Oil price update: Brent continues to struggle as technicals offer bulls hope

- Oil prices are struggling due to uncertainty around tariffs and their impact on global demand.

- Libya supply fears were alleviated as exports returned to normal after discussions with protesters.

- US inventories rose, but total US oil demand also increased, offsetting downward pressure on oil prices.

- From a technical analysis standpoint, Brent has tapped into a key area of support and formed a double bottom pattern.

Oil prices continue to struggle to gain any sort of bullish traction as uncertainties around tariffs and the impact it will have on Global Demand continue to weigh on the minds of market participants. Meanwhile, comments earlier this week by US President Trump have put OPEC in a corner with the President saying he will speak to the group about lowering prices.

Libya supply fears alleviated

Oil prices received a bit of a boost yesterday with news that protesters in Libya threatened to block Crude Oil exports via two terminals.

These fears were alleviated as the State Oil company reportedly talked to protesters and exports returned to normal.

The National Oil Corporation released a statement on Tuesday per Reuters, stating that operations are proceeding without interruption across all fields and ports, subsequent to discussions held with protesters who conducted a demonstration this morning at the ports of (Es Sider) and Ras Lanuf.

Tariff threats continue to offer support to Crude Oil prices.: A double edged sword of sorts?

Tariff threats continue to ramp up with markets expecting US President Donald Trump to slap a 25% tariff on all goods from Canada and Mexico.

The President has said this will come into effect on February 1st, with many market participants and analysts of the view that this will make Brent Crude more expensive.

For context, In 2023, Canada sent 3.9 million barrels of oil per day to the U.S., making up about half of all U.S. oil imports. Mexico supplied 733,000 barrels per day, according to the Energy Information Administration. Tariffs may also impact refined products such as gasoline, while an increase in transport costs may also factor in.

At the moment there does appear to be some back and forth between President Trump and Treasury Secretary Scott Bessent on the tariff issue. According to reports, Bessent would like to introduce tariffs gradually,starting at 5%. However, yesterday President Trump pushed back against this idea suggesting tariffs on individual products and items.

Such uncertainty will do little to ease the concerns of market participants who are already adopting a cautious approach as they weigh up the potential impact of tariffs. Much like with Gold, this is a double edged sword as market participants are concerned about the impact on global growth, while on the other hand we have the idea that tariffs will lead to an increase in Oil and refined products.

US inventories on the rise

Earlier we had data from the EIA regarding US crude inventories which rose by 3.5 million barrels to 415.1 million barrels in the week ended Jan. 24. This could have added further strain to Oil prices but the data also showed total U.S. oil demand rose last week.

This could have offset any downward pressure on Oil prices as demand continues to thrive.

