Market Overview

Wall Street came through a big test of sentiment yesterday as it rallied into the close. The manner of Tuesday’s bull failure, where the market gave up strong gains to close lower, had the potential to be a real turning point in the recovery. The decision of Bernie Sanders to pull out of the race to be the Democratic candidate for President will certainly have played into yesterday’s positive response, but holding onto the breakout support (around 2640 on the S&P 500) could be a crucial moment. If this is a bear market rally, the move continues to build moving into the Easter break with futures again marginally positive today. Elsewhere there is a consolidation that has taken over, in forex majors especially. There are some key fundamental events to tackle today before we get to the Easter break, with another EuroGroup meeting and OPEC+. The EuroGroup meeting broke down yesterday with no decision on how to implement a €500bn package of fiscal support across the Eurozone. The big stumbling block has again become debt mutualisation. Countries are issuing national debt to deal with their economic shocks, but the Southern European states are crying out for Eurobonds (dubbed “coronabonds”) to safeguard against a huge disparity of credit worthiness and enforced austerity measures as mandated fiscal restraints are re-established in the future. The meeting of the Eurogroup resumes today and markets will be looking for how this situation is resolved. Also on the docket is a massively important OPEC+ meeting. Production cuts are being discussed, with signals from the Kuwaiti oil minister than as much as 10-15m barrels per day could be cut from production. For the oil price, the bigger the cut the better (seeing as demand for oil is reportedly down by -24m, bpd in April). Add in today’s US weekly jobless claims which is fast becoming the most up to date snapshot of the massive impact that coronavirus is having on the US economy. There is lots for traders to be cautious of today. A break for Easter will be welcome, that’s for sure.

Wall Street closed strongly back higher with S&P 500 +3.4% at 2750, whilst US futures are +0.4% in early moves today. Asian markets were mixed (Nikkei -0.1%, Shanghai Composite +0.4%) but European indices are taking the positives, with the FTSE futures and DAX futures both +1.4%. In forex, there is almost no direction to speak of, which is the first time we can really have said this in weeks. In commodities, gold is a shade higher as support continues to build, whilst silver is also consolidating. Oil has continued on from yesterday’s rebound, with Brent up +2% and WTI up +4% ahead of OPEC+.

There are a few importance entries on the economic calendar to watch for today. The minutes of the ECB’s meeting on 12th March are at 1230BST. The impact of these minutes may be reduced seeing as there has subsequently been a huge unscheduled policy response, and the outlook for the Eurozone has shifted significantly in recent weeks. The US Weekly Jobless Claims are at 1330BST and are expected to show another mammoth number of claims, with 5.25m this week (following the 6,.65m last week). There will also be a lot of focus on the prelim release of the Michigan Sentiment at 1500BST which is expected to decline to 75.0 for April (from a final 89.1 in March). This would be the lowest since 2013. Also look out for the Expectations component which could begin to be a lead indicator in the coming months as we look for signs of a recovery.

There is also a speech by Fed chair Powell to look out for today. Speaking via satellite at 1500BST, Powell will speak about the outlook for the US economy. This is likely to add to volatility later in the session today.

