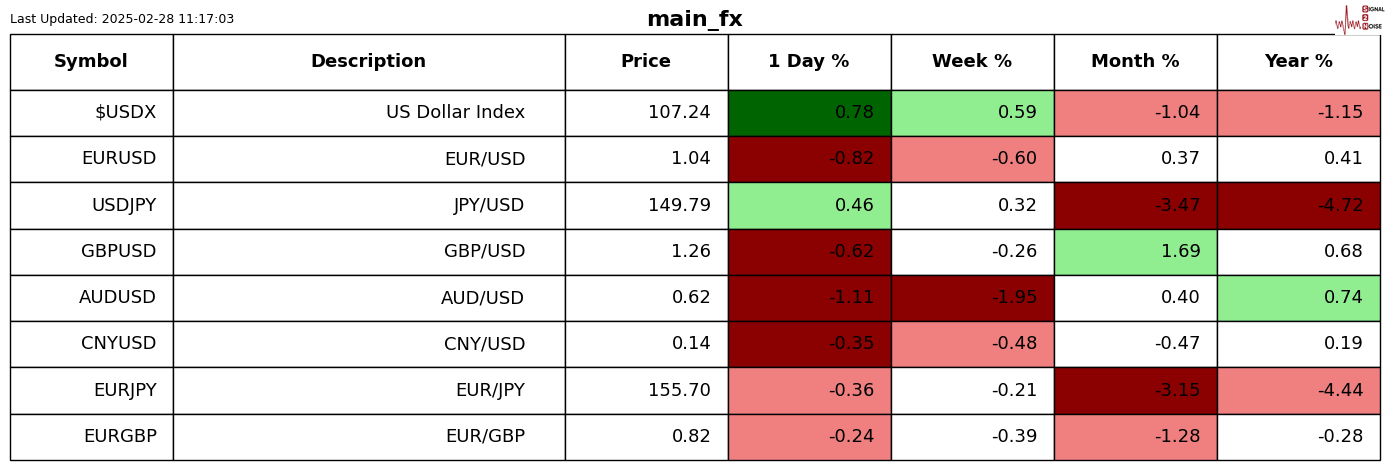

S2N screener alerts

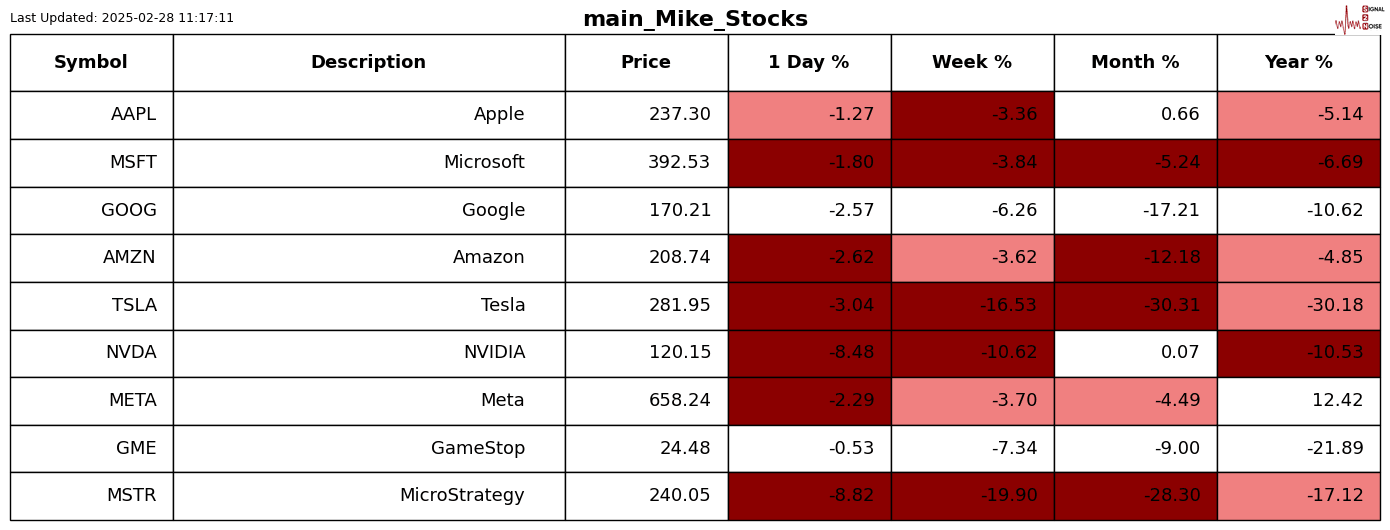

There were 3 notable assets having 2 sigma down days. The Singapore Dollar and the Chinese Renminbi along with Nvidia despite coming out with positive results. Talk about buy the rumour sell the facts.