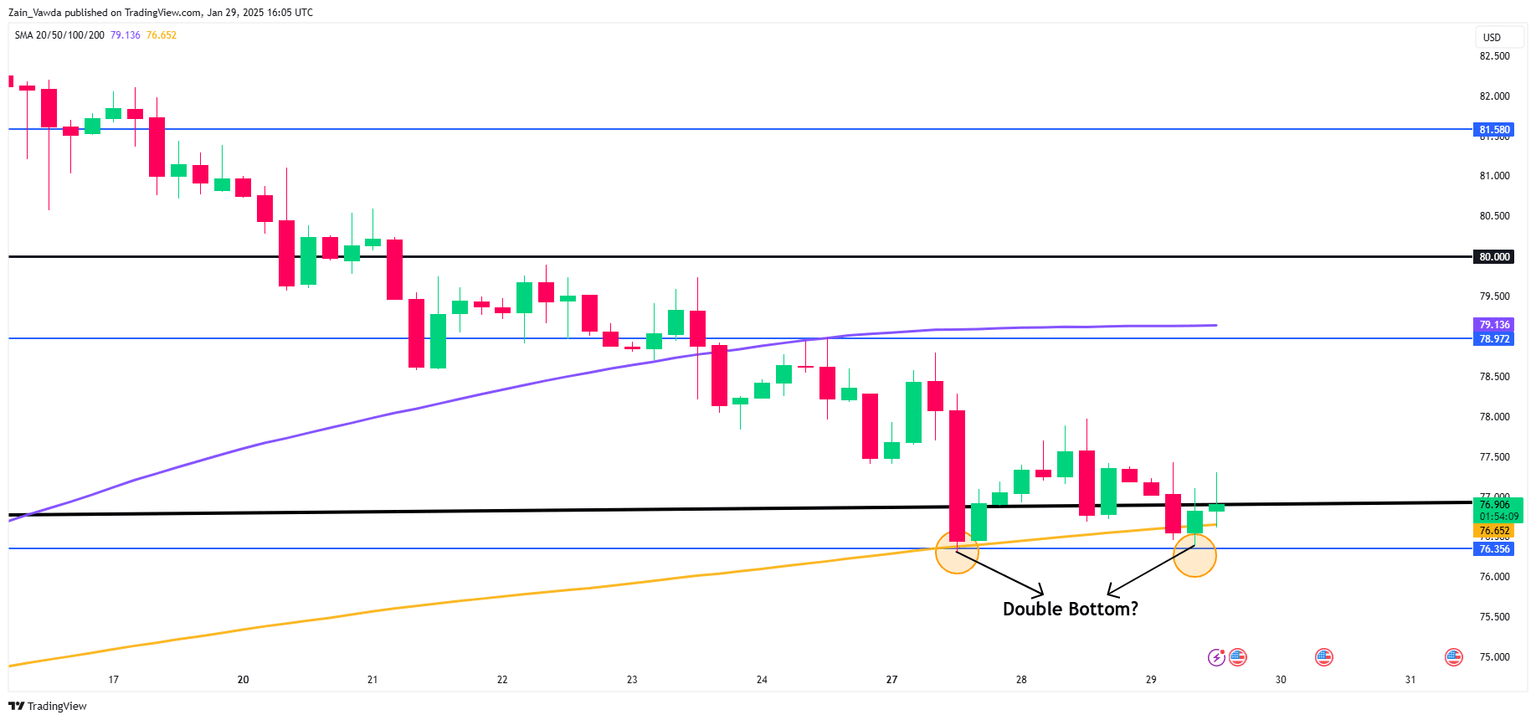

Looking ahead, we do have a significant amount of US Dollar news to end the week. However, I do not expect many surprises with the tariff picture and geopolitical risks remaining the biggest factors to pay attention to.

Technical analysis - Brent Crude

This is a follow-up analysis of my prior report “Oil Prices Slide – Brent Crude Taps 200-day MA. Can it Snap 4-day Losing Streak?” published on 13 January 2025. Click here for a recap.

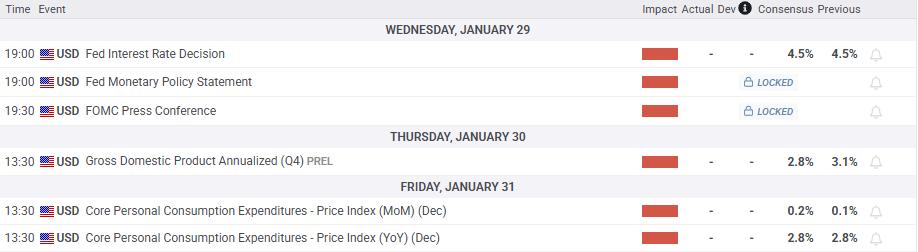

From a technical analysis standpoint, Brent has tapped into a key area of support where the previous impulsive move to the upside began following a period of consolidation.

The key level serving as support is 76.35 with crude oil hovering above for the past three days. A sign of bearish exhaustion?

