Oil prices deflate while geopolitical tensions are anchored

Oil prices continue to deflate while war tensions are very much anchored in place between Iran and Iraq. There is no doubt that we two groups of traders are currently moving the prices. One of them is moving the price to the upside on any war related news, while the pros on the other have seen these episodes many times push the prices back to the downside as they continue to maintain their view that if the war situation is real, we would be looking at completely different dynamics. The question for traders is when Israil will attack Iran and if the attack will involve any oil fields as that would really impact the oil equations.

Background

Oil prices have been experiencing volatile moves in the past few months as the initial attacks began. Traders have been on the edge as they continue to be that the recent retaliatory attacks by Iran on Israeli soil changed the dynamics of things significantly as this was the first time that we saw Iranian missiles landing in Israel. The tensions have been intense ever since, as traders believe that the situation could really get out of hand. The expectations were that Israil would attack even more intensely. However, the fact that Israil is still in the planning stage has kept traders very much on the edge.

The war and price action

Oil prices moved higher yesterday when the news came out yesterday that Israil is likely to attack Iranian energy resources. This is despite the fact that President Biden has publicly advised Israil not to attack any energy resources, as that would have much wider implications for the global economy, especially the US, where the elections are just around the corner. Traders are concerned that if Israil does attack Iranian energy resources, it could lead to a significant spike in oil prices worldwide. This uncertainty in the market has caused oil prices to fluctuate as investors weigh the potential consequences of such an attack. With tensions escalating in the Middle East, traders are keeping a close eye on the situation and preparing for any potential market volatility that may arise.

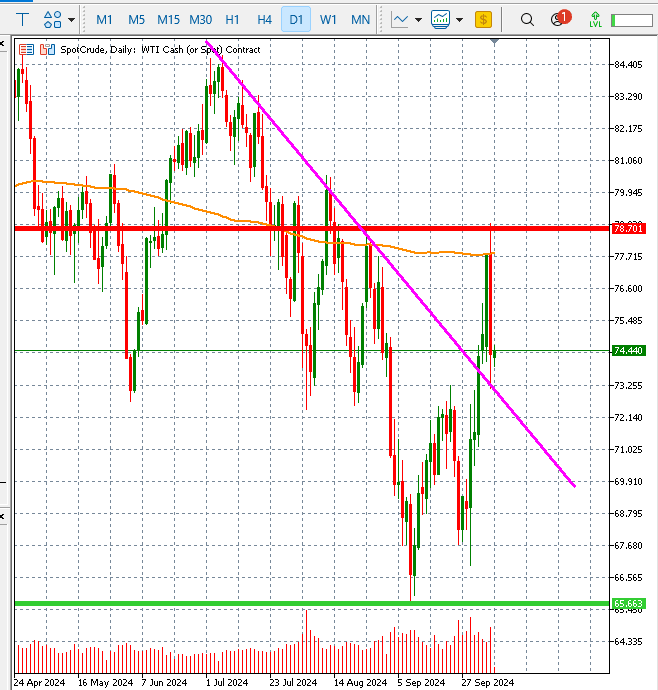

The upward price moves in both crude and Brent oil prices didn’t last long, although Brent prices did move above the price of $80 per barrel. However, today, the prices are trading well off those levels, as Brent is near the $78 while the crude oil prices are near the $74 price mark. This volatility in oil prices is a constant reminder of the fragile nature of the global energy market. Investors are bracing themselves for any sudden shifts in supply and demand that may result from geopolitical tensions. As uncertainty persists, market participants are staying vigilant and adapting their strategies to navigate through the unpredictable landscape of the oil market.

Speaking from the technical perspective, the crude oil price continues to trade below the 200-day SMA on the daily time frame, which is a concern for bulls as they strongly believe that if the price was going to move higher, we should see the price moving above this SMA. The bears have their strong belief, which is that prices are likely to move to remain under their control as long as the price doesn’t move above the $80 price mark.

From a fundamental standpoint, the ongoing tensions in the Middle East and the potential for disruptions in oil supply continue to keep market participants on edge. The recent OPEC+ agreement to gradually increase production levels has also added to the uncertainty surrounding future price movements.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.