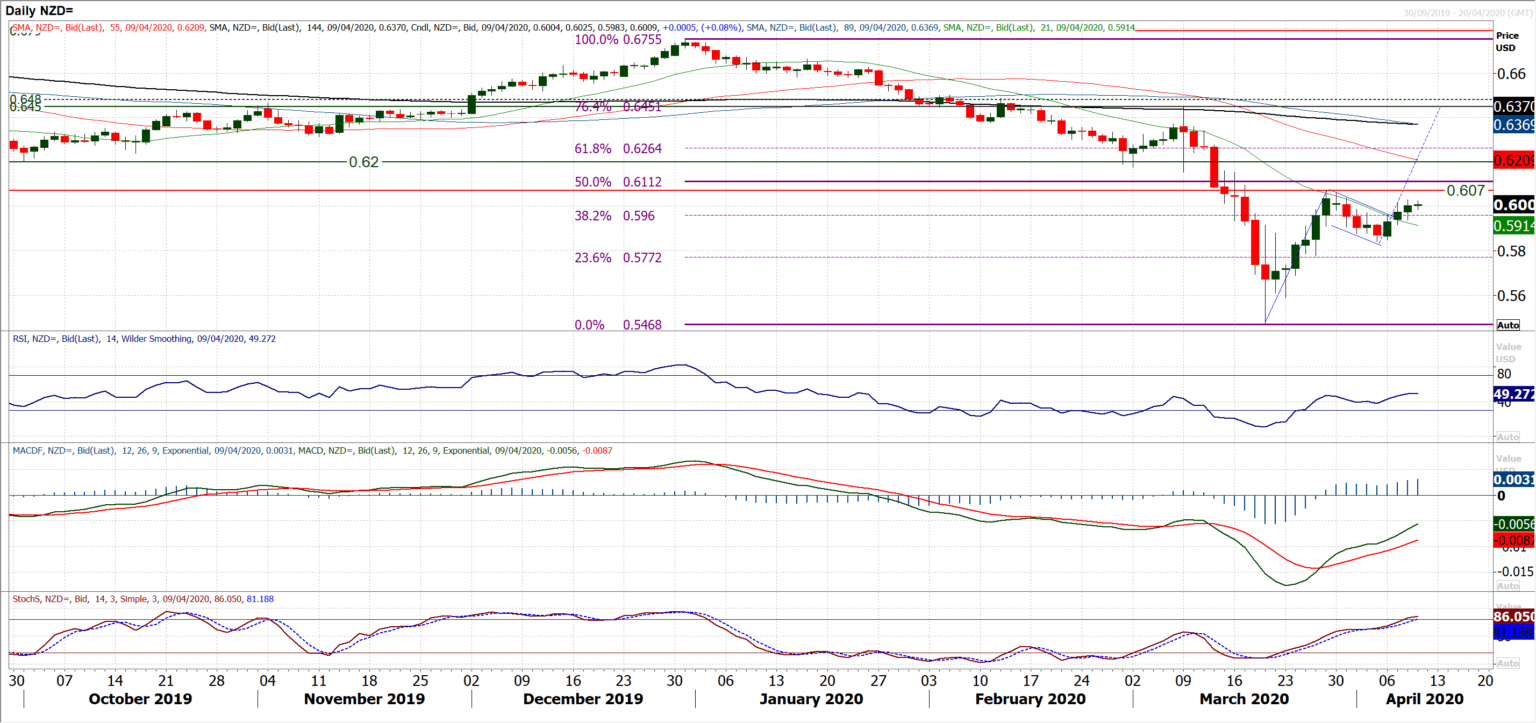

Chart of the Day – NZD/USD

Despite the mixed outlook for risk in the past 24 hours, the commodity currencies have continued to drive back higher this week. The Aussie has already broken through its resistance of the late March reaction high, and the Kiwi is looking to do the same. However, it is interesting to see the Kiwi recovery far less technically advanced than the Aussie, something which if the market takes a turn for the worse, could leave it susceptible. However, for now we look towards the recovery for NZD/USD. The resistance at $0.6070 is key, as a closing breakout would signal an important improvement in the near to medium term outlook. Firstly, it would be the market leaving a key higher low at $0.5840, which would suggest a medium term bull trend formation. Already the pair has moved decisively clear above the 21 day moving average (today around $0.5915) for the first time in 2020 and can now begin to be considered supportive. With momentum indicators leading the recovery for a breakout, the bulls will be looking for a test of $0.6070. RSI is around 50 and a ten week high, whilst Stochastics are at three month highs. The bulls will also note the potential for a bull flag but tis will need more conviction. The candles are perhaps lacking the drive to be considered a flag and there would need to be a decisive close above $0.6070 very soon for this to be considered a flag pattern. The problem that the bulls face is a re is plenty of resistance to get through once $0.6070 is cleared, with the key overhead supply around $0.6200 to get through. The hourly chart shows good support now between $0.5920/$0.5970 and the prospect for a recovery will remain on track whilst this support holds.