Brent crude Oil daily chart, January 29, 2025

Source: TradingView (click to enlarge)

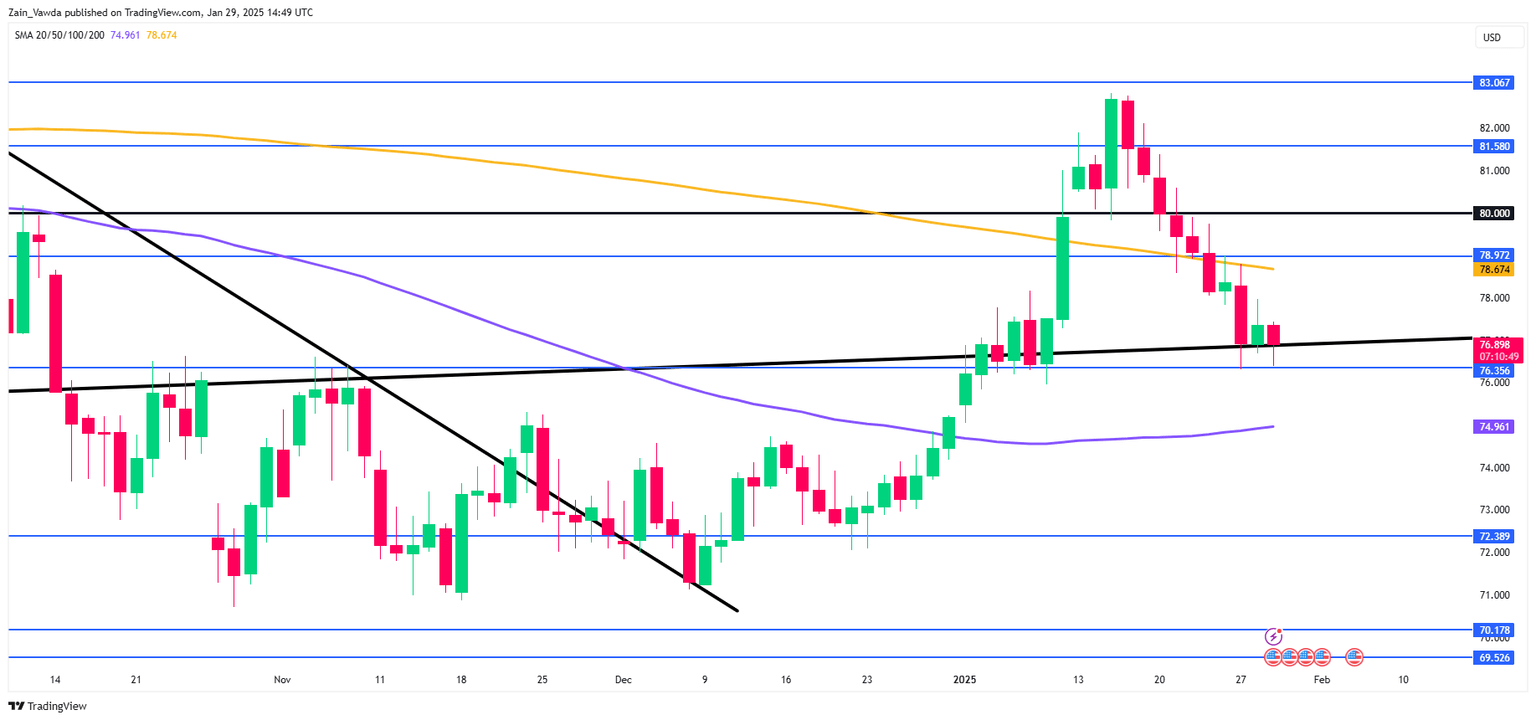

Dropping down to a four-hour chart and as you can see price has formed a double bottom pattern at the key support level of 76.35.

The 200-day MA adds another layer of support as it rests at 76.65 and currently supports prices.

In order for the double bottom pattern to play out, oil prices need to record a four-hour candle close above the previous swing high resting at 77.57 which could embolden bulls and see prices make a swift return toward the psychological 80.00 a barrel mark.

Oil is another prime example of the conundrum facing market participants at the moment where the fundamental and technical outlooks appear to be diverging. This makes it hard for market participants and may not get any easier until a clear path forward on tariffs is established.

Brent Crude Oil four-hour chart, January 29, 2025

Source: TradingView (click to enlarge)

Support

- 76.35

- 75.00 (psychological level)

- 72.38

Resistance

- 78.97

- 80.00 (psychological level)

- 81.58

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.