Oil tests a major support again

Oil is still struggling to climb higher, despite the fact that, in general, commodities are doing fine. That’s largely due to a weaker USD. Brent oil is currently testing a very important horizontal support, which has held its price from dropping since the end of October.

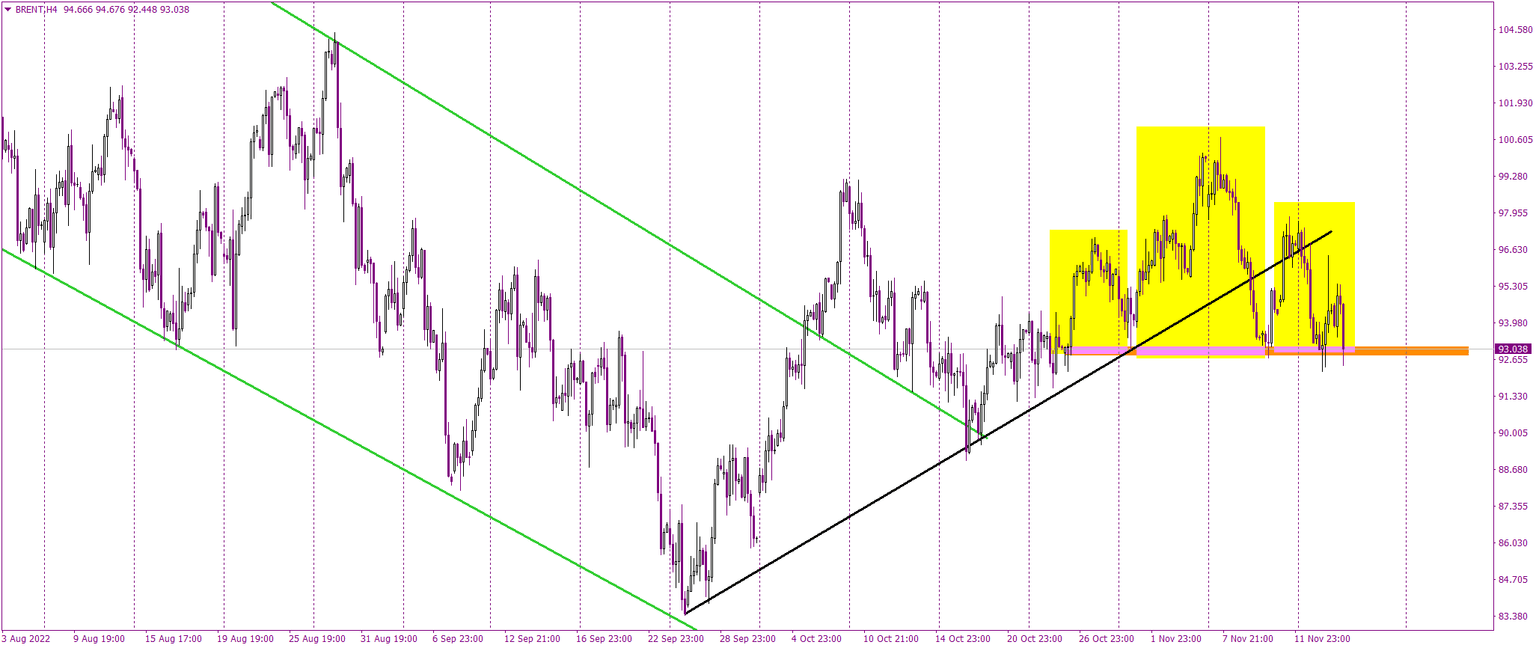

Let’s start at the very beginning. Between June and the beginning of October, brent oil has been going down inside a very handsome channel down formation (green). On October 5th, the price escaped the channel down to the upside, giving buyers hope. Despite an interesting technical situation, buyers were really struggling. The price couldn’t climb higher for the rest of October.

Most recently, brent oil created a Head and Shoulders pattern (yellow), promoting an end to the bullish correction. The important part in this formation is the neckline, which is the support mentioned at the beginning of this analysis. That’s the orange area around 93 USD/bbl.

Today, the price is trying to break this support again and its defence is getting weaker and weaker. If oil manages to close a day below the orange area, we’ll get a major sell signal, with the potential target on the lows from September. In my opinion, chances of that happening are quite significant.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.