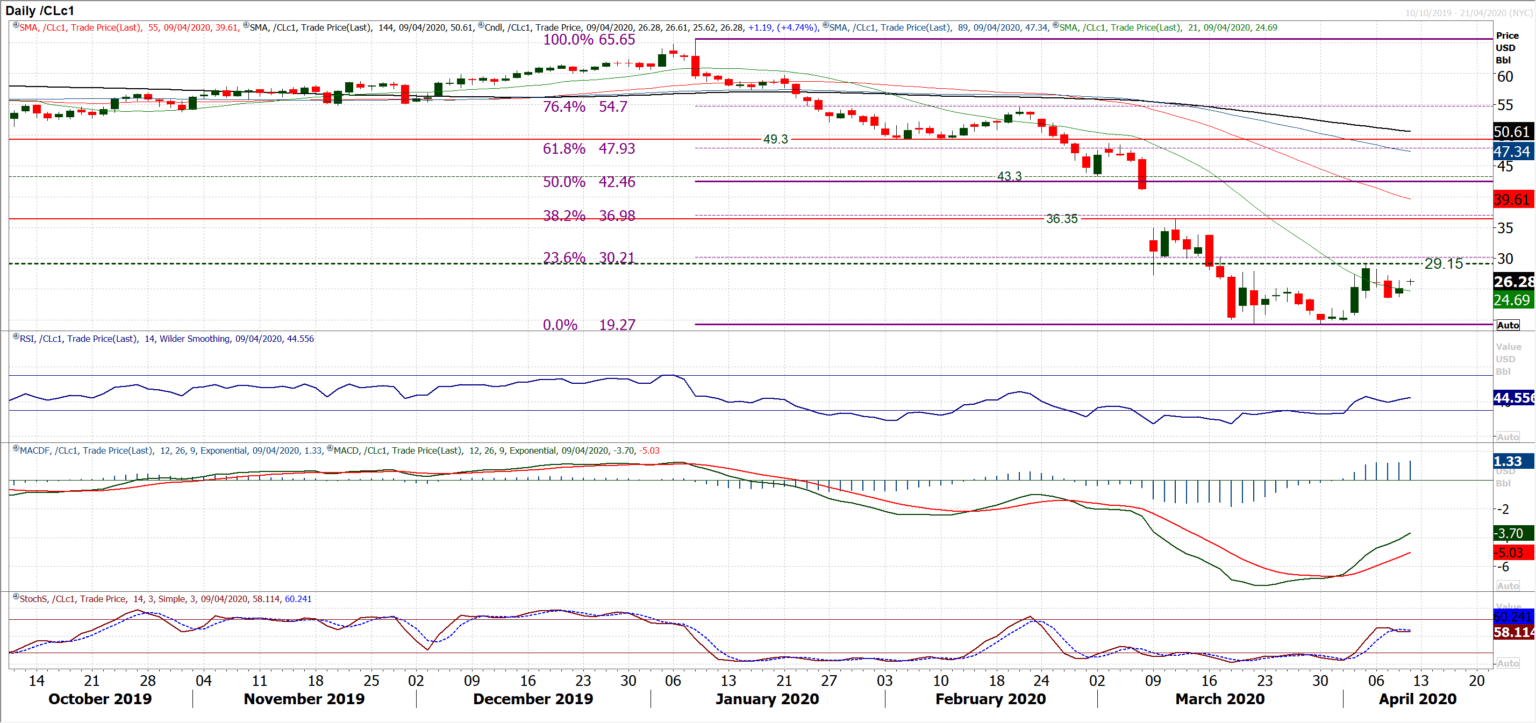

WTI Oil

It could be another hugely volatile session for oil as the OPEC+ meeting to discuss oil production levels takes place. A positive reaction in yesterday’s session has helped to build on the near term support at $23.50 and this is seen as something of a benchmark now on the hourly chart. This will not be a market reacting to technical in the near term though. It is all about production cuts. The bigger the production cut from OPEC+ countries, the more positive the response from the market. The $29.15 April rebound high will be possible. An acrimonious end to the meeting (anything is possible with such volatile nations as Russia, Saudi Arabia and even Iran) then we could see oil retesting the low at $19.27 again. If there is something in the middle, such as another delay to talks, then expect a slide back towards $23.50. Once the dust settles on what is likely to be considerable market moves int eh wake of the decision, we can get back to the technical.

