One and done for Fed rate hikes in 2023?

There is a 99.8 percent chance the Fed hikes by a quarter point on February 1. Is that it for the year?

Rate hike probabilities for the February 1 FOMC meeting.

The above graph is from CME Fedwatch.

The market is nearly 100 percent certain of a rate hike in February to the range 4.50-4.75 percent.

Let's turn our focus to December.

Target Rate Probabilities for December 2023

The market says it's odd-on for the Fed to cut rates later this year.

So is it one and done then one cut? Not quite.

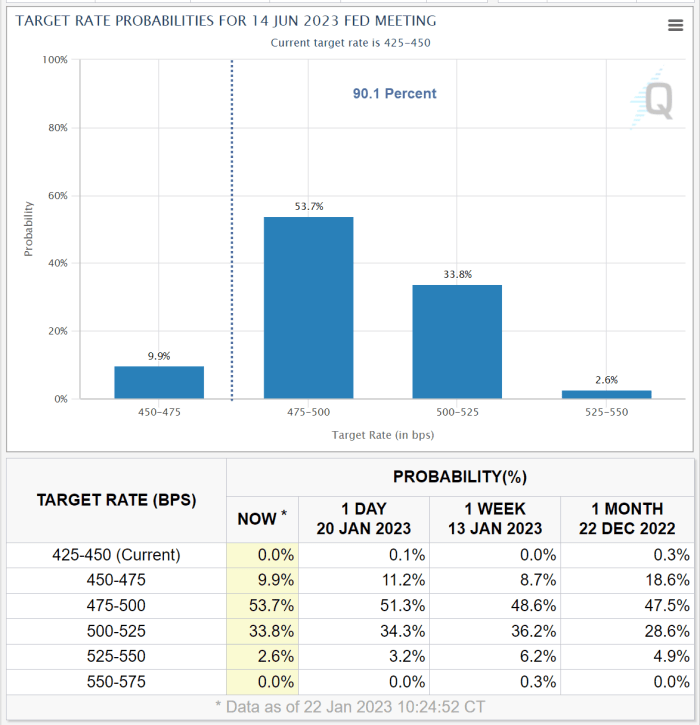

Target Rate Probabilities for June 2023

The market believes there is a 90.1 percent chance the Fed gets in at least one more hike in 2023.

There's a 36.4 percent chance of 2 or more quarter-point hikes through June.

Not One And Done

The market does not expect one and done.

However, there's a 56.9 percent chance that net hikes for the year are zero.

Whatever hikes the Fed does get in through June, the market expects will be taken back.

Will the Fed Get to 4.75-5.00 Percent or Higher?

I expect they will if for no other reason than the Fed can be stubborn as hell when it makes pronouncements.

It kept QE going when it was clear that it shouldn't.

The Fed is not really data dependent. It does what it wants and makes excuses for it.

However, if there is a credit event of some sort, the Fed will not get in those June hikes. February is a done deal.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc