Once again fine

S&P 500 refused yet another intraday rebound attempt, and closed around my 3,955 level, which would be broken through on a closing basis today. And the catalyst would of course be unemployment claims via tightening– the bulls will have nothing today to run on.

Add some details about job market resilience and prospects, and you have more ingredients to usher in more downside in stocks as the rally of the laggards gets reversed, and behemoths start participating in the decline. Don‘t forget about the steep yield curve inversion and still declining LEIs, which together with disappearing liquidity and bank lending standards tightening will usher in recession with all its accompanying early hallmarks such as earnings downgrades, bankrupties rising, slower business formation, getting behind on payments of all kinds etc.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

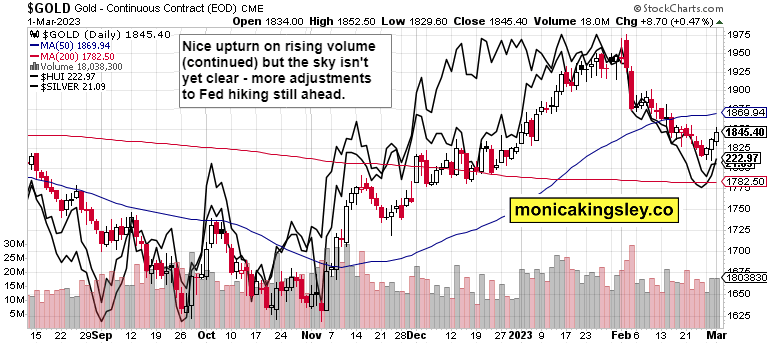

Gold, Silver and Miners

The daily upswing reflects waning USD momentum over the last couple of days, and even if the volume is enouraging, this isn’t the end of PMs woes – the short end of the curve rising will propel the dollar higher still, making for a rickety ride in copper as well.

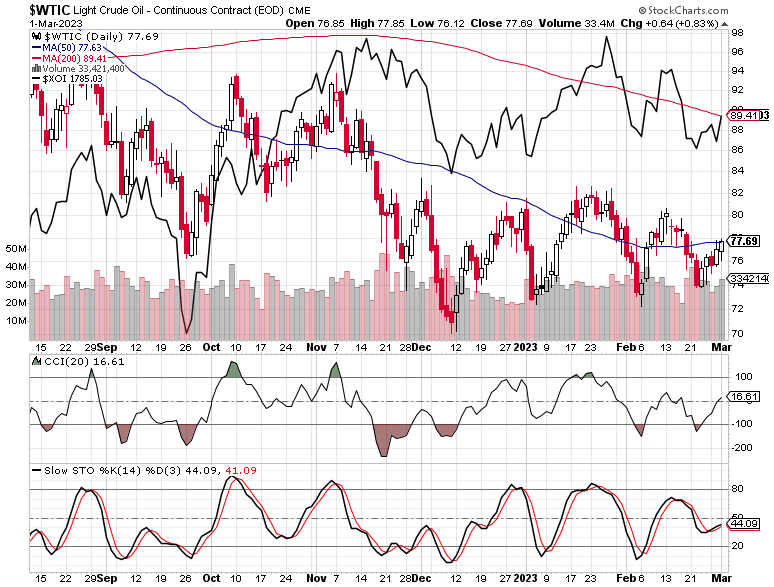

Crude Oil

Crude oil continues doing fine as regards the sequence of strong supports - $71-73, then $76, and finally it’s the tough $78-80 resistance which needs an $82.50 clearance to the upside. As written yesterday, the time for a washout in energy, has grown distant.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.