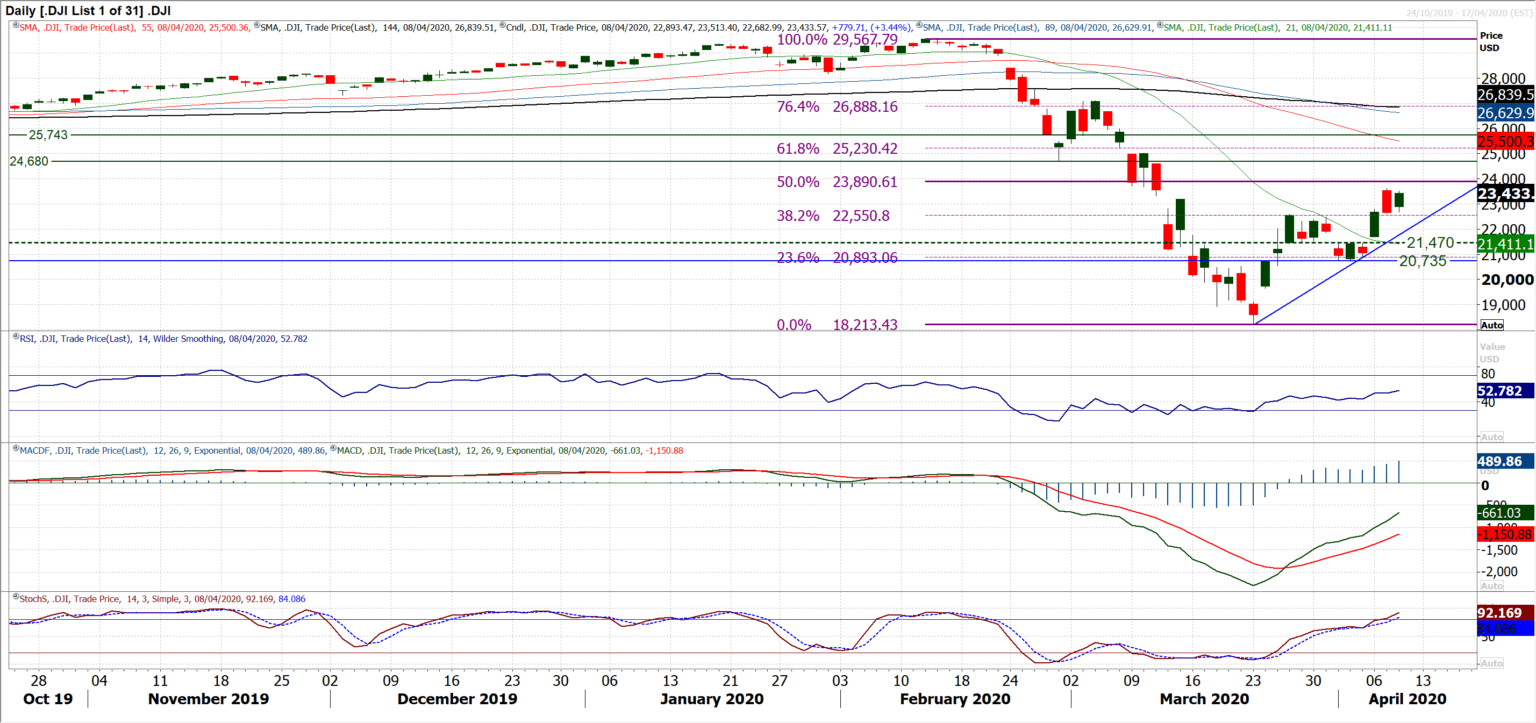

Dow Jones Industrial Average

Given the disappointment of Tuesday’s bull failure of a session, there was an incredible reaction from the bulls yesterday. A strong rebound back higher again (Bernie Sanders pulling out of the race for President certainly helped) has been technically a very positive move. The importance of the breakout support at 22,480/22,595 was already important, in light of the pullback. However, the market used this basis of support to spring back higher and close with strong gains. The legacy of Tuesday’s bull failure will be extinguished of the market can now close today at a four week high above 23,617. Momentum indicators continue to climb and are now advancing into strong configuration with the RSI rising above 50, Stochastics into bullish positioning and MACD lines accelerating higher. Having now decisively pulled clear of the 38.2% Fibonacci retracement (of 29,567/18,213) at 22,550 and which adds further strength to the support around 22,480/22,595, the bulls will also now be eyeing a test of the 50% Fib at 23,890. Being half of the massive sell-off, the 50% Fib line would mark a significant moment in the recovery.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD languishes near multi-year low after RBA meeting minutes

AUD/USD remains depressed after the December RBA meeting minutes reiterated that upside inflation risks had diminished, which reaffirms bets for a rate cut in early 2025. This, along with concerns about China's fragile economic recovery and US-China trade war, undermines the Aussie and weighs on the currency pair.

USD/JPY sticks to positive bias after BoJ meeting minutes

USD/JPY holds steady above the 157.00 mark and moves little following the release of the October BoJ meeting minutes, emphasising a cautious approach to monetary policy amid domestic and global uncertainties. Adding to this, doubts over when the BoJ will hike interest rates again, which, along with a positive risk tone, undermines the safe-haven JPY.

Gold flat lines above $2,600 ahead of holiday trading week

Gold price trades flat around $2,610 during the early Asian session on Tuesday. Markets face a relatively quiet trading session ahead of the holiday trading week. The US Richmond Fed Manufacturing Index for December is due later on Tuesday.

Ethereum risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.