Performance review

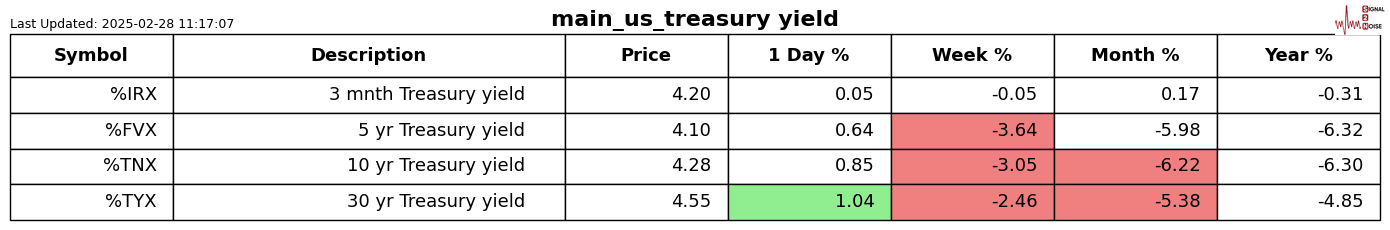

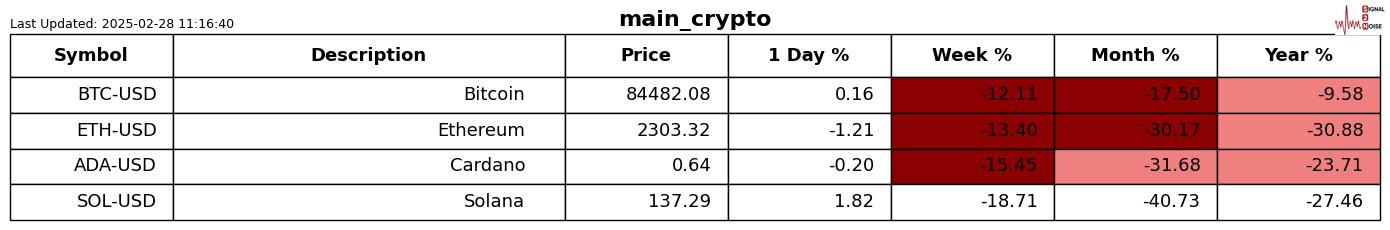

For those who are new to the letter, the shading is Z-Score adjusted so that only moves bigger than usual for the symbol are highlighted.

Chart gallery

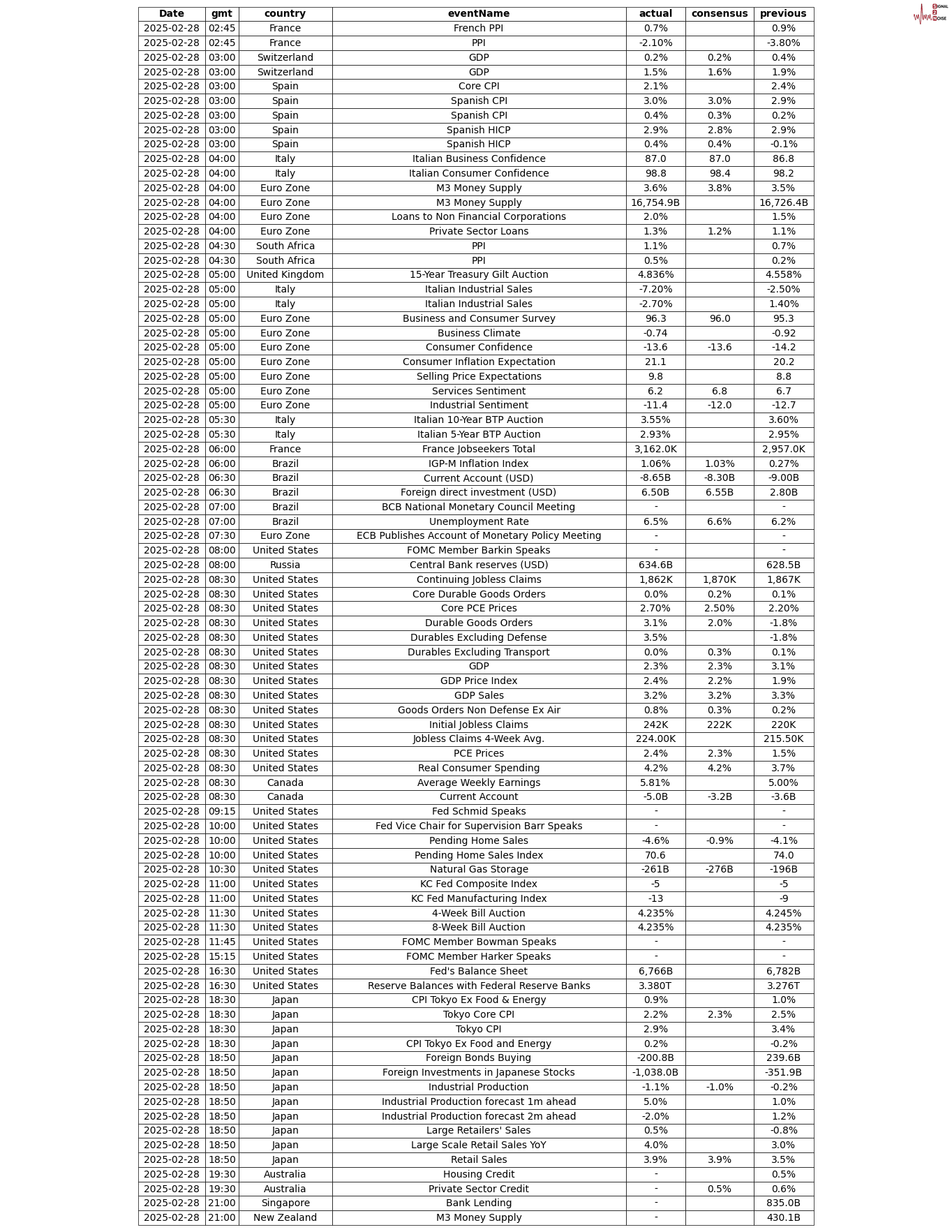

News today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.