Oil outlook: Strong weekly gain boosts reversal signals

WTI Oil

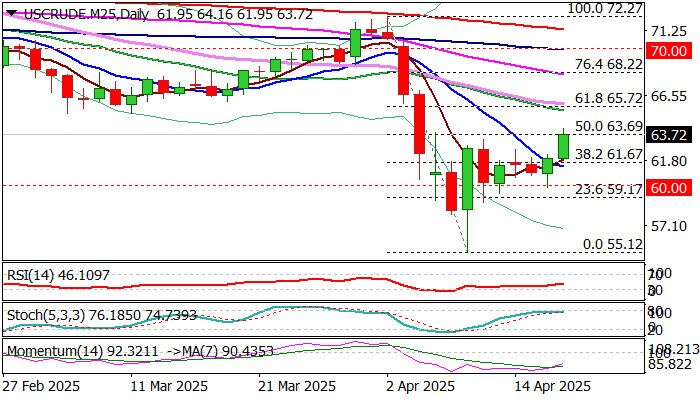

WTI oil has registered the second weekly gain (the contract was up 3.3% this week), lifted by growing optimism over easing trade tensions between the USA and the European Union and signals of possible deal, new US sanctions on Iran and initial positive signals in US - China trade relations.

Reversal signal is developing on daily and weekly charts, as bounce from new 4-year low ($55.12) has so far retraced over 50% of $72.27/$55.12 bear-leg, while Doji morning star pattern has formed on weekly chart.

However, recovery may face increased headwinds as technical studies on daily chart are predominantly negative and still fully bearish on weekly, suggesting that much stronger work at the upside is still required to improve the picture (sustained break above cracked Fibo 50%, reinforced by daily Kijun-sen at $63.63, seen as minimum requirement).

Also, fundamental factors that support current recovery would be countered by the latest downgrade of oil prices and demand growth by OPEC, Energy Information Administration, in light that existing economic crisis could be deepened if negotiations fail, and trade war escalates.

Res: 64.16; 65.22; 65.72; 66.08.

Sup: 63.32; 62.65; 61.67; 60.00.

Interested in Oil technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.