Oil traders are gearing up for one of the most closely watched OPEC+ meetings in recent history.

Oil has risen over 10% across the past two sessions as investors grow increasingly optimistic that the OPEC+ group can agree to cut between 10 million – 15 million barrels per day. Reports on Thursday that Russia is prepared to cut 1.6 million barrels per day boosted optimism, sending WTI 5% higher to $27.46. However, reports that Saudi Arabia would want to cut from their April baseline, which is higher, making cuts more trivial, pulled oil off its high.

The OPEC+ meeting, via video conferencing today, is expected to be more successful than the group’s previous attempt in March. Last month’s the group’s failure to agree to extend supply cuts triggered a price war between Saudi Arabia and Russia.

$35 here we come?

There are still differences over plans to cut global output that Russia and Saudi Arabia need to resolve. However, we, like most traders expect a deal to be reached. This should set oil off on a short-term bullish move. The size of the rally will depend largely on whether the cuts are closer to 10 million barrels per day or 15 million.

Any rally will be capped below $35 because fundamentals remain weak. The bottom line is that the is too much oil whist demand has been crushed by coronavirus outbreak. Demand will start to ramp up but only once the lock down measures are eased. Signs of China starting to fire up again will offer support here.

Failure to agree

Should the OPEC+ group, or more specifically Russia and Saudi Arabia fail to iron out their differences, oil could rapidly give back the 10% gains achieved over the past 36 hours taking the price back towards support at $19.25

Levels to watch

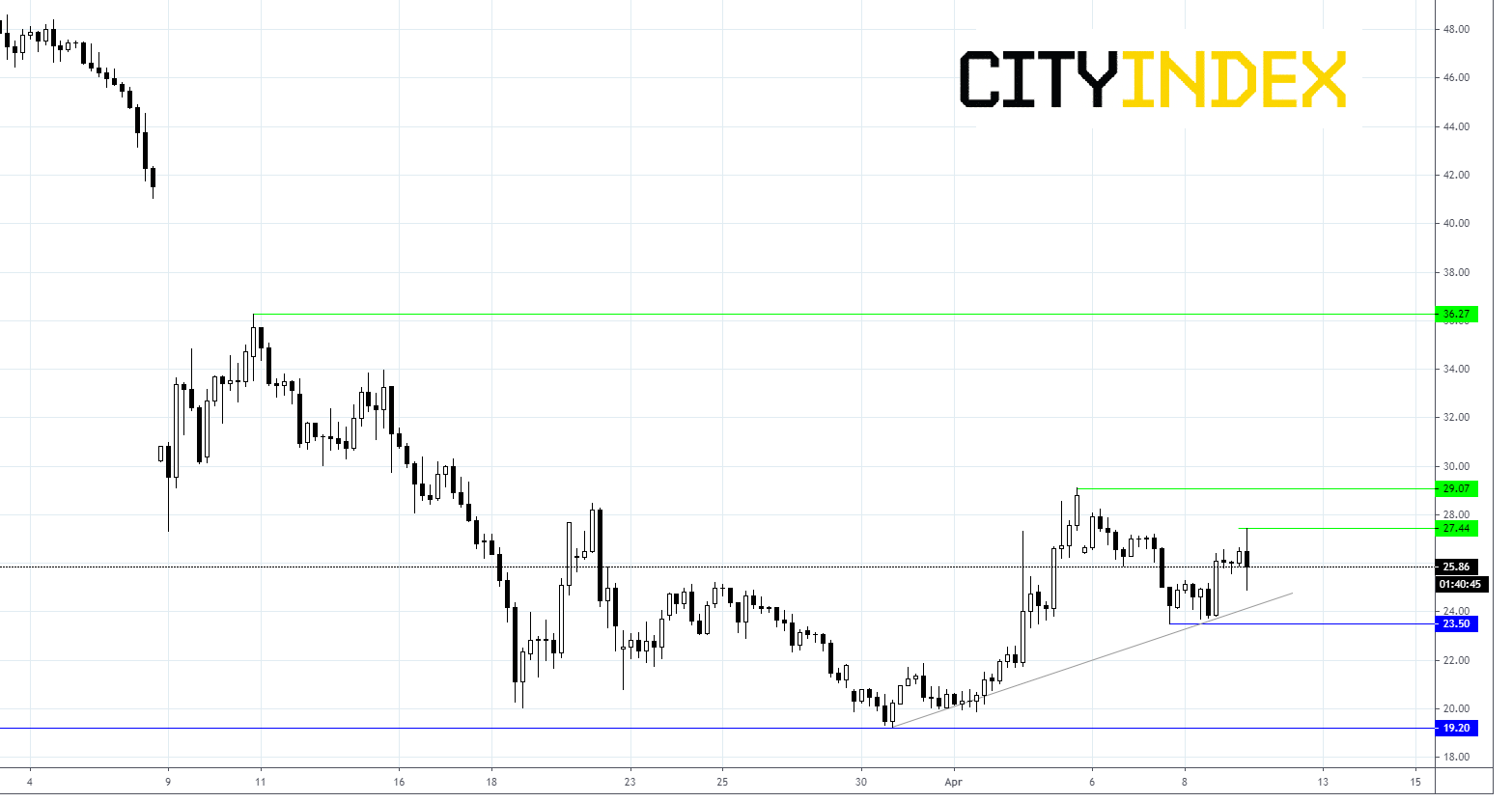

WTI is trading 4% higher at $26.10, it has fallen back from the session high of $27.46 to $25.00 before rebounding again. Oil is trading comfortably above its ascending trendline from March 30th low.

Immediate resistance can be seen at $27.46, prior to $29.10 (high 3rd April) and $30.00 psychological number.

On the downside, support can be seen at $24.25 (trendline) prior to $23.50 (low 7th April).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.